Ethereum Price Prediction: Will ETH bulls squander another opportunity?

- Ethereum price rallies 15% due to the interest rate hike during the FOMC meeting.

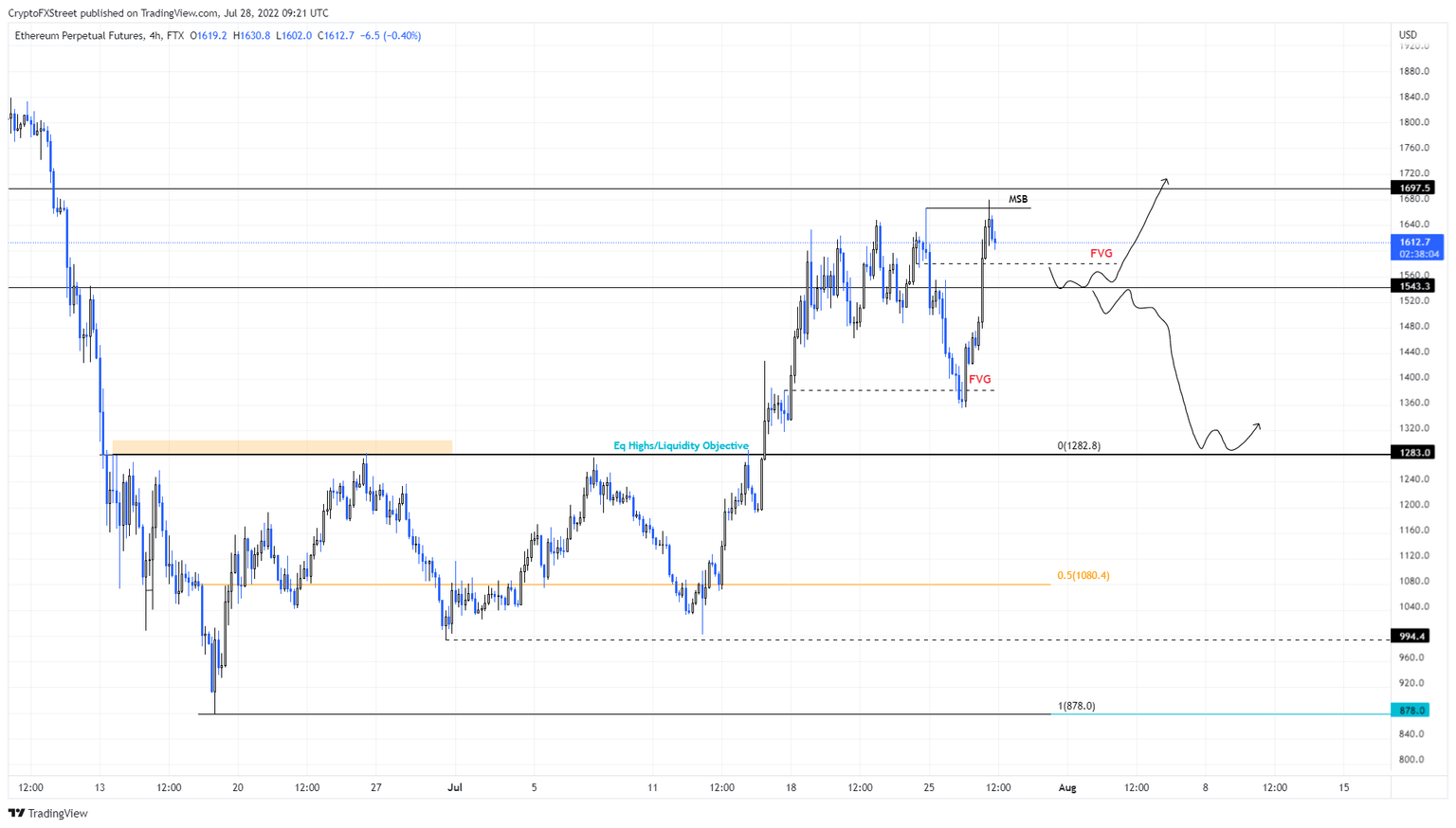

- ETH could continue this rally to retest the $1,700 hurdle or retrace and bounce off the $1,543 level.

- A daily candlestick close below the $1,543 support level will invalidate the bullish thesis.

Ethereum price shows signs of continuing the uptrend that was recently triggered by the US central bank raising interest rates by 75 basis points. This development spurred buying pressure triggering rallies in Bitcoin, Ethereum and many altcoins.

Ethereum price has another chance

Ethereum price fell short of retesting the $1,700 resistance barrier after rallying 65% between July 13 and July 24. However, the FOMC-induced rally is giving ETH bulls another go at reigniting a bull rally.

During the FOMC meeting on July 27, ETH climbed 15% and set a swing high at $1,680 but failed to retest the aforementioned resistance barrier. This lack of bullish momentum could result in a retracement.

However, the Ethereum price and the bulls will get another chance after retesting the $1,543 support level. A bounce off this level is the last chance for buyers to band together. If successful, investors can expect the resulting upswing to retest the $1,700 level.

If the momentum persists, the Ethereum price could even revisit the $2,000 psychological level.

ETH/USDT 4-hour chart

On the other hand, if Ethereum price breaks below the $1,543 support level, the chances of revisiting the $1,284 barrier are high.

A daily candlestick close below this level will invalidate the bullish outlook and open the path for ETH to revisit the range’s midpoint at $1,080.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.