Cryptocurrencies Price Prediction: Bitcoin, Ripple & Ethereum – Asian Wrap April 16

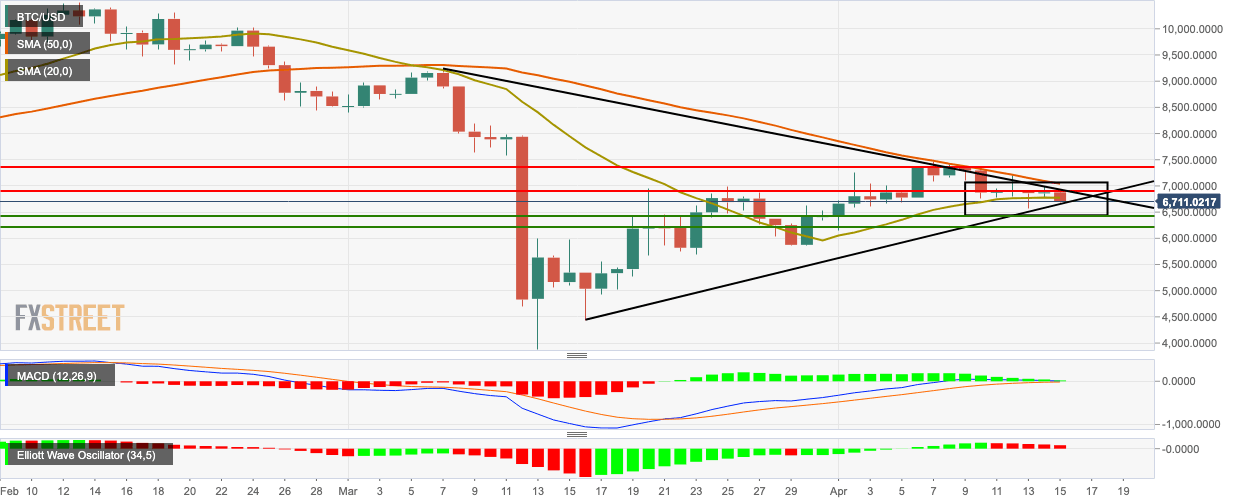

Bitcoin Price Analysis: BTC/USD bears take control, the price breaks below the SMA 20

BTC/USD fell from $6,876.98 to $6,712.75 this Wednesday as it continues to consolidate in a triangle formation. The bearish price action dropped BTC/USD below the SMA 20 curve. The upward trending line needs to hold firm to inhibit further price drop. The MACD indicates decreasing bullish momentum, while the Elliott Oscillator has had five straight red sessions.

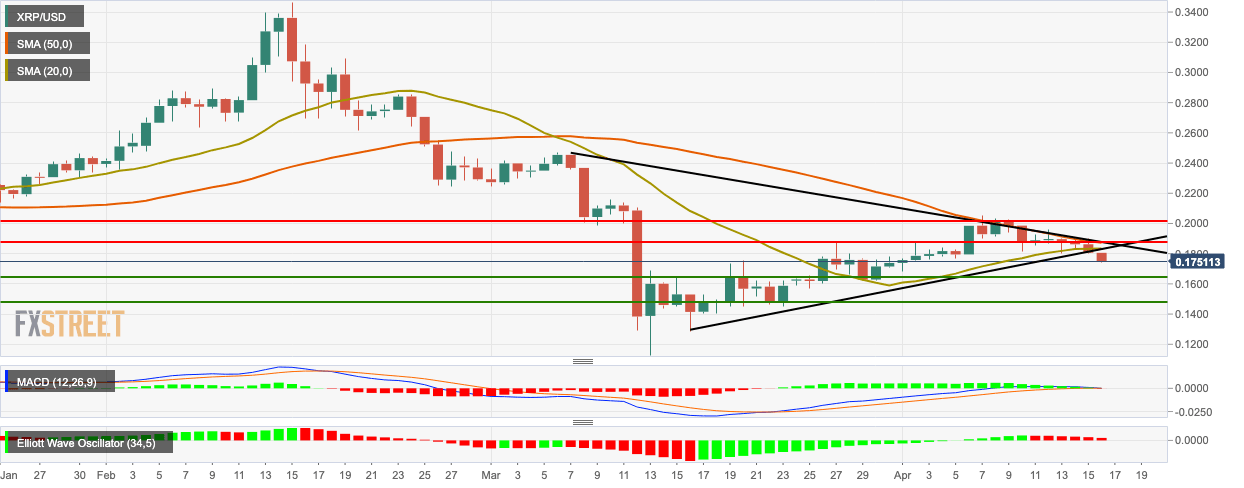

Ripple Price Analysis: XRP/USD drops by 5.35% in four hours as bears stay in cruise control

XRP/USD charted its fourth consecutive bearish day, as the price dropped from $0.1806 to $0.176 in the early hours of Thursday. In the process, the price dropped below the triangle formation and the SMA 20. The bulls will need to garner enough momentum to break above the upward trending line to reverse bearish sentiment.

Ethereum Price Analysis: ETH/USD bears retain control as they test the SMA 20

ETH/USD dropped from $152.82 to $151.45 in the early hours of Thursday. The price is consolidating in a triangle formation. The SMA 20 curve is holding steady and refusing to relent under pressure. If the bears do manage to break below the SMA 20, they will need to negotiate with the upward trending line next.

Author

FXStreet Team

FXStreet