Ethereum Price Forecast: Treasury companies ramp up demand amid record outflows in ETH ETFs

- SharpLink Gaming bought 83,561 ETH last week, pushing its holdings above 521,000 ETH.

- The buying pressure from Ethereum treasury vehicles failed to incentivize traditional investors who logged $465 million in the largest ETH ETF daily outflow.

- After seeing a rejection just above $3,700, ETH eyes a rising trendline support, strengthened by the 50-day EMA.

Ethereum (ETH) failed to hold the $3,700 level on Tuesday despite SharpLink Gaming's (SBET) announcement that it acquired over 83,000 ETH last week. Rather than reacting to the buying pressure of corporate entities, the top altcoin's move closely aligns with a record daily outflow of $465 million in US spot ETH exchange-traded funds (ETFs).

SharpLink boosts Ethereum treasury, ETH ETFs post largest outflow

Ethereum treasury and esports marketing company SharpLink Gaming disclosed that it purchased 83,561 ETH last week, boosting its total holdings to 521,939 ETH as of August 3. The company said it made the purchase after raising $264.5 million through its at-the-market (ATM) facility during the period.

SharpLink pivoted to an ETH treasury strategy in May after it raised $425 million through a private placement. Since then, it has filed with the Securities & Exchange Commission (SEC) to expand its ATM facility to $6 billion, aiming to use the proceeds to expand its ETH stash.

The company, which stakes nearly all of its holdings, also reported a total staking rewards increase to 929 ETH since the launch of its treasury in June.

SharpLink's 521,939 ETH stash places it behind Peter Thiel's backed BitMine (BMNR) in the leaderboard of publicly-traded companies focused on building a treasury vehicle for the top altcoin. BitMine revealed holdings of over 833,100 ETH on Monday, adding that Bill Miller and Cathie Wood's ARK Invest are key shareholders of its stock. As a result, the combined holdings of ETH treasury vehicles have climbed above 1.9 million ETH.

The sustained buying pressure from ETH treasury companies follows record outflows in US spot ETH ETFs. The products recorded their largest daily outflow on Monday, worth $465 million, per SoSoValue data. This comes after breaking a 20-day inflow streak worth about $5.3 billion last Friday following fresh reciprocal tariffs from President Donald Trump on international trading partners.

Ethereum Price Forecast: ETH could find support near rising trendline

Ethereum experienced $108 million in futures liquidations over the past 24 hours, comprising $74 million and $34 million in long and short liquidations, respectively, per Coinglass data.

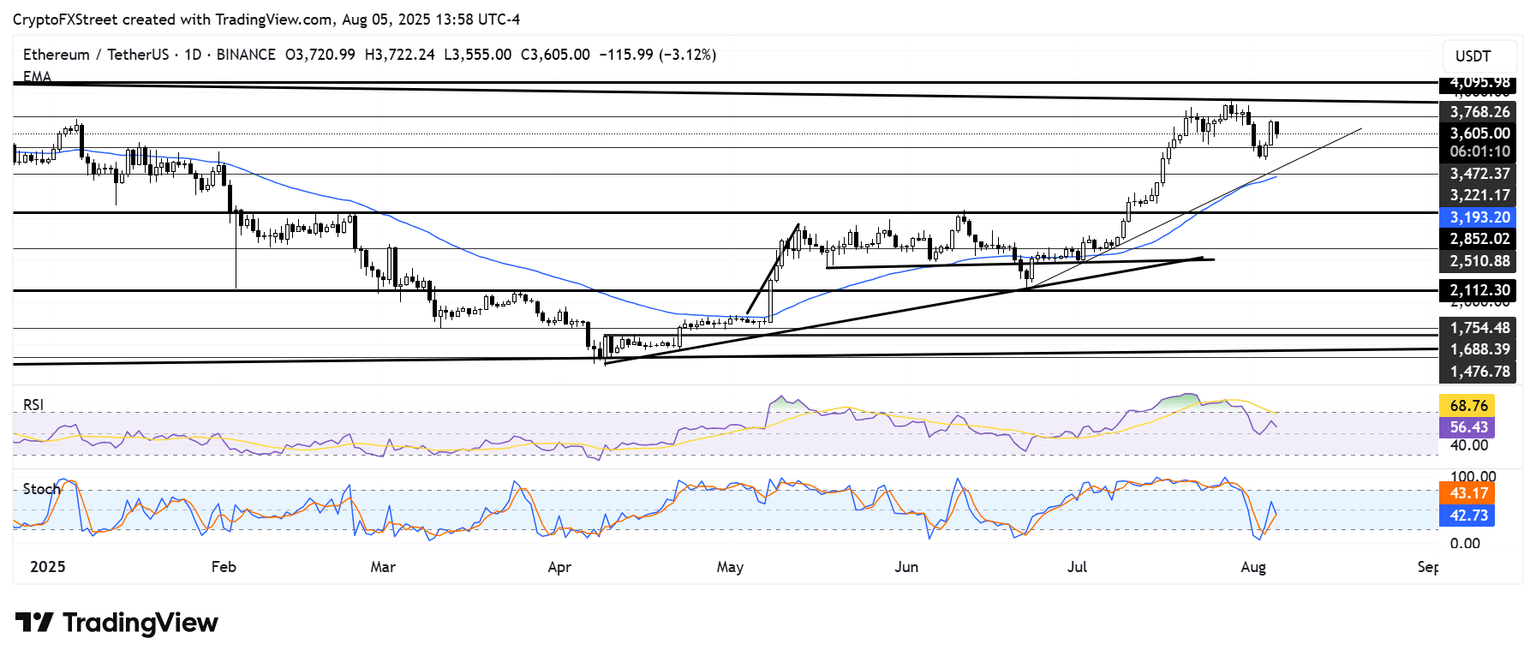

Ethereum saw a rejection just above $3,700 on Tuesday after kicking off the week with a 6% rally. As a result, the top altcoin is declining toward the $3,470 level.

ETH could find support near a rising trendline — strengthened by the 50-day Exponential Moving Average (EMA) — extending from June 22. Just below this trendline is the $3,220 support. A breach of these levels could send ETH toward the $2,850 key level.

On the upside, a daily candlestick close above the descending trendline near $3,900 could send ETH to test its 2024 high of $4,107.

ETH/USDT daily chart

The Relative Strength Index (RSI) is below its moving average and trending downward toward its neutral level, indicating a weakening bullish momentum. Meanwhile, the Stochastic Oscillator is below its midline and trending toward the oversold region. A crossover into the region could spark a short-term recovery.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi