Dogecoin traders on alert as Trump backs Elon Musk after tariffs triggered $200B Tesla losses

- Dogecoin price reached $0.14 on Tuesday, down 46% since Trump confirmed tariffs on Canada and Mexico on March 3.

- Since March 3, Dogecoin has mirrored Tesla’s 20% losses, as the automaker lost $200 billion in market cap.

- Trump announced the purchase of a new Tesla car, drumming up national support for DOGE chief Elon Musk.

Dogecoin price reached $0.14 on Tuesday, posting 46% losses in the last 10 days. Market reports suggest that fresh developments surrounding United States (US) President Donald Trump and Elon Musk could see DOGE prices stabilize in the days ahead.

Dogecoin (DOGE) slumps to five-month low amid heightened inflation fears

Dogecoin (DOGE) has emerged as the hardest-hit asset since the current phase of the crypto market dip began in early March. After the US Nonarm Payrolls (NFP) report triggered inflation risk signals, investors have been reallocating capital away from risk assets.

This negative macro sentiment has weighed heavier on memecoins, often observed in macro-driven price dips.

Due to the highly speculative nature of memecoins and their sensitivity to media sentiment, strategic traders often exit meme tokens at a rapid pace when overarching market momentum turns negative.

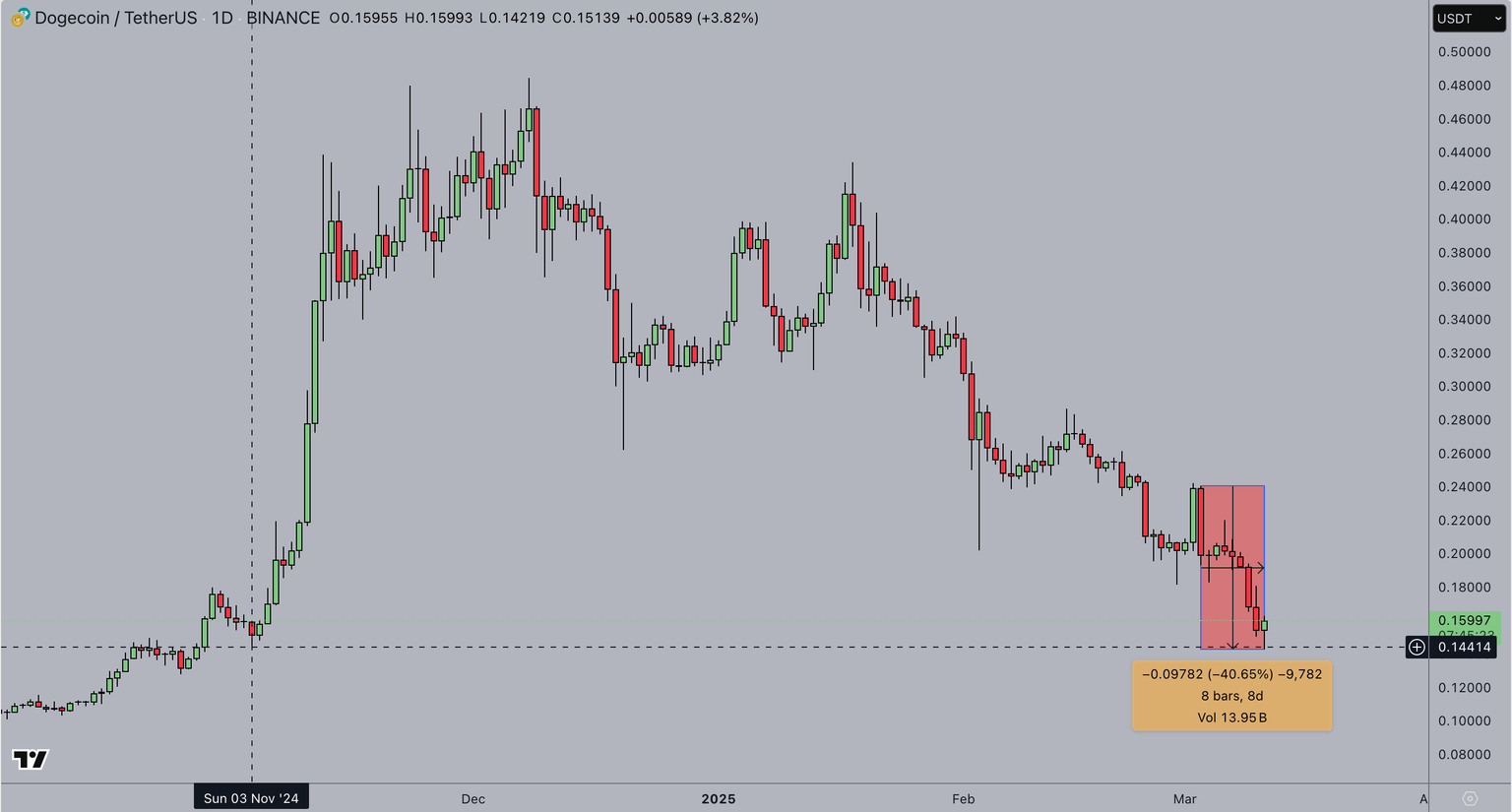

Dogecoin Price Analysis, March 11, 2025 | Source: TradingView

Confirming this narrative, Dogecoin’s ongoing price dip coincided with the market downturn after Trump confirmed tariffs on Canada and Mexico on March 3.

While Bitcoin’s price has only declined by 15%, falling from $95,000 to $81,000 at press time on Tuesday, Dogecoin has lost more than twice that pace.

The chart above shows DOGE traded as low as $0.14 on Tuesday, posting 46.7% losses in the last eight days dating back to March 3.

Key factors driving DOGE price action this week

With large downward movements and increasing trading volume, Dogecoin traders have been on red alert to external bearish catalysts over the past week.

-

Trump policies sparking Tesla sell-off

The recent Tesla sell-off in response to Trump’s tariff announcements has had a ripple effect on risk assets linked to Elon Musk.

Investors have been pulling back funds, attempting to slim costs ahead of inflation, leading to fewer jobs in the US NFP report.

However, assets linked to Musk appear to be experiencing considerably intense sell-offs, reflecting the unpopular sentiment around these policies.

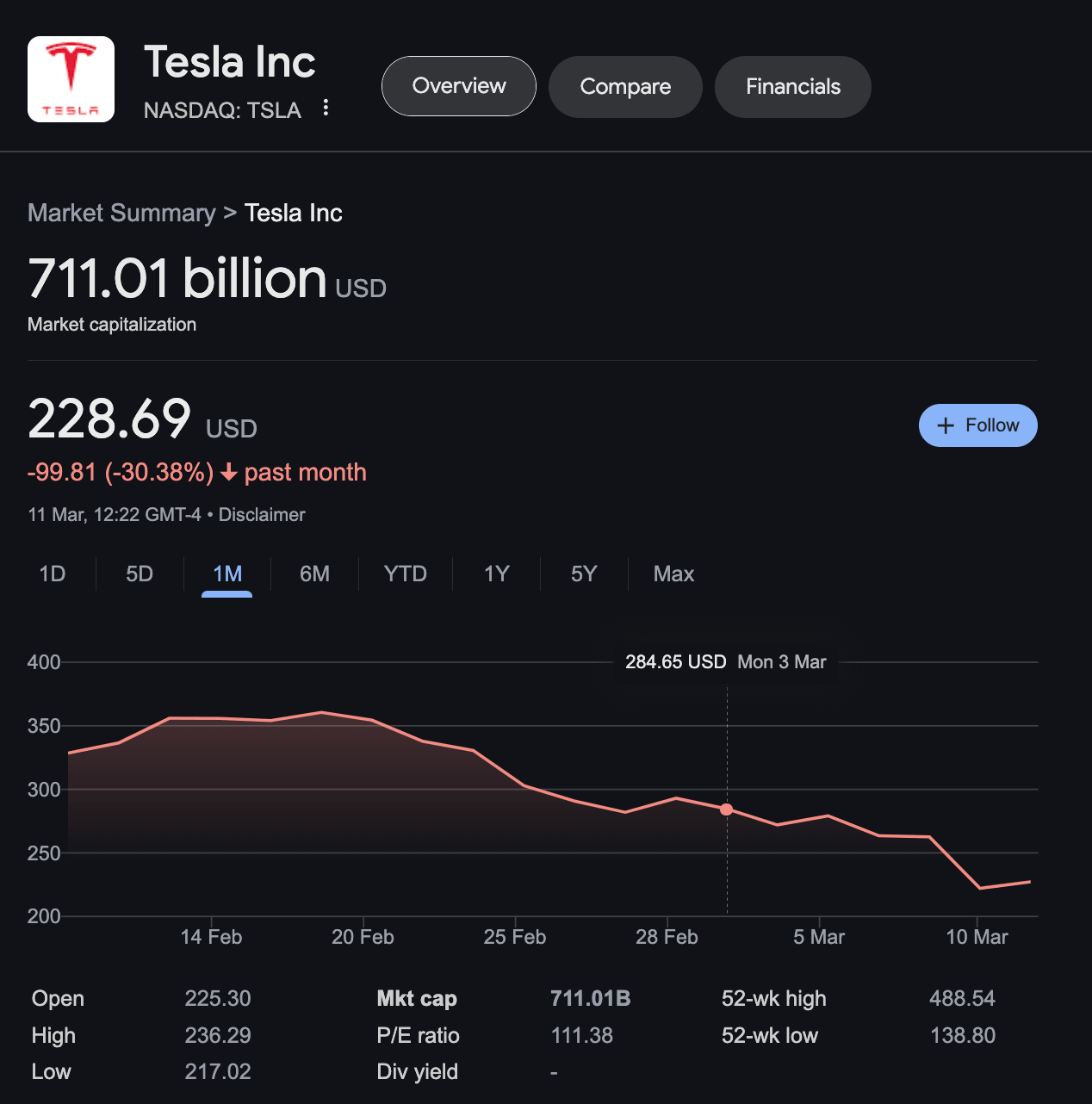

Tesla (TSLA) Stock Price Action, March 2025 | NASDAQ

Tesla recently warned investors that tariffs are expected to impact sales in the next quarter as Canada announces retaliatory measures.

This catalyst, combined with ongoing economic uncertainty, saw Tesla stock slump 20% from $284 when Trump announced the tariffs on March 3 to hit $227 at press time on Tuesday.

Meanwhile, the S&P 500 has only declined 8% in the past month.

This shows that both DOGE and Tesla’s current price downtrends align with double-speed sell-offs in their respective markets, confirming the influence of Trump administration policies.

-

Trump promises to buy Tesla could lift DOGE price

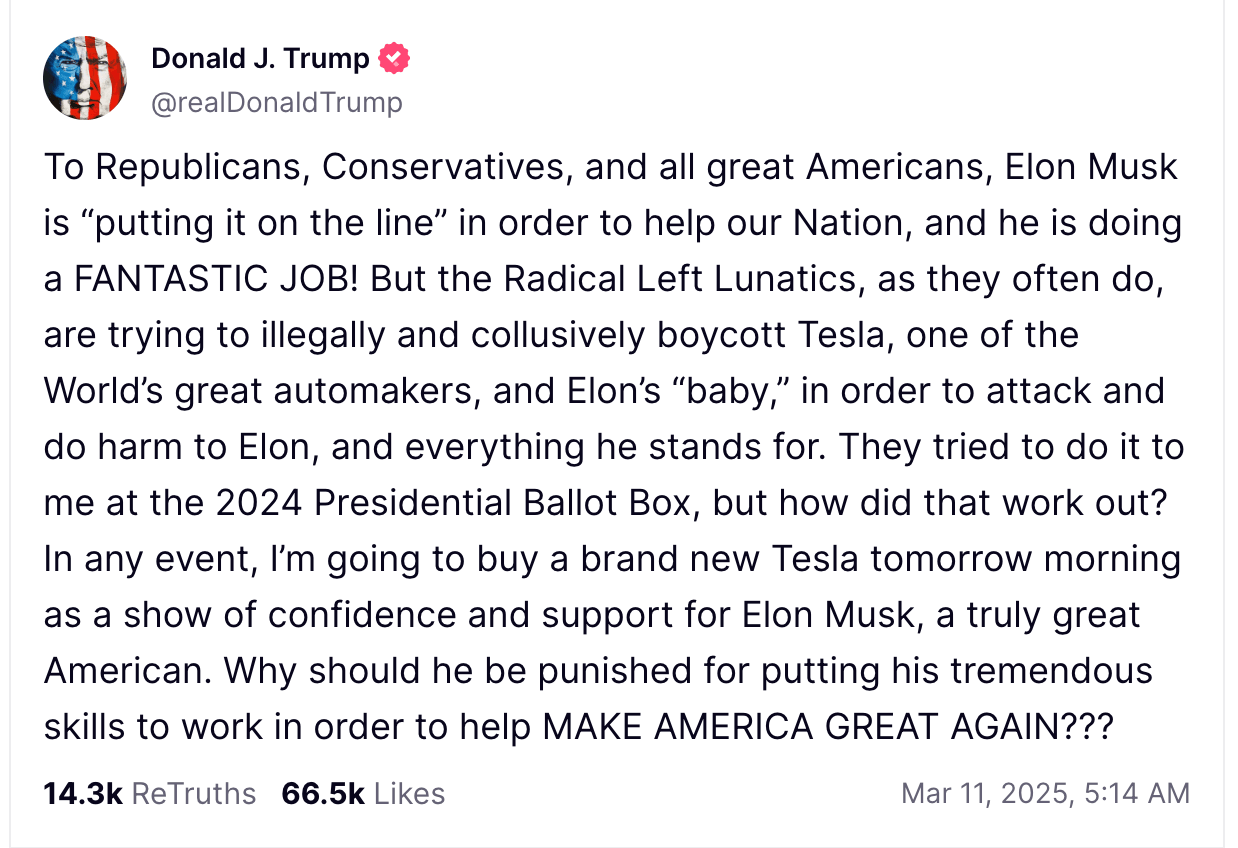

On Tuesday, Trump took to his Truth Social platform to drum up Tesla sales, calling on "Republicans, Conservatives, and all great Americans" to support Musk, who has been focusing on slashing federal government jobs.

US markets slumped on Monday as investors concerned about the economic effects of Trump’s tariffs sold shares.

This came after the US President hinted at a potential recession, telling a TV interviewer that the world's biggest economy was in a "period of transition."

Investors fear Trump's tariffs could push the pace of price increases and hit economic growth as firms pass the costs of bringing goods into the country onto customers.

Trump issues statement supporting Elon Musk’s Tesla amid tariff crisis | Source: TruthSocial, March 11

As part of the sell-off, shares in technology firms dropped sharply, with Tesla stock sinking by 20%. Artificial intelligence (AI) chip giant Nvidia, Facebook owner Meta, Amazon, and Google-parent Alphabet also saw steep losses.

Trump said on Tuesday that Musk is doing a "fantastic job," but "radical left lunatics" are "trying to illegally and collusively boycott Tesla" in an effort "to attack and do harm to Elon."

"I'm going to buy a brand new Tesla tomorrow morning as a show of confidence and support for Elon Musk, a truly great American." – Donald Trump

Amid Trump’s supportive statement, Tesla shares recovered 3.6% when US markets opened on Tuesday. Other US tech stocks also regained some lost ground.

Given the close price correlation observed between Tesla and Dogecoin since March 3, it remains to be seen if this could translate into a major upside for DOGE price to attempt a rebound towards $0.20 in the coming trading sessions.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.