Cryptocurrencies Price Prediction: BTC, OKX & SUPRA - American Wrap 04 April

$790M liquidation in BTC ahead? Here’s how Bitcoin price could react to China’s 34% tariffs on US imports

Bitcoin (BTC) price plunged as low as $81,600 on Friday, facing renewed downside pressure as China retaliated against the United States (US) with steep import tariffs, heightening market uncertainty.

OKX fined $1.2M by Malta for breaching money laundering rules

OKX's Europe company—also known as OKCoin Europe, a subsidiary of crypto exchange OKX—was fined 1.05 million euros ($1.2 million) by Malta's financial watchdog on Thursday for breaching the country's money laundering rules.

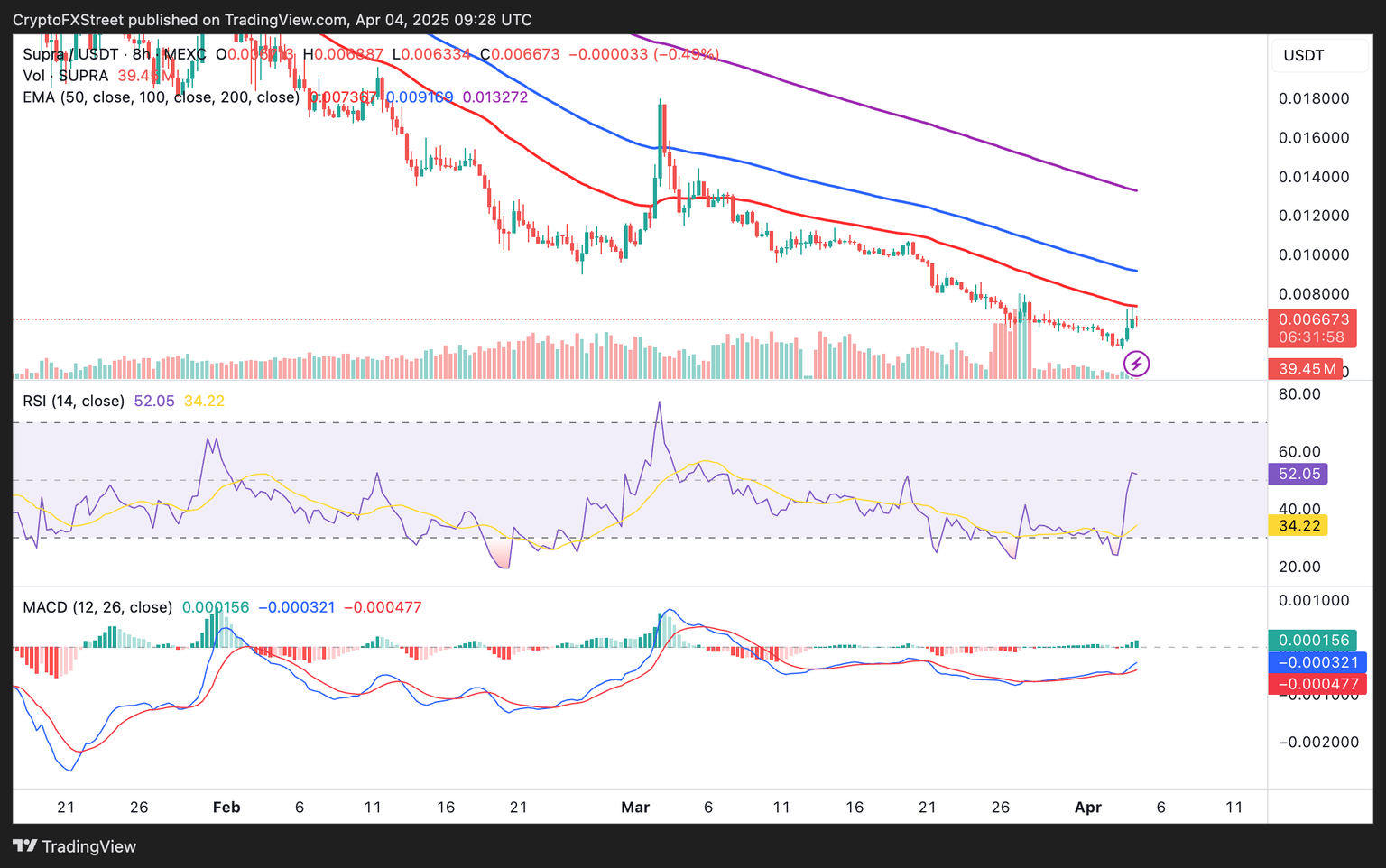

Top 3 gainers Supra, Cosmos Hub, EOS: Supra leads recovery after Trump’s tariffs announcement

Supra (SUPRA), the first all-in-one Multi-VM Layer 1 built for super decentralized applications (dApps), is up 25% daily and trades at $0.0066 at the time of writing on Friday. Although range-bound since early February, Cosmos Hub (ATOM) flaunts a bullish technical pattern likely to set it on a clear recovery path above $5.

Author

FXStreet Team

FXStreet