Cryptocurrencies Price Prediction: Ethereum, Altcoins & Bitcoin – American Wrap 19 February

Ethereum Price Forecast: ETH transaction fees decline to an all-time low, bulls could force move above $2,850

Ethereum (ETH) recovered the $2,700 level on Wednesday despite its average transaction fees declining to an all-time low. The reduced fees could attract new users to the top Layer 1 (L1) blockchain and help bulls overcome the $2,850 critical resistance.

-638755852656174901.png&w=1536&q=95)

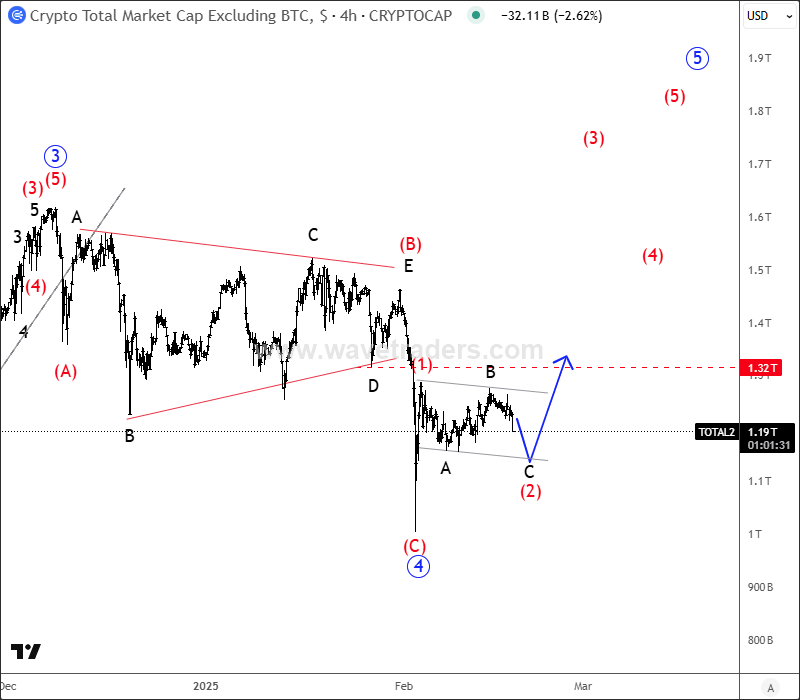

Altcoin market is forming a lower degree bullish setup

ALTcoin market with ticker TOTAL2, which excludes Bitcoin shows a completed higher degree wave 4 correction and it can be getting ready for a bullish continuation within wave 5. It could be forming a lower-degree bullish setup with waves (1) and (2), so as soon as it completes an ABC pullback in wave (2), watch out for strong bulls within wave (3) of a five-wave bullish cycle.

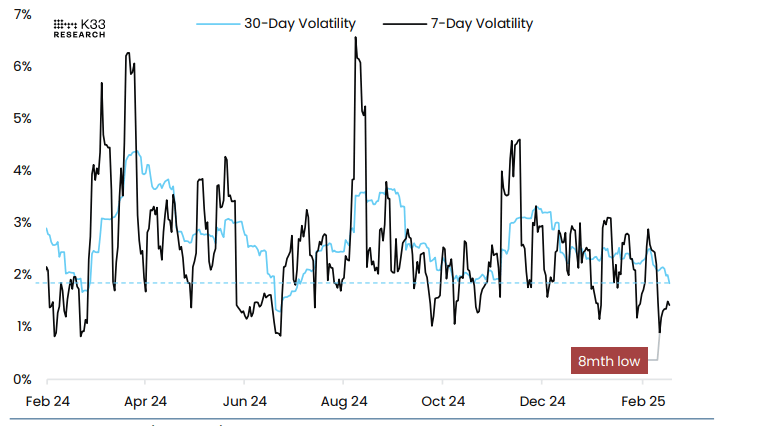

Bitcoin Price Forecast: BTC volatility hits multi-month lows, raising concerns of liquidation cascades

Bitcoin (BTC) price has been consolidating between $94,000 and $100,000 for two weeks. Defund exchange FTX repayments on Tuesday dipped Bitcoin towards its lower boundary of the consolidating range. A K33 report highlights volumes, yields, options premiums, and Exchange Traded Funds (ETF) flows have moved to areas not seen since before the US Presidential election in November, with volatility at multi-month lows and raising concerns of liquidation cascades.

Author

FXStreet Team

FXStreet