Cryptocurrencies price prediction: XRP, Arbitrum & Crypto Market - American Wrap - 16 06

Ripple Price Prediction: XRP flaunts potential breakout to $3.00 on surging risk appetite

Ripple (XRP) flaunts a short-term bullish outlook as part of the recovery from the sell-off encountered last week after Israel launched attacks on Iran, escalating geopolitical tensions in the Middle East. Meanwhile, XRP hovers at around $2.28 at the time of writing on Monday, rising by over 5% on the day.

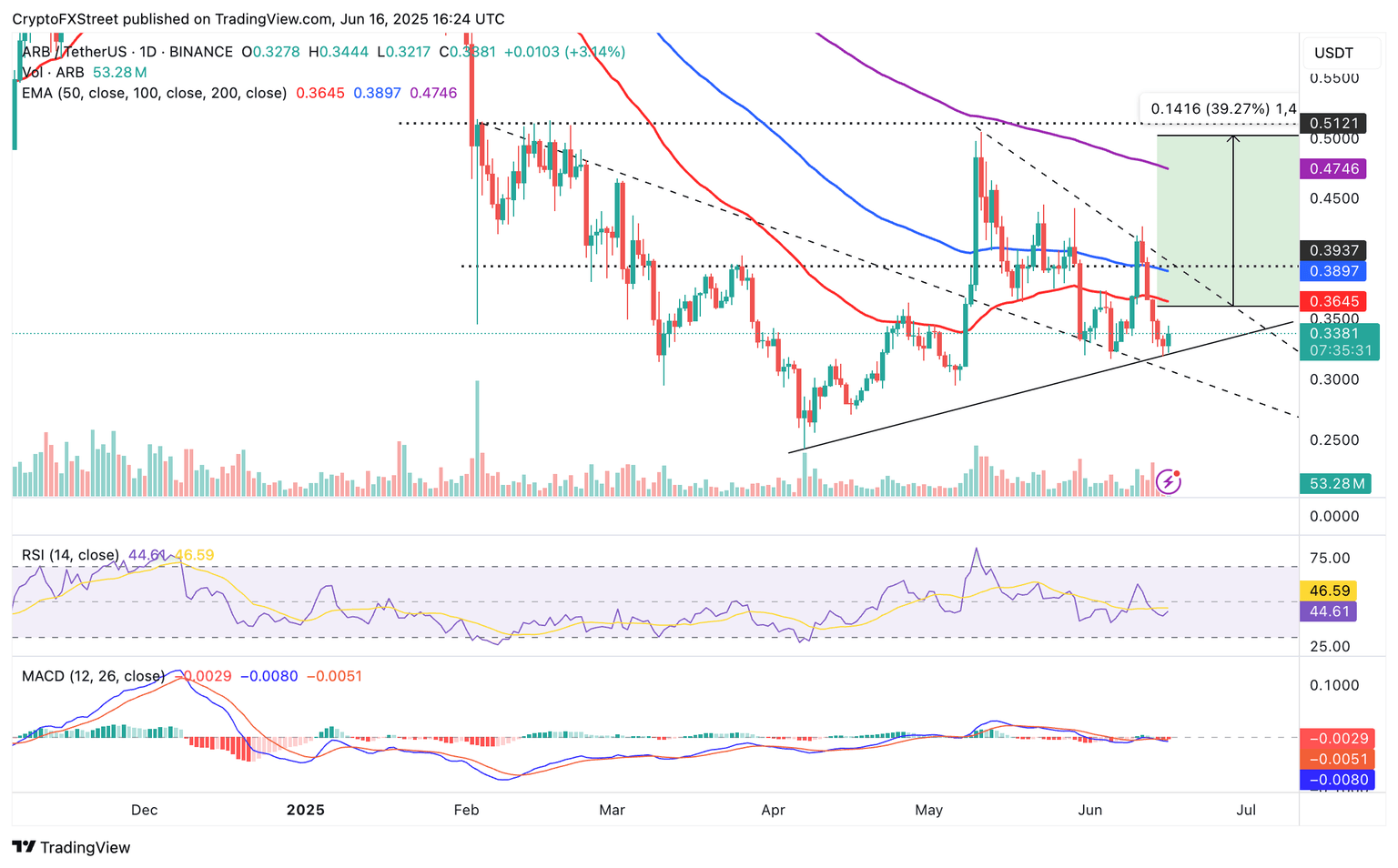

Arbitrum shows resilience as bulls emerge amid $32 million token unlock

Arbitrum (ARB), a roll-up Layer-2 chain designed to enhance the scalability of the Ethereum (ETH) network, continues to experience price fluctuations like many other altcoins in the market. Meanwhile, ARB, the ecosystem's native token, shows resilience, rising over 3% on the day to exchange hands at around $0.33 at the time of writing despite the potential impact of a massive token unlock on Monday.

Bitcoin Price Forecast: BTC recovers above $107,000, yet Israel-Iran conflict clouds bullish outlook

Bitcoin (BTC) is showing signs of recovery during the European trading session on Monday, climbing above $107,000 after a slight correction last week. Despite the signs of mild recovery in price action, the market sentiment remains cautious as the Israel-Iran conflict enters its fourth day after fresh strikes over the weekend. Despite the geopolitical headwinds, institutional interest in Bitcoin remains robust, as Metaplanet added 1,100 BTC to its holdings while spot Bitcoin Exchange Traded Funds (ETFs) recorded a total inflow of $1.37 billion last week.

Author

FXStreet Team

FXStreet