Cryptocurrencies Price Prediction: Cardano, Solana & Avax — Asian Wrap 12 Nov

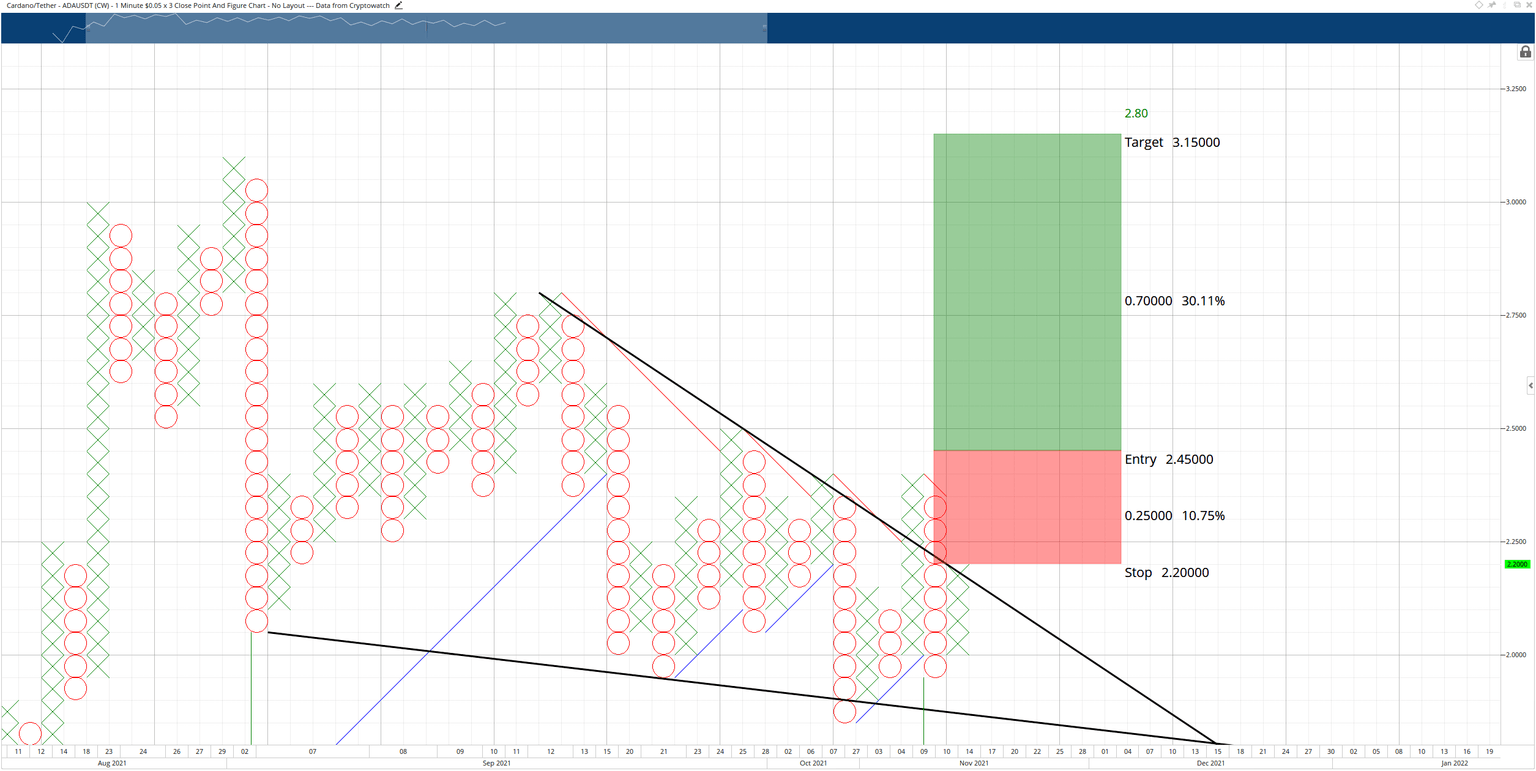

Cardano price action whipsaws bulls and bears despite ADA $2.50 target

Cardano price action has been some of the most volatile and indecisive of all high market cap cryptocurrencies. As a result, Wednesday's sell-off terminated what looked like the beginning of a new bullish expansion phase. However, trade opportunities of equal weight and probabilities are now present.

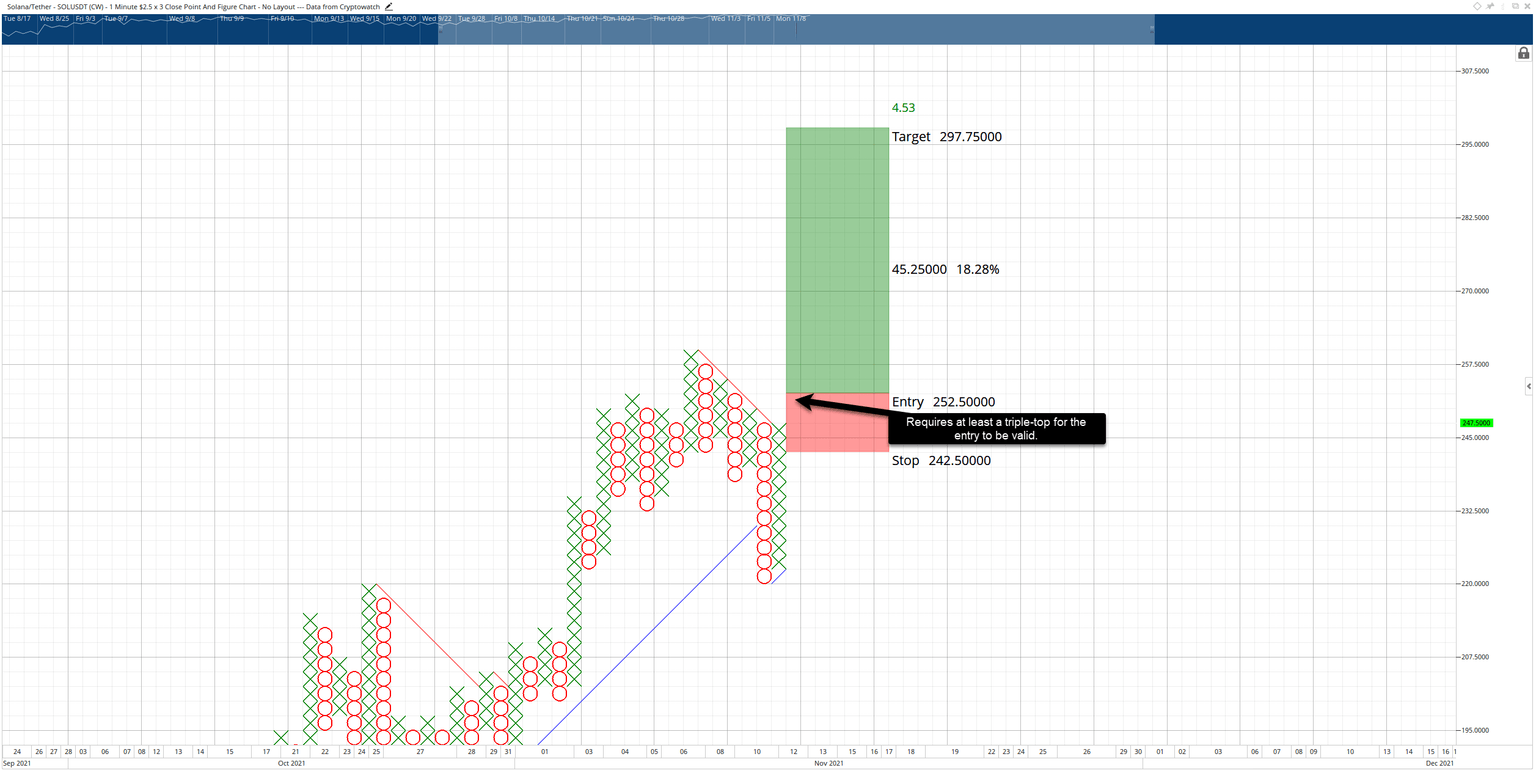

Solana bulls buy the dip but SOL upside potential is capped at $280

Solana price was at more risk of a catastrophic move lower during Wednesday’s selling pressure than most cryptocurrencies. It is a testament to Solana’s strength and bullish sentiment that not only was the retracement limited, but Solana continued to trade near its all-time highs. Two trade possibilities are now present.

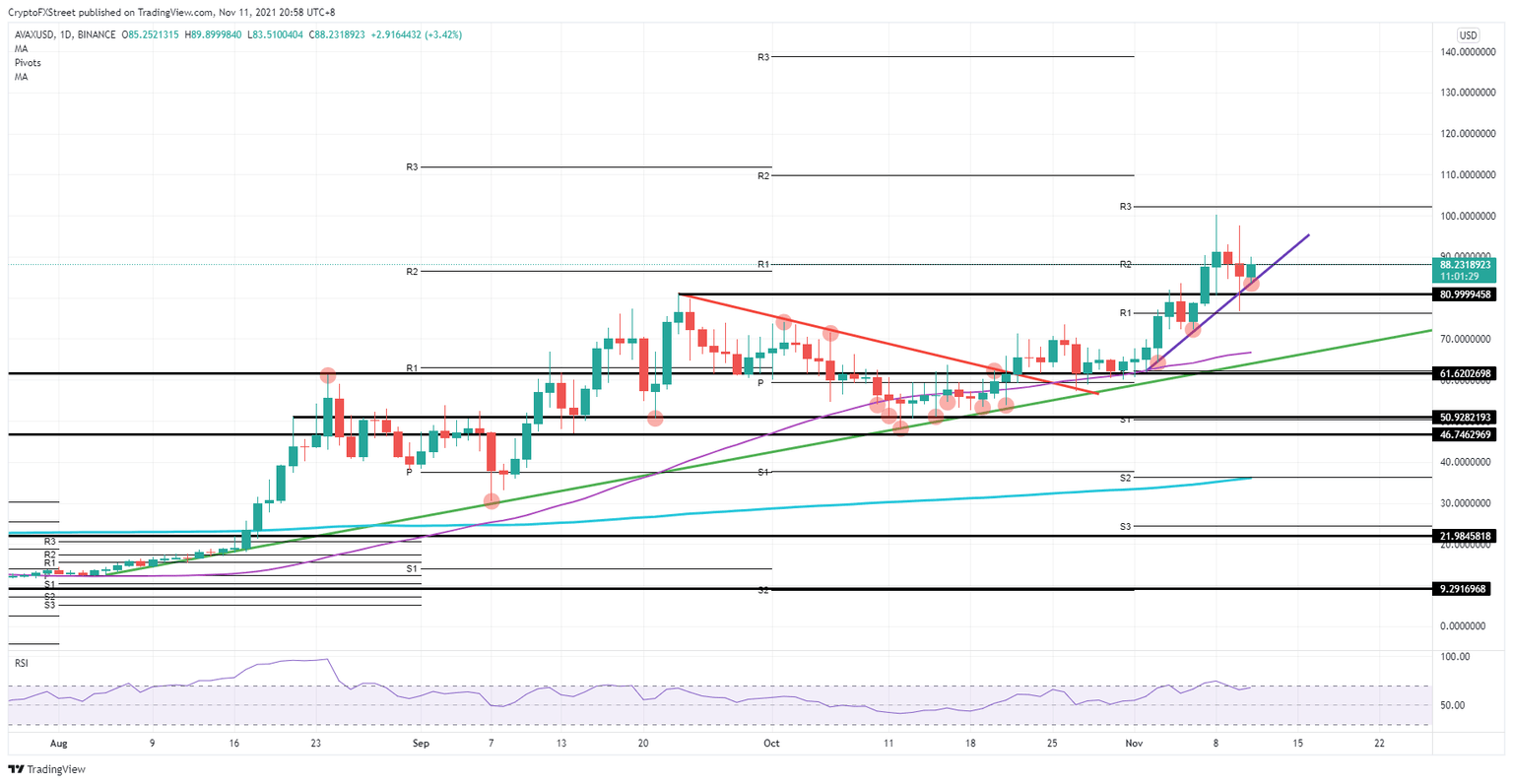

AVAX bulls kill off bearish breakout and relaunch Avalanche to new rally

Avalanche (AVAX) has been restoring its uptrend since the beginning of November after some sideways price action in October. In just a couple of days, AVAX price was able to gain 55% in value and hit $100 as a new all-time high. Since then, AVAX price has been fading slightly under some profit-taking, and the Relative Strength Index (RSI) is traded in overbought territory.

Author

FXStreet Team

FXStreet