Filecoin Price Prediction: FIL prepares for 50% lift-off

- Filecoin price kick-started its recovery as it rallied 8% over the past 24 hours.

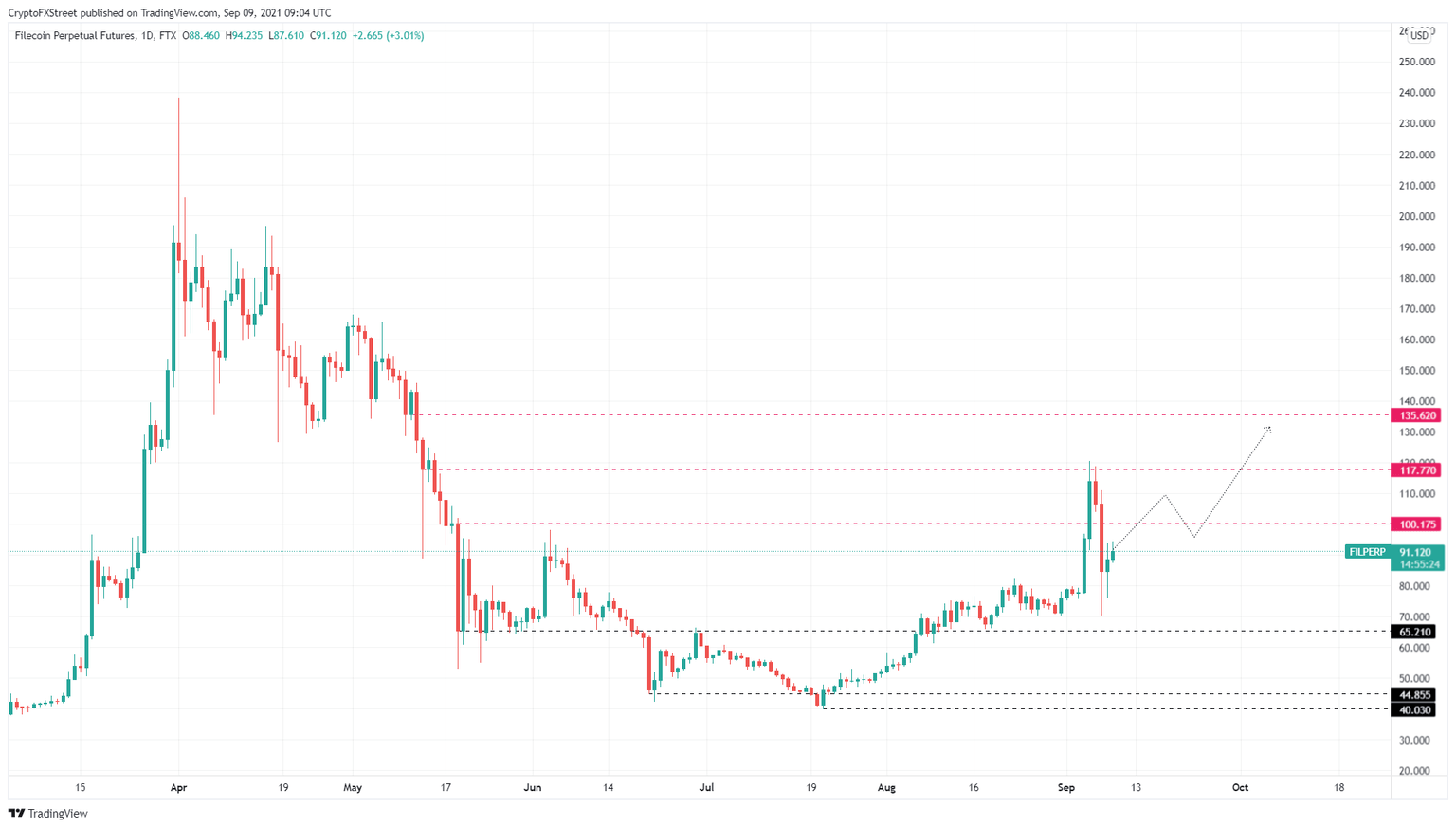

- FIL needs to overcome two key resistance barriers at $100.18 and $117.70 to reach its destination.

- If sellers produce a decisive close below the September 7 swing low at $70.33, that will invalidate the bullish thesis.

Filecoin price was among the altcoins that experienced a ripple effect for a sudden downswing earlier this week. However, like many cryptocurrencies, FIL is on the road to recovery and is showing promise that a massive upswing is around the corner.

Filecoin price eyes a higher high

Filecoin price dropped 25% between September 6 and September 7, undoing its gains accrued since August 31. While the descent was bearish for the time being, altcoins seem to be popping right back up.

If the uptick in buying pressure persists, investors can expect Filecoin price to encounter the $100.18 resistance level after a 10% ascent. Flipping this hurdle into a foothold will allow FIL to advance another 17% before approaching the $117.77 ceiling.

There is a high chance that Filecoin bulls recuperate around this barrier due to the presence of the September 5 swing high. However, clearing this resistance barrier will put FIL on the last leg of its journey to tag $135.62.

This move from its current position to the level mentioned above would constitute roughly a 50% advance.

FIL/USDT 1-day chart

While things seem to be improving for Filecoin price and other altcoins, market participants need to keep a close eye on the immediate resistance levels. Failure to slice through them and the inability to flip these hurdles into foothold will indicate the presence of sellers and weak buying pressure.

Such signs could be hinting that the bears have more to offer. If FIL produces a swing low below the September 7 point at $70.33, it will end the optimistic narrative explained above. This development could trigger an 8% downswing that retests the $65.21 support level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.