First Mover Asia: Terra’s planetary collapse is taking down crypto lending; Altcoins plummet

Data suggests that many traders are moving their assets from DeFi protocols; bitcoin rallies after falling below $26,000 in Thursday trading.

Good morning. Here’s what’s happening:

Prices: Bitcoin struggles; altcoins fare worse.

Insights: Terra's implosion threatens crypto lending protocols.

Technician's take: BTC is oversold and could see a short-term relief bounce.

Prices

Bitcoin (BTC): $29,127 +1%

Ether (ETH): $1,968 -5.1%

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Bitcoin | BTC | +1.0% | Currency |

| Bitcoin Cash | BCH | +0.4% | Currency |

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Solana | SOL | −10.2% | Smart Contract Platform |

| Cosmos | ATOM | −9.1% | Smart Contract Platform |

| EOS | EOS | −9.0% | Smart Contract Platform |

Another forgettable day for cryptos

Bitcoin had a forgettable Thursday. About altcoins, the less said, the better.

After hitting a new 16-month low earlier in the day, the largest cryptocurrency by market capitalization was recently trading at $29,100, up slightly over the past 24 hours. That was little comfort for investors who have watched it plunge with other digital assets the past few days, swept up with investor fears following the collapse of the terraUSD (UST) stablecoin against its 1:1 dollar peg. Bitcoin was already reeling from wider concerns about high inflation and geopolitical turmoil.

Still, other cryptocurrencies fared far worse, a sign of the risk-off environment that has investors veering away quickly from any asset with a whiff of risk. Ether, was trading at about $1,960, off about 5% after dipping under $1,800 earlier in the day, the first time since last July it had sunk below $1,800. In a sea of major crypto red, SOL, CRO, ADA and MATIC were each down roughly 10% at one point. SAND and ATOM were off 14.5% and 9%, respectively.

Meanwhile, Terra blockchain's token LUNA plunged below 2 cents on Thursday, prompting validators to briefly halted the network to implement a patch that would prevent new actors from staking on it. Just a month ago, LUNA had reached a high of $120. UST was recently trading at about 33 cents, down about 54%.

Equity markets did better, rallying late to finish slightly down from where they started the day. Still, rising prices loomed large as a report Thursday found that mortgage rates had climbed to 5.3%, their highest rate since 2009.

In an interview on Thursday with the public radio business show Marketplace, U.S. central bank Chair Jerome Powell said that he could not guarantee a soft economic landing as the Fed increases interest rates to tame inflation. "Whether we can execute a soft landing or not, it may actually depend on factors that we don’t control," Powell said.

"The higher-than-expected inflation figures in the U.S. have prompted investors to move towards selling risky assets, impacting cryptocurrencies in the process as well," wrote Daniel Takieddine, the CEO for the Middle East and North Africa region of brokerage BDSwiss, in an email. "The move towards a rapid rise in interest rates could keep cryptocurrencies on a sliding trend for a longer period of time as investors move to safer assets."

He added: "This bearish trend is further exacerbated by the recent crash of the TerraUSD, which lost its peg to the USD by a large margin. Its fall in value has eroded investors' confidence in the crypto markets and in the stablecoin concept in particular."

Markets

S&P 500: 3,930 -0.1%

DJIA: 31,730 -0.3%

Nasdaq: 11,370 -.06%

Gold: $1,820 -1.8%

Insights

Terra's implosion threatens crypto lending protocols

Crypto lending, the backbone of decentralized finance (DeFi), was built in the rubble of the COVID-19-induced crash of March 2020. The prevailing logic behind crypto lending is to provide a smoother off ramp than rapid-fire selling, which depresses prices.

But as the collapse of Terra’s LUNA and UST tokens has sent shock waves throughout the industry, accelerating the decline of the price of bitcoin, knocking tether off its peg and reiterating concerns from institutions and regulators about the viability of the asset class, crypto lending appears to be its next victim.

Data now suggests that there’s a cavalcade of people looking for an exit.

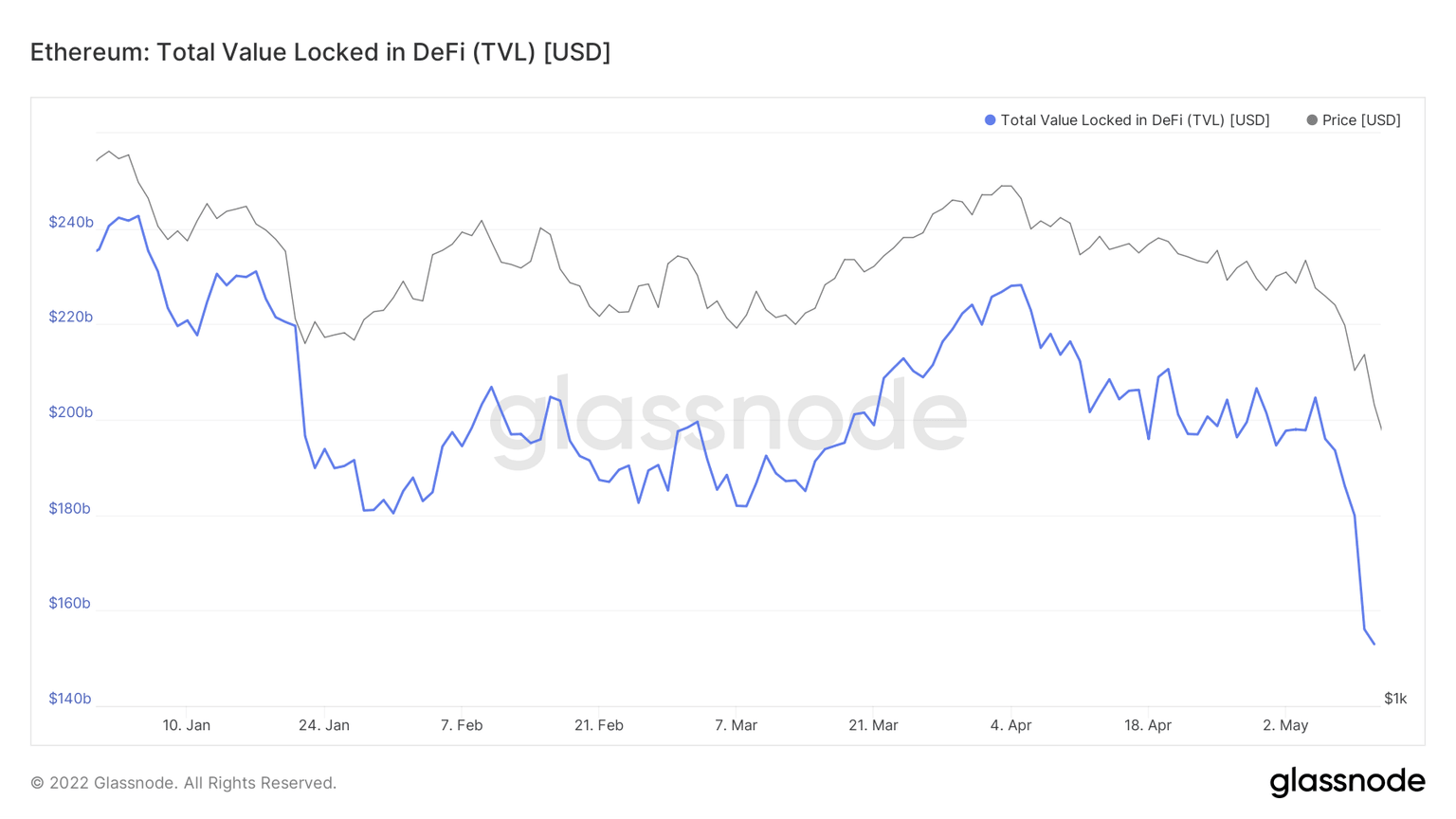

The total locked-in value for DeFi is at $150 billion, down from just under $240 billion at the start of the year and from $230 billion a month ago, according to Glassnode data.

Data would suggest that many traders are moving their crypto out of DeFi protocols and into stablecoins like USDC with plans to redeem them (stablecoins like USDC and USDT can be redeemed for U.S. dollars upon request).

Total value locked (Glassnode)

The supply of USDC, used by institutions and U.S.-based traders because of its regulatory compliance, is now just below $48.5 billion, down from $53 billion at the beginning of March. A similar trend is being seen with Glassnode’s data on exchange net positions. Since mid-April, it has flipped to red, now accelerating with Glassnode reporting daily outflows in the $2 billion range.

At the same time, lending protocols like Compound are reporting large declines in stablecoin supply. Compound, for instance, reports an 11% decline in USDC supply. All the while, gas trackers show that in the last week gas fees from USDC are up 175%, while gas usage at lending protocol Aave is up 705% over the past week.

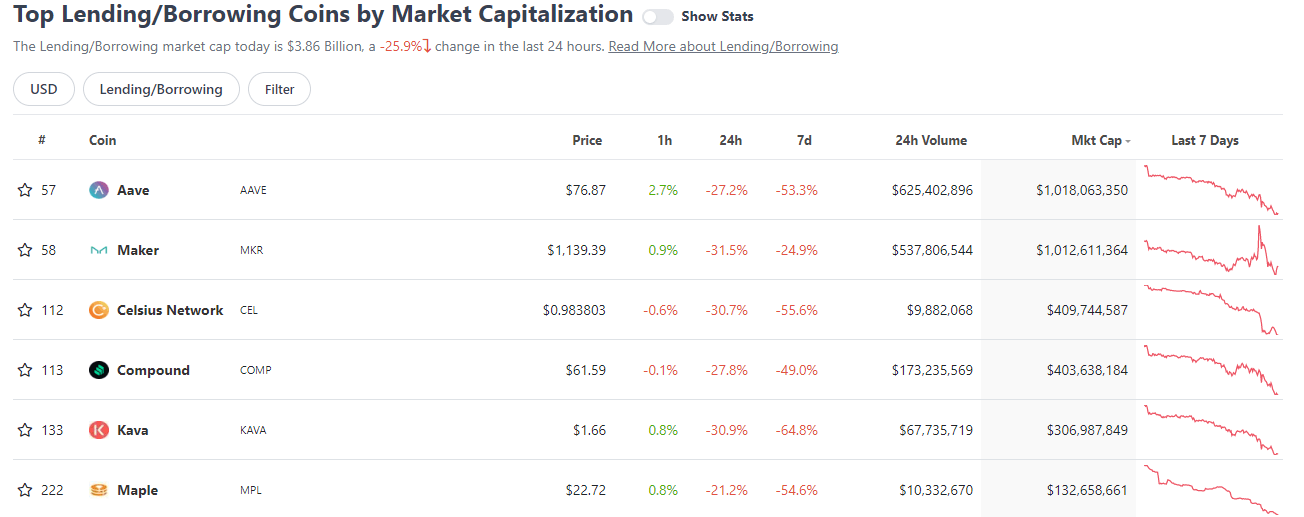

Lending protocol prices aren’t taking well to this dash for the exit. Across the board, the tokens of major lending protocols are down with aave falling 53% over the past week. Celsius has dropped 55.6% over the past week and compound has fallen 49% during that time.

Top lending/borrowing coins

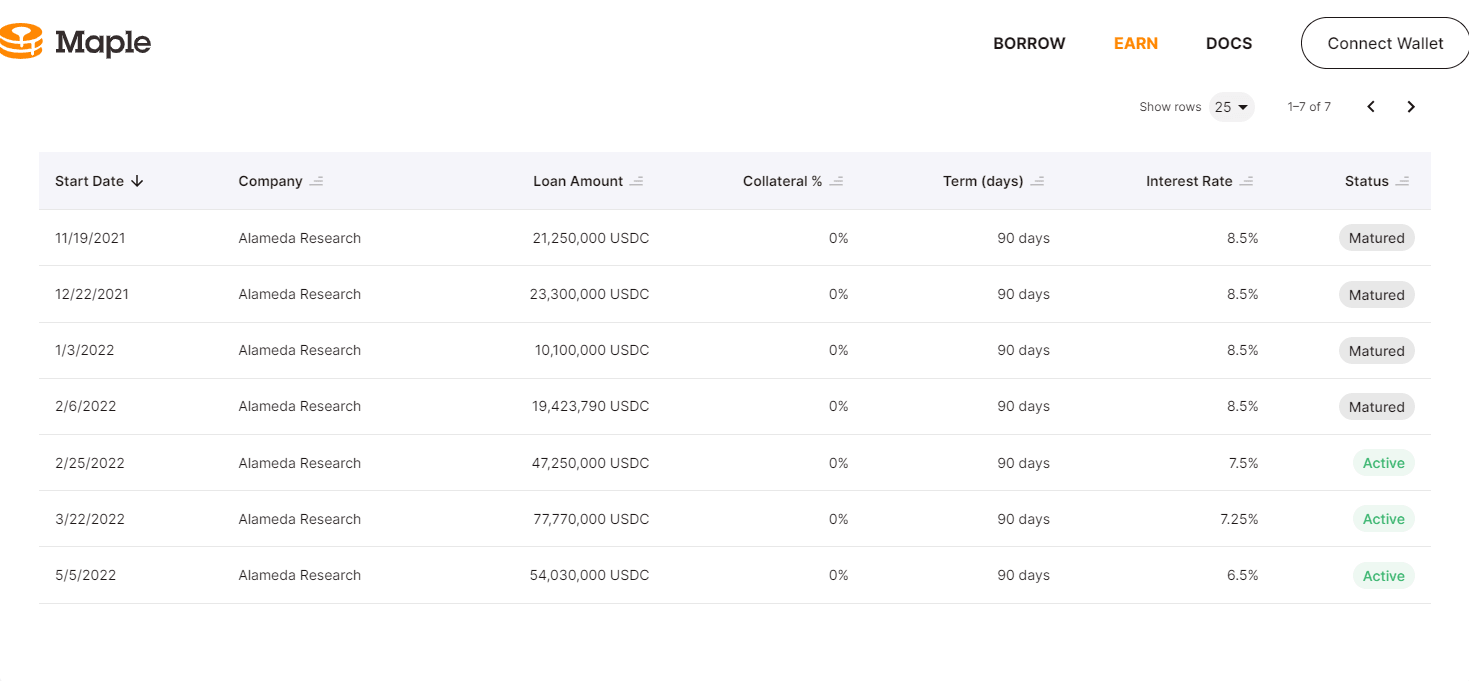

Despite less USDC in circulation, there doesn’t seem to be a particular increase in demand for it. Given the coming bear market, trading tempo will likely decrease and planned investment into crypto infrastructure might slow. The case and point for this is the yield offered by Alameda Research’s syndicated loans powered by the Maple Finance protocol.

Loan amounts (Maple)

Alameda’s most recent USDC-denominated loan, which launched last week just as the Luna crisis emerged, is now offering only a 6.5% yield. When the project began last November, 8.5% was the available yield. Although there is less USDC available, Alameda is anticipating a slowdown and doesn’t have the same need for it.

The good news from this crisis is that many parts of the infrastructure surrounding crypto are continuing to hold. USDC and Binance’s BUSD, are still at $, and redemptions – even from tether which was briefly knocked off its peg – are being processed on request.

Technician's take

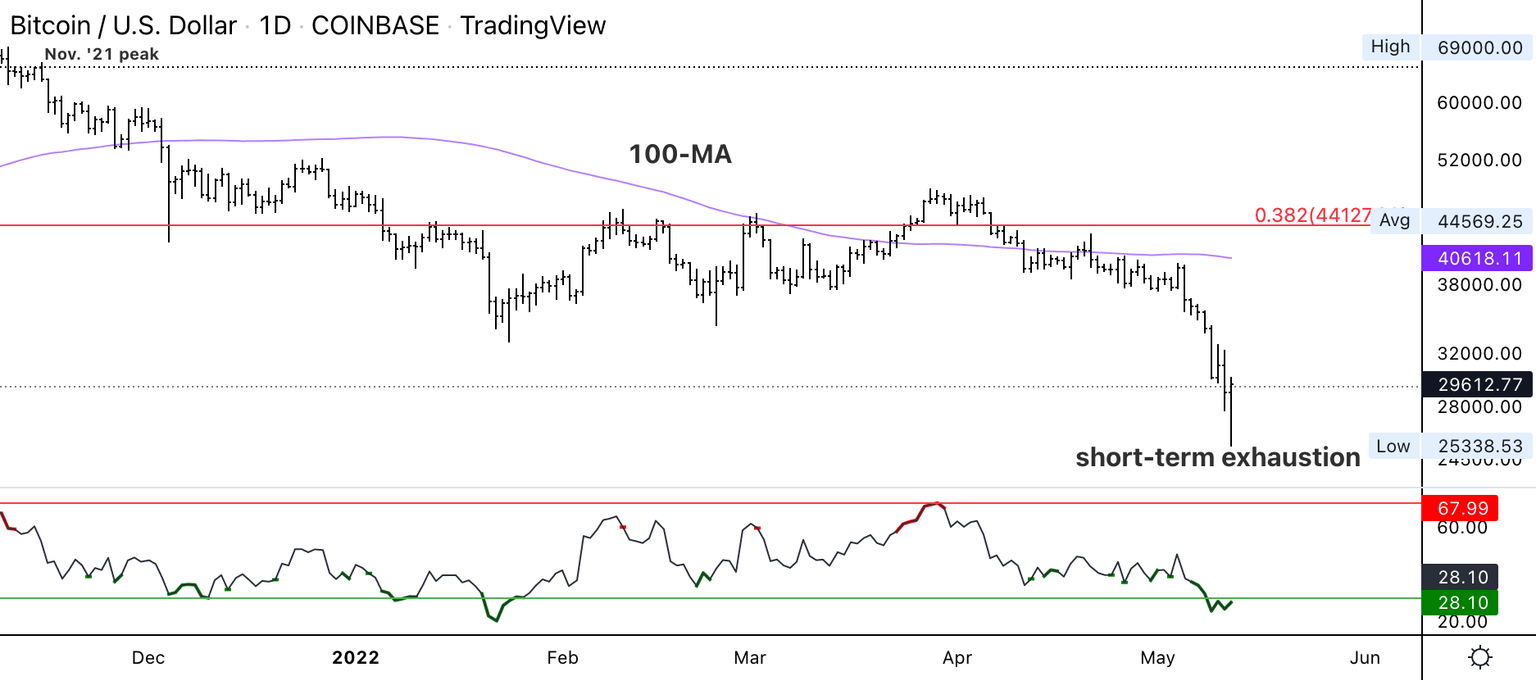

Bitcoin's daily chart shows support/resistance with RSI on the bottom. (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) appears to be oversold on the charts, which typically precedes a short-term upswing in price.

The cryptocurrency declined toward $25,400 Thursday afternoon before quickly recovering back above the $27,000 support level.

The relative strength index (RSI) on the daily chart is the most oversold since January, which preceded a 30% relief rally. This time, however, negative long-term momentum could cap upside moves around the $35,000 resistance level.

Further, BTC registered a countertrend reversal signal on the daily chart, according to DeMARK indicators. That means selling pressure could wane over the next few days as buyers return from the sidelines. Another daily close above $30,000 would confirm the countertrend signal, although there is a low chance of significant upside from here.

Important events

HKT/SGT(UTC): Australia Housing Industry Association new home sales (MoM/April)

10 a.m. HKT/SGT (2 a.m. UTC): Speech by Michele Bullock, assistant governor at the Reserve Bank of Australia

3 p.m. HKT/SGT (7 a.m. UTC): Speech by Luis De Guindos, vice-president of the European Central Bank

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.