How good are Bitcoin (BTC) and Polkadot's (DOT) chances to grow like XRP?

The market keeps booming as almost all of the top 10 coins are in the green zone. Bitcoin (BTC) is the only exception to the rule, going down by almost 1%.

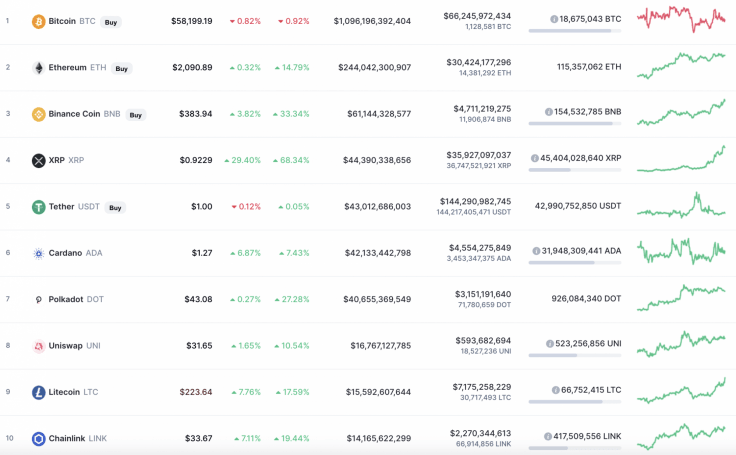

Top 10 coins by CoinMarketCap

BTC/USD

Bitcoin (BTC) is the only falling coin on our list. The rate of the chief crypto has declined by 1% since yesterday.

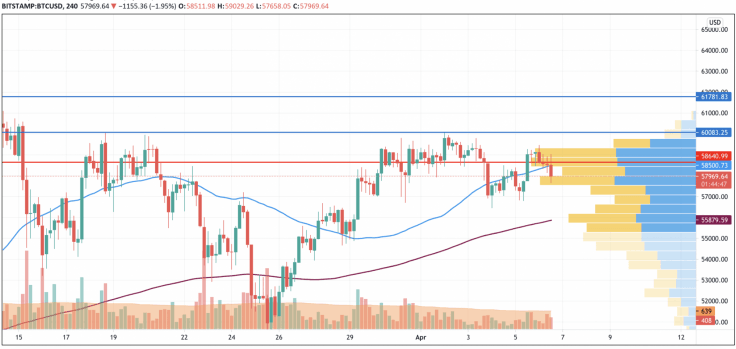

BTC/USD chart by TradingView

On the 4H chart, Bitcoin (BTC) could not fix above the $60,000 that confirms bears' power.

In this case, there is a good chance of seeing a test of the MA 200 that refers to the mark around $55,900.

Bitcoin is trading at $57,450 at press time.

XRP/USD

XRP is the top gainer today. The rate of the coin has reached the vital level of $1.

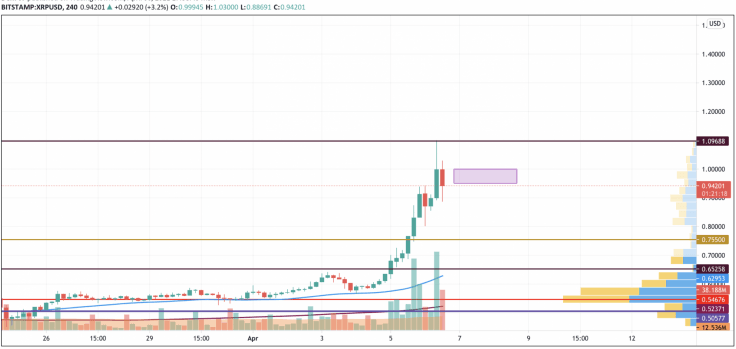

XRP/USD chart by TradingView

XRP has followed our recent scenario and reached the $1 mark. At the moment, one might expect a consolidation in the range of $0.95-$1 to keep the rise going.

XRP is trading at $0.9372 at press time.

DOT/USD

The rate of Polkadot (DOT) is unchanged since yesterday, which means that neither bulls nor bears are dominating at the moment.

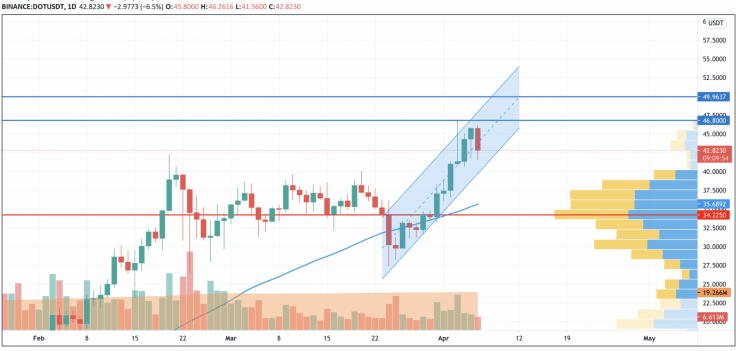

DOT/USD chart by TradingView

Despite today's fall, Polkadot (DOT) remains bullish as it keeps trading within the rising channel. Thus, the selling trading volume is low, which means that buyers have the chance to attach the $50 mark soon.

DOT is trading at $42.89 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.