Cryptocurrencies Price Prediction: Litecoin, Stellar & Dogecoin – American Wrap 27 December

Litecoin price enters buy-zone again as risk appetite remains the central theme

Litecoin (LTC) price is currently on the backfoot as thin volume sparks a slight correction, pushing price action below the monthly S1 support level at $160. With that move, however, LTC has entered a pre-defined zone providing an excellent buying opportunity between $155 and $138. Expect demand to stay persistent in 2022, which should spark a short rally back up to $170.

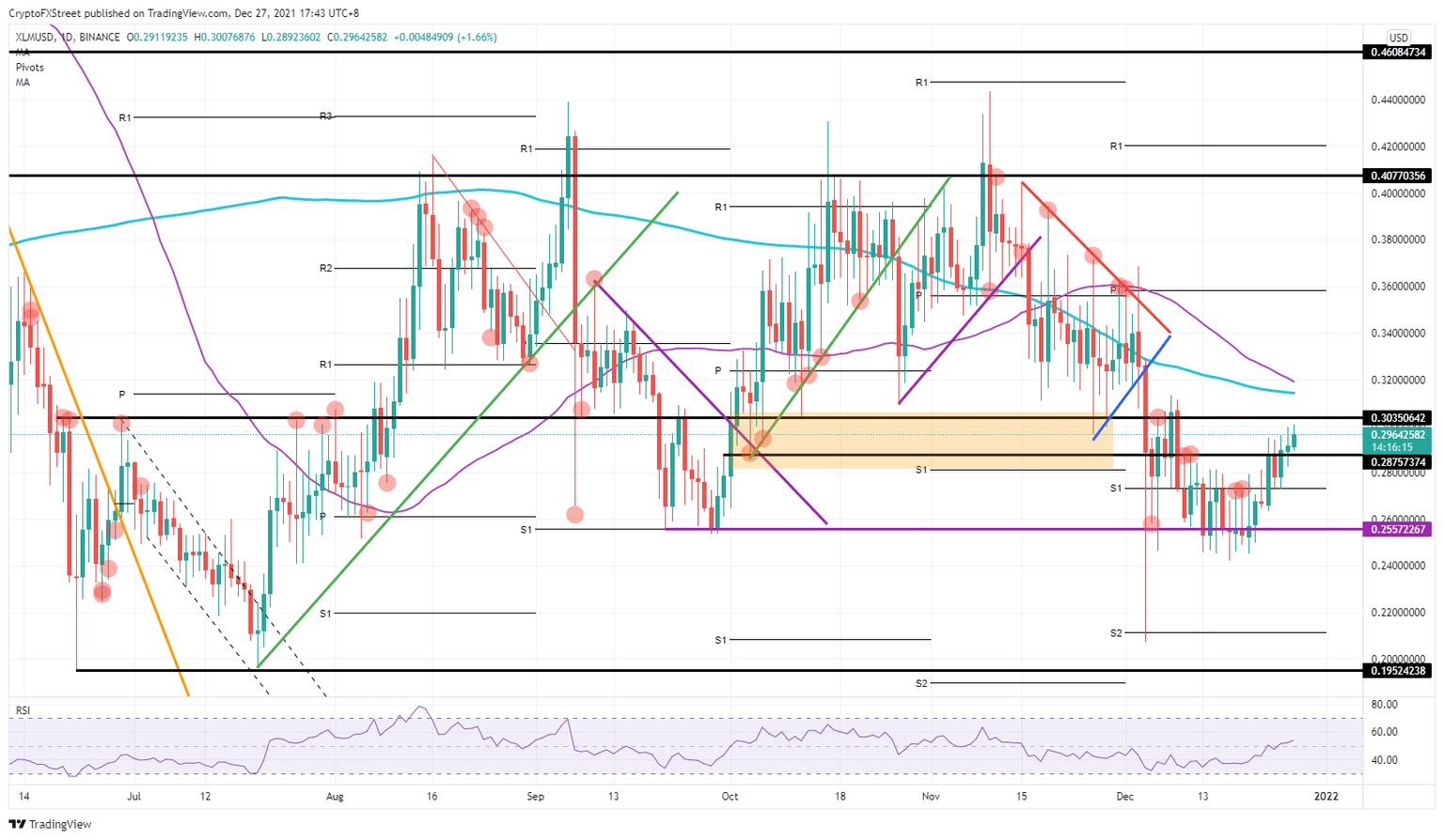

Stellar price heading for $0.32 with bulls in a festive mood

Stellar (XLM) price has opened today above $0.28, which shows that bulls are trying to push the trend higher. The Relative Strength Index (RSI) is confirming the high demand with a move above 50 but still holds plenty of upside potential. The price target looks to be set at $0.32, where both the 55-day and 200-day Simple Moving Average (SMA) form a double cap.

Dogecoin presents buying opportunity before DOGE spikes to 0.38

Dogecoin price has picked up some excellent, bullish traction over the past two weeks. An expected gap-fill between the bodies of the weekly candlesticks and the weekly Tenkan-Sen is currently underway but may extend beyond the Tenkan-Sen.

Author

FXStreet Team

FXStreet