Ethereum Price Forecast: ETH investors resume buying after intense profit-taking

Ethereum price today: $2,560

- Ethereum saw an exchange net outflow of nearly 230,000 ETH on Friday, its highest since March 7.

- Whales led the buying pressure with Abraxas Capital, expanding its holdings to 278,639 ETH.

- The high exchange outflows come after investors realized over $1.5 billion in profits from ETH's recent rally.

- ETH could begin an extended consolidation if volume declines and bulls hold the $2,530 support.

Ethereum (ETH) saw a 2% gain on Friday, with investors, particularly those in the whale cluster, initiating a 230,000 ETH exchange net outflow.

Ethereum whales lead buying pressure after intense profit realization

Ethereum spot-based investors returned to action on Friday, triggering nearly 230K ETH in net outflows from exchanges — its highest single day outflow since March 7.

%20-%20All%20Exchanges%20(3)-1747427620551.png&w=1536&q=95)

ETH Exchange Net Flow. Source: CryptoQuant

Exchange Net Flow shows the total amount of ETH flowing in and out of crypto exchanges. Net outflows indicate dominant buying pressure and vice versa for inflows.

The spot buying pressure on exchanges flowed from investors holding between 10K and 100K ETH, according to the ETH Supply Distribution metric. This cohort has accumulated 520K ETH since Wednesday.

%20%5B21-1747427677927.34.27%2C%2016%20May%2C%202025%5D.png&w=1536&q=95)

ETH Supply Distribution. Source: Santiment

Most of the accumulated ETH is potentially flowing to staking protocols as total ETH staked has been in an uptrend since May 6, further fueling the bullish momentum, per CryptoQuant data.

Another main contributor to ETH's increased exchange net outflows is the digital asset investment firm Abraxas Capital, which continued its ETH buying spree on Friday. The firm has withdrawn 278,639 ETH from exchanges since May 7, according to data from on-chain wallet tracker Lookonchain.

The huge outflows on Friday came after ETH's price slightly declined between Wednesday and Thursday, partly fueled by investors realizing over $1.5 billion in profits from its recent rally.

%20%5B21-1747427715382.35.00%2C%2016%20May%2C%202025%5D.png&w=1536&q=95)

ETH Network Realized Profit/Loss. Source: Santiment

Meanwhile, active addresses on Ethereum have continued to grow since the Pectra upgrade on May 7, signaling increased interest in its ecosystem.

-1747427785279.png&w=1536&q=95)

Ethereum Active Addresses. Source: CryptoQuant

The Pectra upgrade introduced several features to Ethereum, including smart wallet functionality, increased scalability for Layer 2 networks and validator-focused updates.

Ethereum Price Forecast: ETH eyes consolidation as volume drops

Ethereum saw $53.65 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of long and short liquidations is $27.01 million and $26.68 million, respectively.

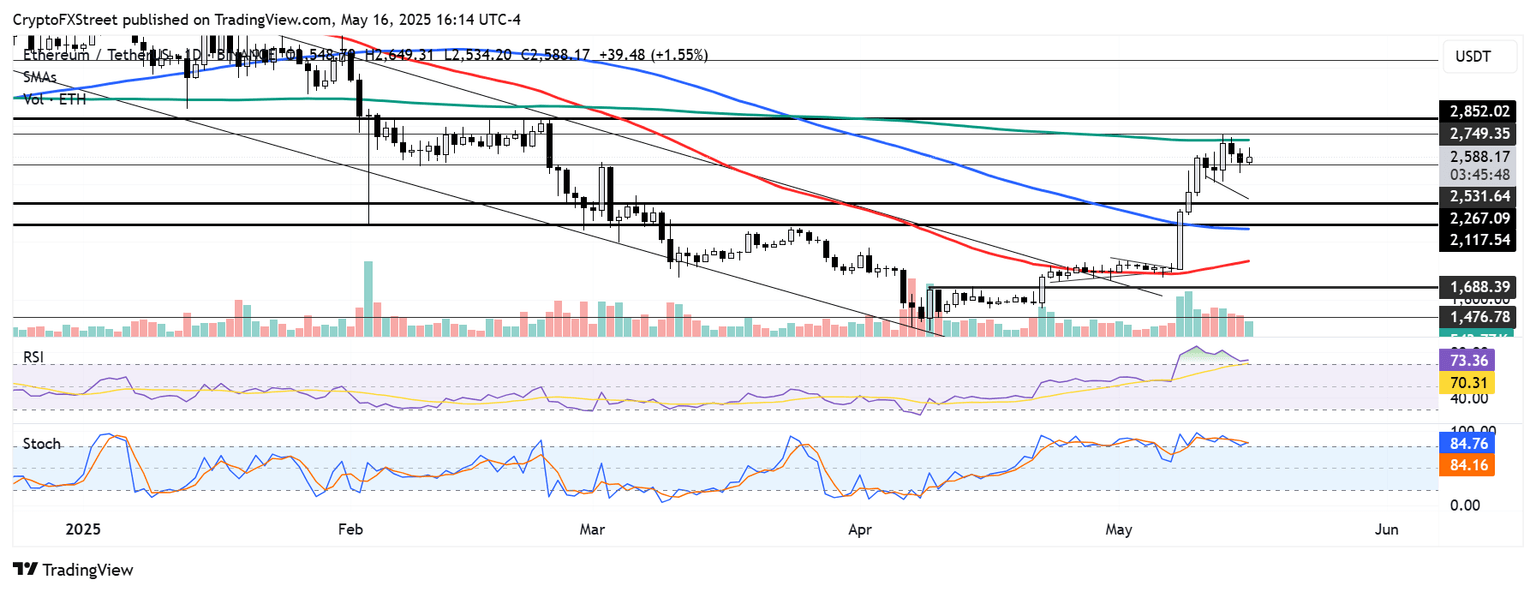

After seeing a rejection at $2,750, ETH found support at the $2,530 key level but still faces resistance at the 200-day Simple Moving Average (SMA). A firm move above this resistance could see ETH tackle the $2,850 key level.

Trading volume for the top altcoin has also declined toward levels seen in late April. If such low volume persists and ETH holds the $2,530 support, it could post a consolidation similar to that seen between April 23 and May 7.

ETH/USDT daily chart

On the downside, ETH could find support between the $2,260 and $2,100 range if it loses the $2,530 key level.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are in their overbought regions but trending downward, indicating a modest decline in the bullish sentiment among traders.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi