NFT Market Weekly Analytics: Moonbirds and Bored Apes dominate

Despite what we are used to, this week in the NFT market has been relatively steady. The market continues to fix their eyes on Moonbirds: the collection from Kevin Rose (PROOF Collective) continues to gain traction and appreciate in price. Meanwhile the rest of the other top collections seem to continue to appreciate in price besides some exceptions.

This performance can be seen in the next matrix, which shows the 10 most valuable collections sorted by their market capitalization. The market capitalization of each collection is calculated as the average daily price of the NFTs sold in a collection times the supply. The time frame selector is useful to highlight the variation of the metrics over the selected period of time.

Most Valuable NFT Collections according to IntoTheBlock NFT indicators.

As the matrix shows, Bored Apes interest increased this week with a gain of 81% in volume traded compared to the last week. Similarly,the number of sales grew by 50%, with 107 Apes changing hands in the last 7 days. This buying pressure has translated as well into their price per piece, which currently stands at 137.54 ETH as average, almost $400K. Their main derivative collection, Mutant Apes, also reacted strongly, with similar gains and an average price increase of 32% in just a week, sitting at around 37 ETH on average ($105K).

It is also worth noting the impressive performance of Moonbirds. Two weeks after their release the collection continues to gain interest among NFT collectors. This week their average price has doubled and is reaching already 34 ETH on average per each piece, almost $100k. On the opposite side, both Azuki, Cryptopunks and Sandbox are the other collections that are lagging behind, with their average prices receding between 7% and 10% compared to the last week.

The dominance of Bored Apes is clear if we take a look at which are the daily top NFT sales. As can be seen in the next chart. Most of these top sales lately tend to be plagued by rare Bored Apes, averaging around $430K at the moment.

Top NFT Sales according to IntoTheBlock NFT indicators.

The exceptions are usually some rare Cryptopunks or as seen yesterday some niche pieces of other collections, such as Deafbeef, a collection with a very limited supply that offers a sort of audiovisual experience stored on-chain.

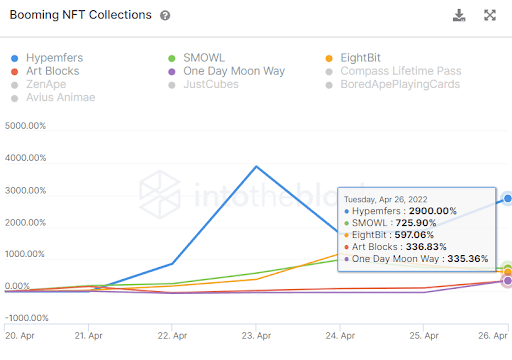

Booming NFT Collections according to IntoTheBlock NFT indicators.

This indicator displays the fastest growing collections over the past week. Some of these collections are derivatives, like Hypemfers, or pixelated profile pictures such as SMOWL or EightBit. Curiously an Art Blocks collection gains a spot among the top 5.

Some of the trending collections of this week.

Despite what many would have predicted, the recent market downturn both in Equities (S&P 500 -11% in the last 30 days) and Crypto (-22%) is not affecting much of the NFT market. Both in terms of trading volume and in terms of successful new collections launching, the space seems to not be taking a rest. It will be interesting to witness the impact on the long term of Moonbirds among the other top collections. Will it cannibalize other collections with some of their holders selling to buy a Moonbird, or is there demand in the space for another prolific collection? It will be worth taking a look at these indicators over the next weeks to find it out.

Author

IntoTheBlock Team

IntoTheBlock

IntoTheBlock Team consists of a tribe of data scientists, crypto experts and AI geeks.

-637867572775214164.png&w=1536&q=95)

-637867572465078702.png&w=1536&q=95)