Dogecoin price targets massive 50% breakout to a new all-time high

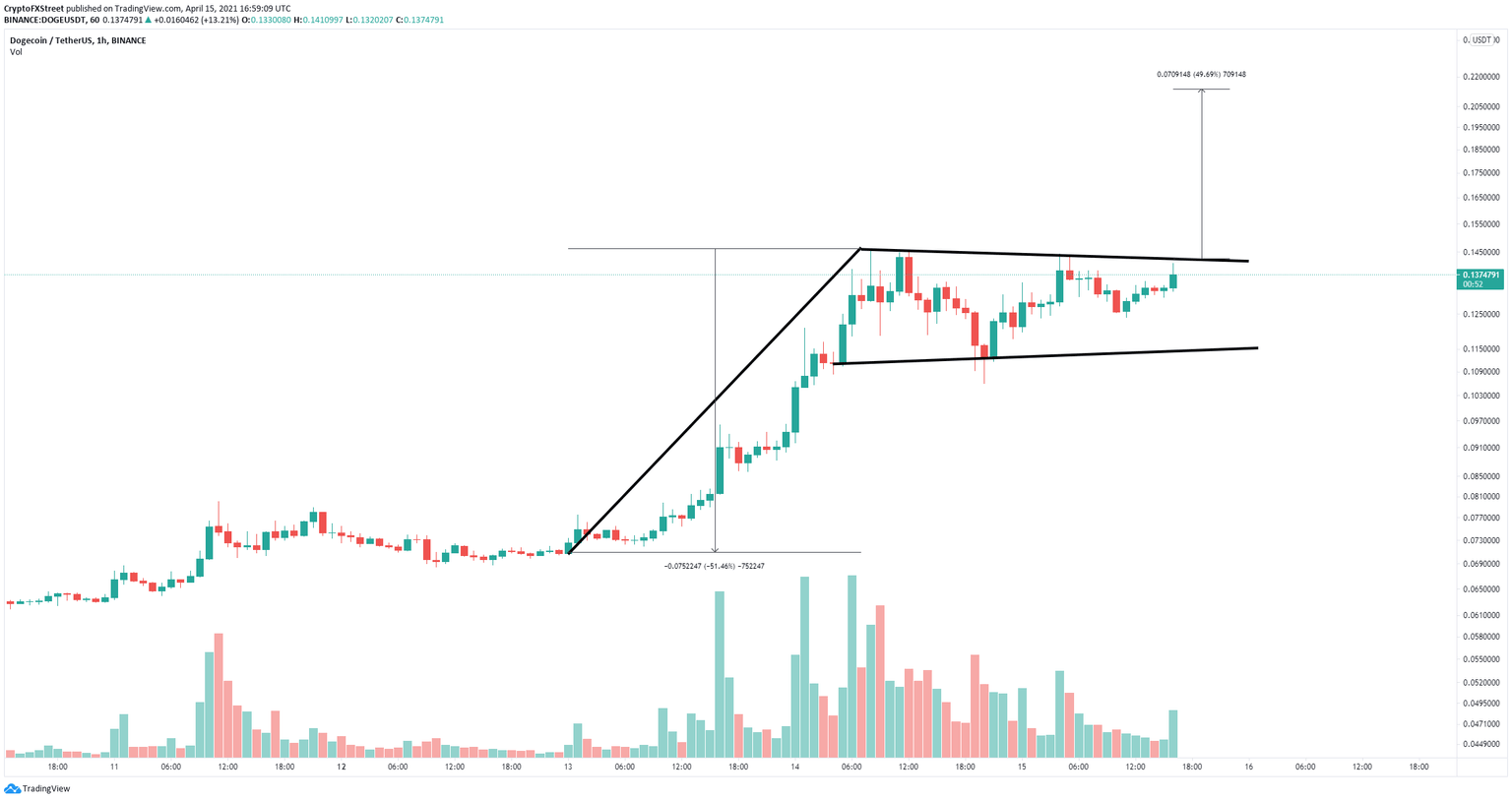

- Dogecoin price has established a bull flag on the 1-hour chart.

- Only one crucial resistance level separates the digital asset from a significant 50% upswing.

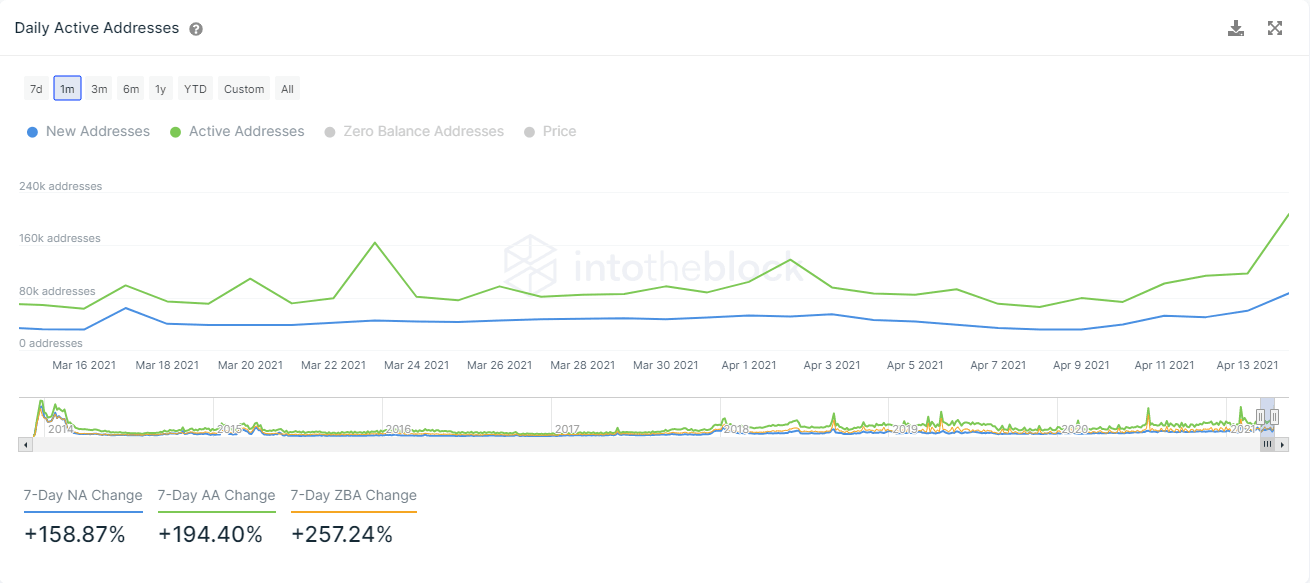

- The network growth of Dogecoin continues increasing adding credence to the bullish outlook.

Dogecoin had a colossal 100% rally in less than two days reaching a new all-time high at $0.145. The digital asset has a ton of bullish momentum behind it and aims for a new leg up toward $0.2.

Dogecoin price faces just one critical resistance level ahead

On the 1-hour chart, Dogecoin price has formed a bull flag with the most significant resistance level at $0.142. A breakout above this point has a price target of $0.21, determined by measuring the height of the flag’s pole.

DOGE/USD 1-hour chart

The network growth of DOGE is exploding again as the number of new addresses increased by 158% in the last week. Similarly, the number of active addresses also had a massive 194% spike, which indicates investors are eager to buy Dogecoin even at current prices, adding credence to the bullish outlook.

DOGE Network Growth

However, if DOGE bears can hold the key resistance level at $0.142, they can quickly push Dogecoin price down to the lower trendline of the pattern at $0.115, even though this wouldn’t invalidate the overall bullish outlook.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.