Cryptocurrency platforms avoid Ripple like the plague; over companies 14 suspended XRP trading

- More companies announced the decision to suspend XRP trading.

- The token may be ready for a short-term rebound.

The list of cryptocurrency companies delisting or suspending Ripple's XRP trading is growing faster than mushrooms after a rainy day.

At the time of writing, 14 digital assets service providers announced the decision to distance themselves from the troubled startup and its token. The list includes such big names in the cryptocurrency industry as Coinbase, Bitstamp, Coinmama, and Wirex.

The UK-based cryptocurrency debit and credit card issuer said that it would not include XRP in the list of assets available via its US app. Also, Swipe Wallet will delist XRP on January 5. A crypto-friendly bank Ziglu, decided to suspend XRP trading as of January 12, 2021, while a handful of UK-based cryptocurrency wallet providers are considering the same actions.

Bitcoin Swiss also suspended XRP trading, according to the announcement distributed by email to the company's customers.

Currently, the following companies introduced restrictions on XRP:

- Wirex

- Bitcoin Swiss

- Swipe Wallet

- Ziglar

- Coinbase

- Bitstamp

- Simplex

- Galaxy Digital

- Bitcoin Suisse

- Wirex

- Jump Trading

- Coinmama

- OSL

- Beaxy Exchange

- CrossTower

- Bitwise

- B2C2

- 21Shares.

The court announced the date of the first hearing

New York Southern District Court announced the date of the first hearings on the SEC vs. Ripple case. It will take place on February 22 in the form of a telephone call.

The parties were instructed to provide a joint letter before February 15. The letter should include a brief description of the case, including the legal basis for the claims and defenses, contemplated motions, and settlement prospect.

According to Ripple, groundless SEC's charges inflicts losses for the innocent cryptocurrency users. The company prepares to fight in court.

XRP is ready for a technical rebound

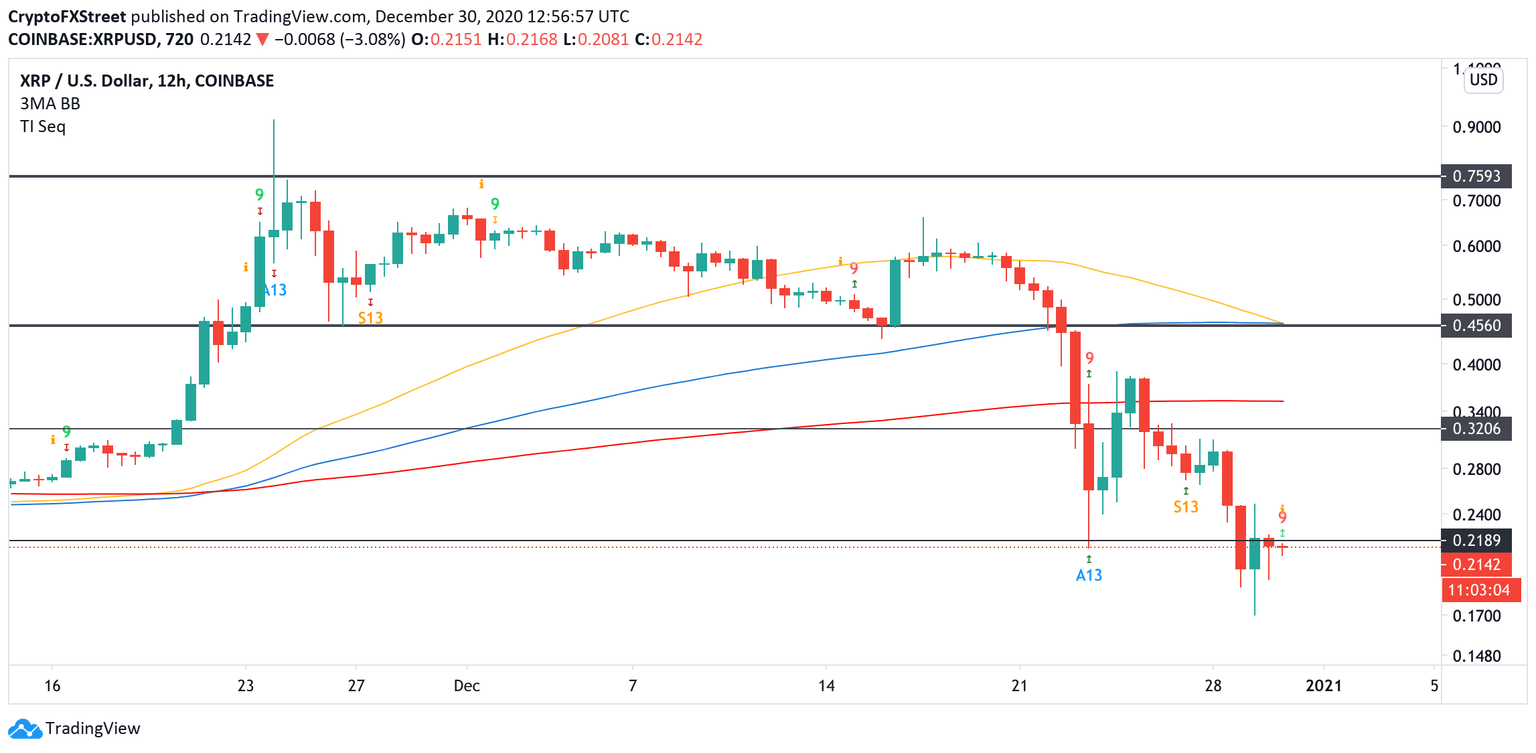

Meanwhile, XRP's technical picture implies that the token is grossly oversold and may be ready for a short-term rebound. TD Sequential indicator presented a buy signal in the form of a red nine candlestick on a 12-hour chart.

XRP, 12-hour chart

If the bullish pattern is confirmed, XRP may extend the recovery for one to four green candlesticks with the local target at $0.32, followed by 12-hour EMA200 at $0.35. A sustainable move above this area is needed for the upside to gain traction. However, the critical barrier comes at $0.45. This resistance is reinforced by 12-hour EMA50 and EMA100.

Author

Tanya Abrosimova

Independent Analyst