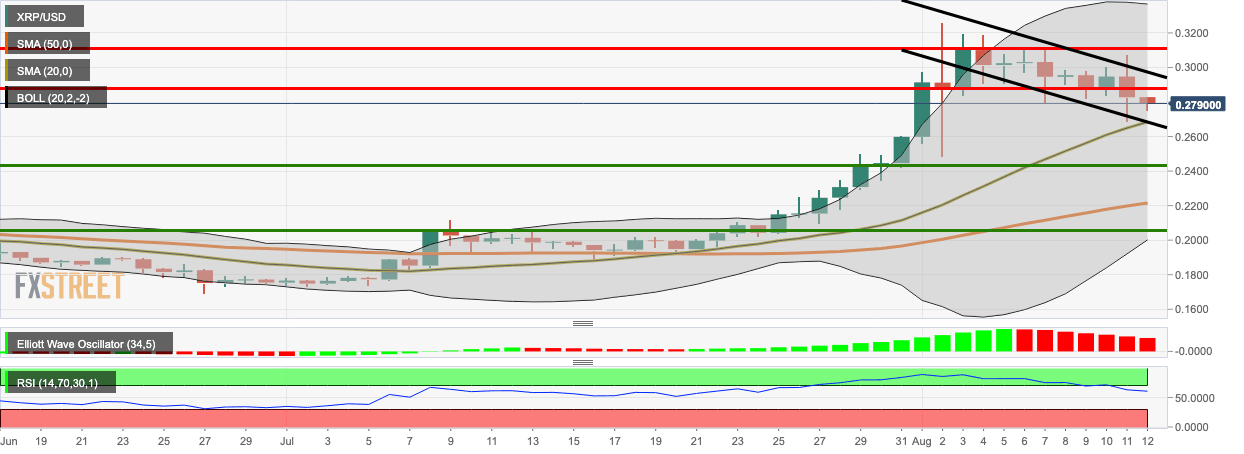

Ripple Technical Analysis: XRP/USD keeps trending in downward channel formation as price drops below $0.27

XRP/USD daily chart

XRP/USD bears stayed in control of the market for the second straight day as the price continued trending in a downward channel formation. So far this Wednesday, the price has dropped from $0.2828 to $0.2788. The Elliott Oscillator has had seven straight red sessions. Finally, the RSI is hovering around 61 having dropped below the overbought zone. This shows that Ripple is no longer overvalued.

XRP/USD has strong resistance at $0.2881and $0.31. On the downside, we have healthy support levels at $0..267 (SMA 20), $0.244, $0.2226 (SMA 50) and $0.205.

Key levels

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.