Decentraland whales load on MANA awaiting rally in MANA price banking on the “conference hype”

- MANA price registered gains of 54% in the past three weeks and could breach a five-month-old barrier.

- Decentraland is set to host its Music Festival from November 16 to 18, which is anticipated to be a bullish catalyst for price action.

- Whale addresses have seen inflows of nearly 25 million MANA, suggesting expectations of a further rally going forward.

Decentraland, which was once the talk of the town, along with The Sandbox for being the leaders of the Metaverse, is now looking to draw the attention of investors by making the most of the ongoing bullishness in the crypto market surrounding developer conferences. Interestingly, MANA whales seem to be anticipating a rally from an upcoming event, as suggested by their recent accumulation.

Decentraland to host its music festival

The month of November is expected to be a bullish one, thanks to the slew of developer conferences taking place across the crypto market. Naturally, some crypto organizations may find ways to make use of this wave.

While the Metaverse protocol’s first-ever Community Summit is set to be held in Argentina in May 2024, it seems FOMO has pushed Decentraland to plan an event earlier. As such, it is set to host the Decentraland Music Festival in the Metaverse from November 16 to 18.

Get ready to experience the future of music at #DCLMF23 from Nov 16-18!

— Decentraland (@decentraland) November 8, 2023

Join in for a lineup of 80+ innovative acts, groundbreaking games, and insights from digital music pioneers.

RSVP now: https://t.co/SHb8fBcaKA

While this event does not offer any technical development, it seems to be an attempt to bring users to the platform by capitalizing on FOMO.

MANA price could see new highs

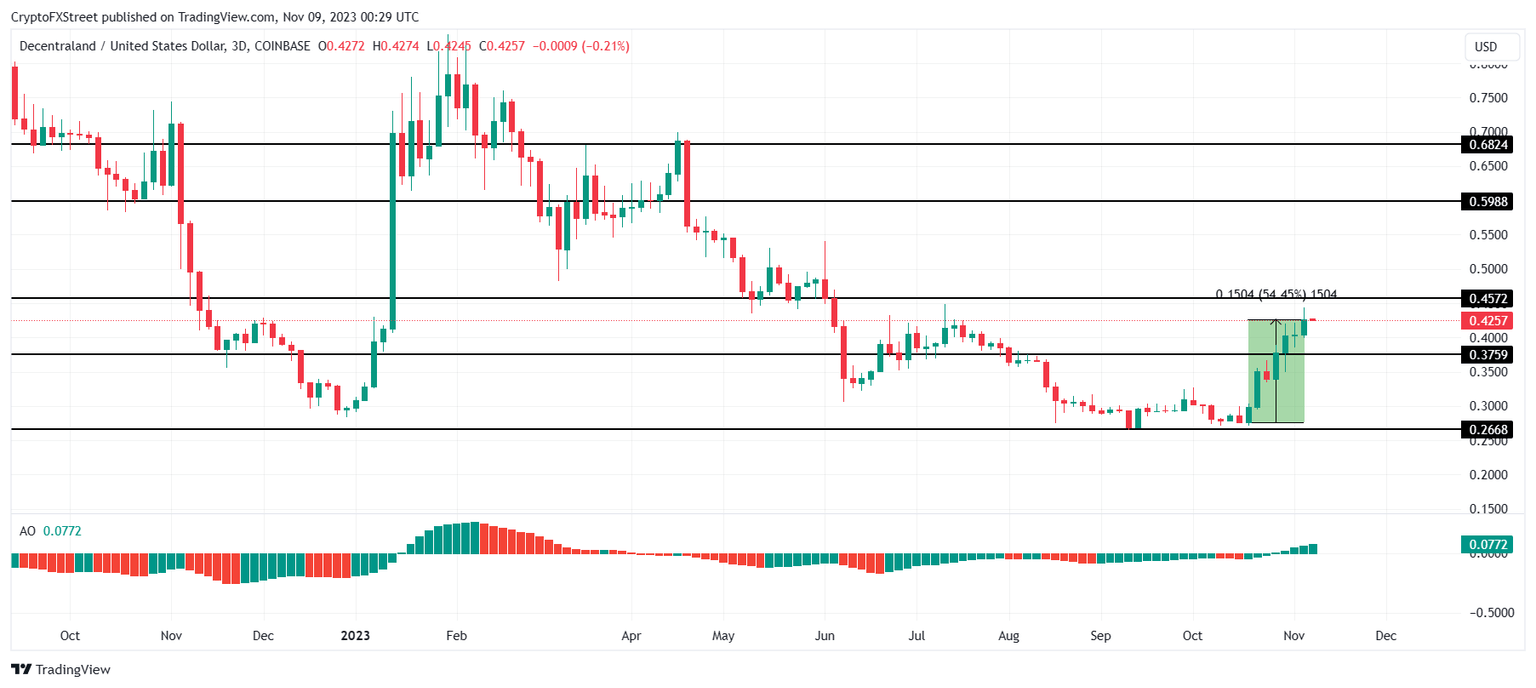

MANA price trading at $0.425 has already risen by more than 54% in the last three weeks and still notes the potential of a rise. The Awesome Oscillator’s green bars suggest that the bullish trend is yet to be reversed. Since the positive momentum is not lost, the Metaverse token could see some more increase after a slight pullback as the Music Festival inches closer.

If the bullish momentum dominates the price action, the cryptocurrency could touch $0.452, and breaching it would mark a five-month high for MANA price.

MANA/USD 3-day chart

On the other hand, if the breach fails and the upcoming festival turns into a sell-the-news event, MANA's price could fall back. If the Decentrlaand token loses the support of $0.375, the bullish thesis would be invalidated, and MANA could be vulnerable to falling below $0.350.

Whales remain optimistic

Interestingly, MANA whales are more hopeful of the optimistic outlook to the extent that they are prepared to make profits following the surge in price before the end of the month. This is evident by their recent transactions wherein whale addresses loaded up on MANA in less than 24 hours.

Addresses holding 1 million to 10 million MANA noted an increase of more than 25 million MANA tokens in the span of a day worth more than $10.5 million. This brought their total holdings to 585 million MANA.

MANA whale accumulation

Looking at past movements, it seems that these whales have been close to accurate in anticipating rises as their accumulation is followed by a price rally. Similarly, if they choose to book profits and sell their assets, a crash would not be too far away either.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B05.58.53%2C%252009%2520Nov%2C%25202023%5D-638350888304953768.png&w=1536&q=95)