Dogecoin Price Prediction: DOGE preps up for a rally towards $0.30

- Dogecoin price confirms a triangle breakout on the 4H chart.

- DOGE bulls target $0.30 amid the renewed upside momentum.

- $0.1969 is the level to beat for the bears amid bullish RSI.

Dogecoin price is jumping this Sunday, displaying a solid start to August, as a fresh buying wave grips the crypto market, with Bitcoin challenging two-month tops above $42,000.

DOGE price has gained about 5% in the past four hours, as it hovers around $0.2150, having witnessed two straight weekly rise.

The eleventh most traded coin posted 11.50% gains over the last seven days after receiving endorsements from two technology giants. Tesla Inc. CEO Elon Musk tweeted out; the meme coin isn't a speculative asset but rather "dogecoin is money."

Meanwhile, the report that the number of global crypto users doubled to 200 million in four months, courtesy of the growing interest in tokens such as Shiba Inu (SHIB) and dogecoin (DOGE) among others, helped keep the buoyant tone intact around the canine-inspired coin.

DOGE/USD: Technical setup indicates more room to the upside

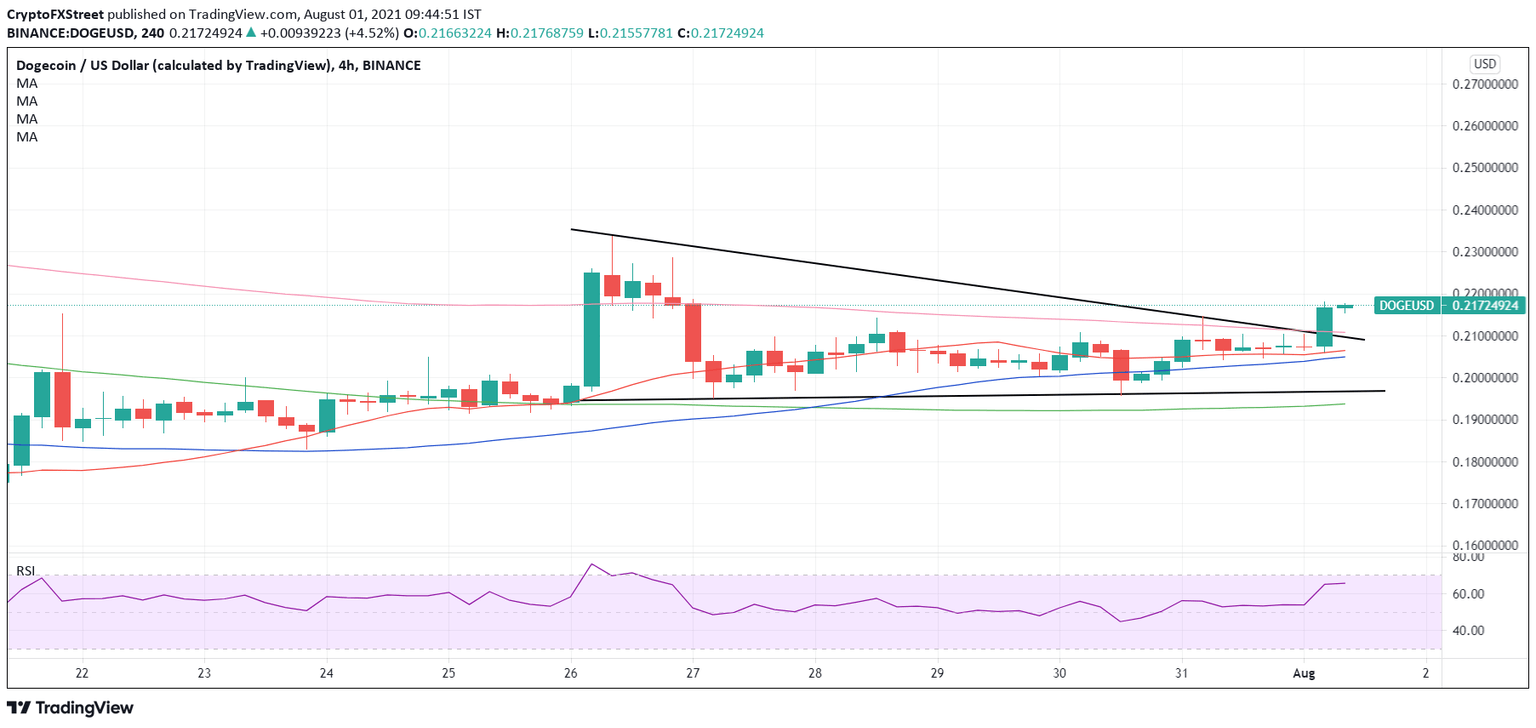

The meme-coin confirmed a descending triangle breakout on the four-hour chart in the last hour, following a candlestick closing above the falling trendline resistance at $0.2103, where the bearish 200-Simple Moving Average (SMA) coincides.

The upside breakout has opened gates for a rally towards the July 26 high of $0.2336, above which the $0.25 psychological magnate could be challenged.

Further up, the $0.30 round number could test the bullish commitments. Justifying the move higher, the Relative Strength Index (RSI) holds comfortably above the midline while sitting beneath the overbought territory.

DOGE/USD: Four-hour chart

Any pullbacks will meet initial demand at $0.2100, the abovementioned key resistance now turned support.

The next relevant support is seen around $2050, the confluence of the mildly bullish 21 and 50-SMAs.

The triangle support at $0.1969 is likely to be the line in the sand for the DOGE buyers.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.