Cryptocurrencies Price Prediction: Solana, Bitcoin & Ethereum – European Wrap 20 June

Solana Price Forecast: SOL eyes trend reversal as bearish momentum bottoms out above $140

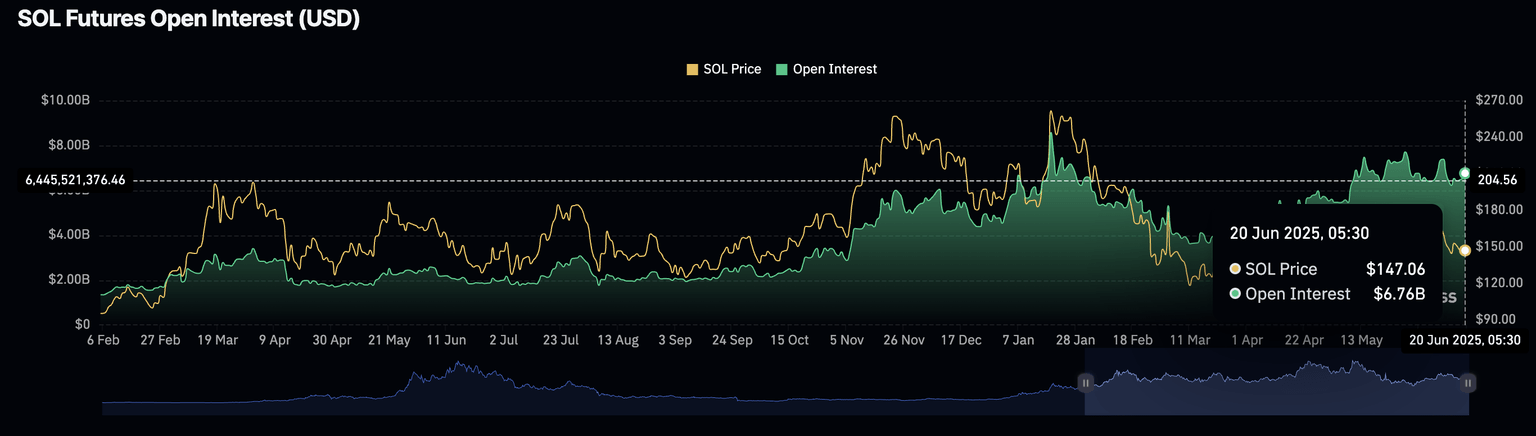

Solana (SOL) experiences a minor uptick of under 1% at press time on Friday, with multiple long shadow candles forming above $140 as bearish momentum fades off. The optimism surrounding Solana is on the rise, as evidenced by the SOL Open Interest (OI) reaching a weekly high. A bullish inclination in Solana’s technical outlook aligns with the anticipation of a trend reversal in the derivatives market.

CoinGlass’ data shows the Solana Open Interest reaching a new high for this week of $6.67 billion on Friday. A surge in OI relates to an increased inflow in the derivatives market, reflecting potential buying activity and an increase in optimism.

Bitcoin Weekly Forecast: The calm before the storm

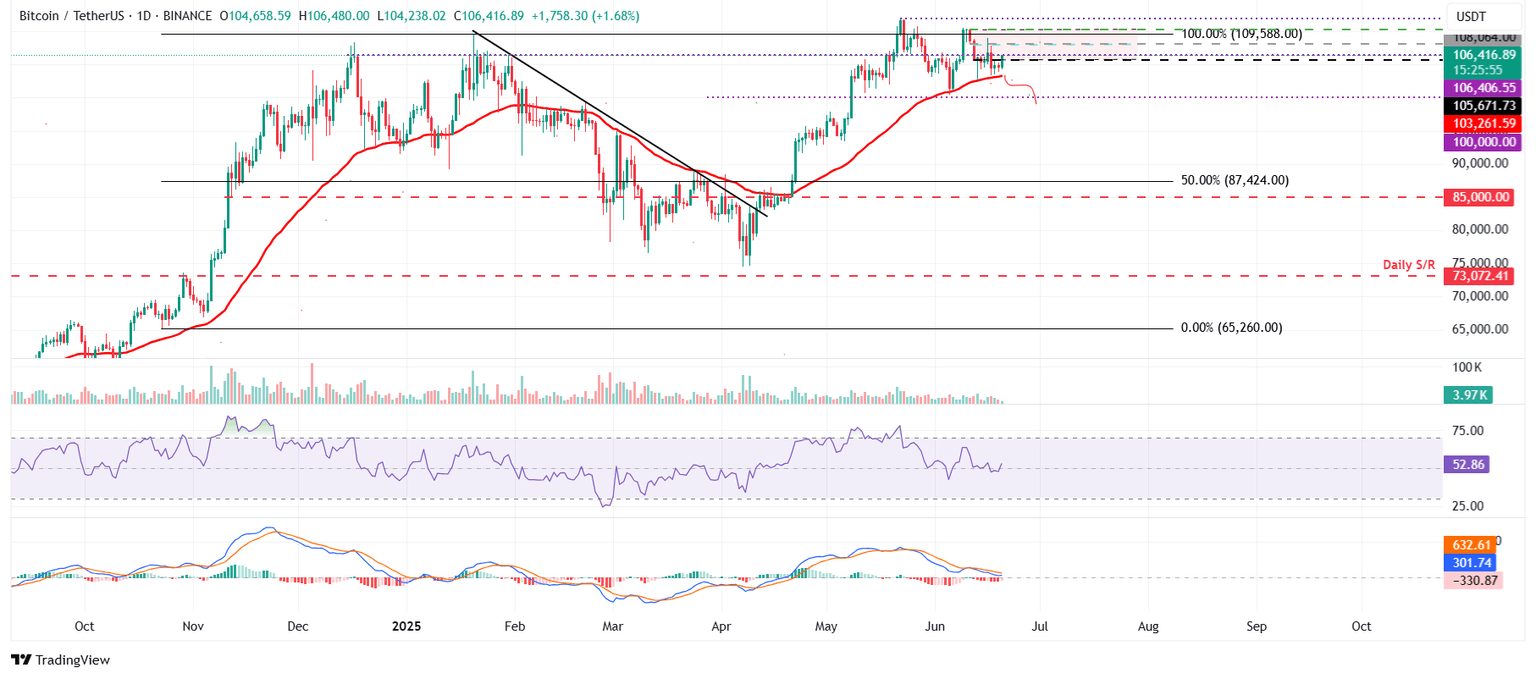

Bitcoin (BTC) price remains steady above a key support level, trading slightly above $106,000 at the time of writing on Friday. The uncertainty looms as geopolitical tensions between Iran and Israel show no sign yet of an exit strategy from either side. US President Donald Trump is expected to decide within two weeks on a potential role for the US in the Israel-Iran conflict. Despite the cautious sentiment, corporate and institutional interest in BTC held firm so far this week.

The ongoing war between Iran and Israel, which has been taking place since last week, continued to escalate with no sign yet of an exit strategy from either side. Bitcoin's price action remained broadly resilient at the start of the week on Monday despite escalating tensions in the Middle East. The largest cryptocurrency by market capitalization held above its key psychological threshold of 100,000 despite the initial shock, compared to April last year, when BTC fell more than 8% amid similar Iran-Israel turmoil.

Ethereum Price Forecast: ETH network growth explodes as GENIUS Bill advances

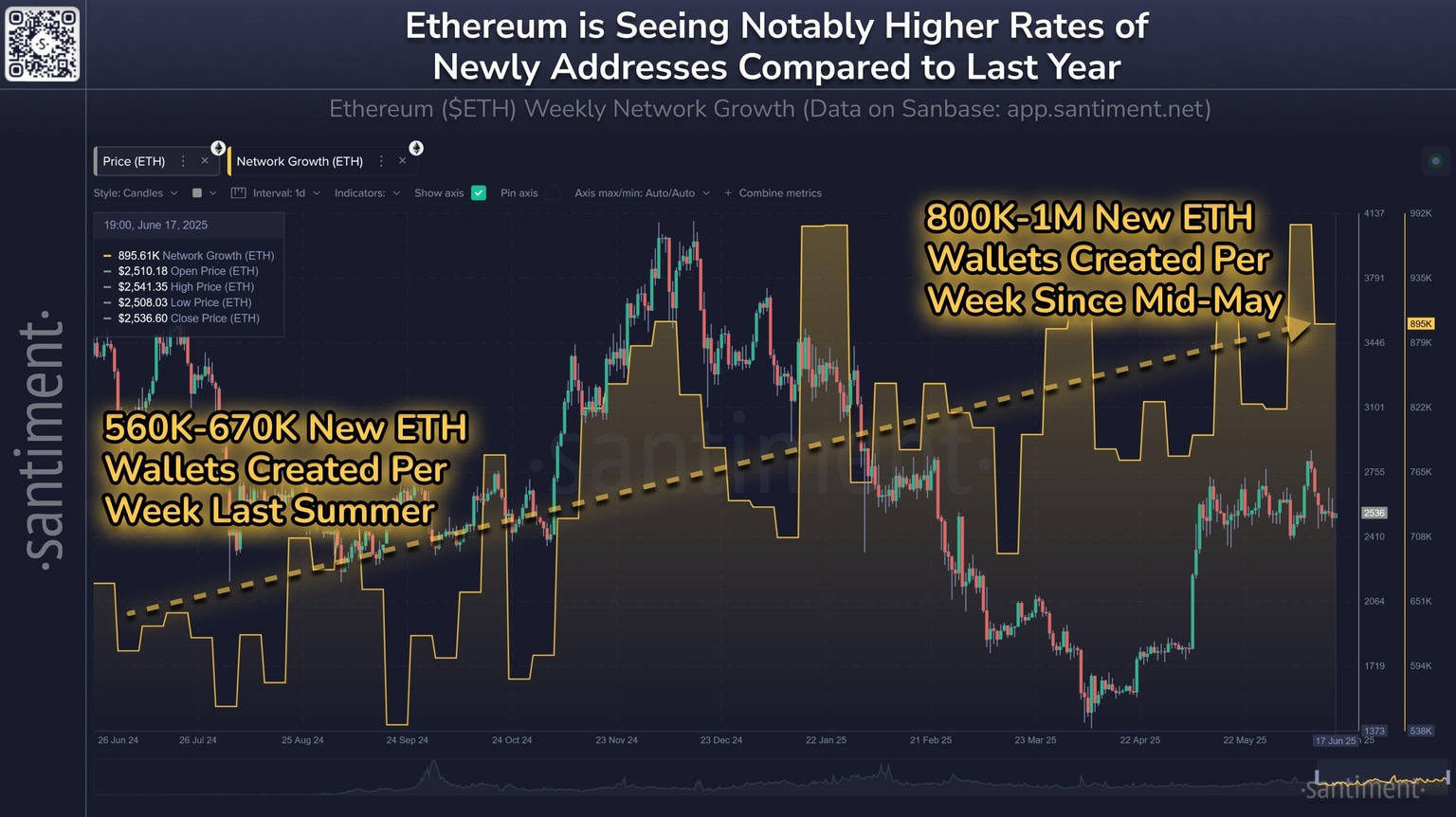

Ethereum (ETH) is trading around $2,500 in the early Asian session on Friday despite a surge in new address growth over the past month. The development follows progress in digital assets regulations after the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) bill passed the Senate.

The number of new ETH addresses created in a week has increased in the past month, rising by almost one-third from around the same period last year, according to data from Santiment.

Author

FXStreet Team

FXStreet