Cryptocurrencies Price Prediction: Bitcoin, Ethereum Classic & Bitcoin Cash – Asian Wrap 14 Aug

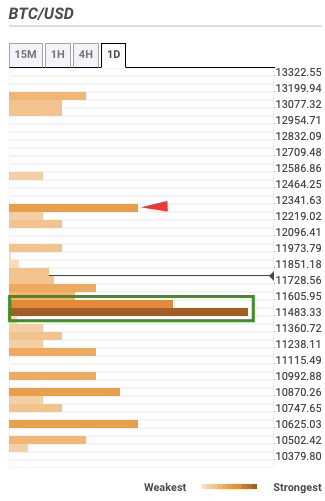

Bitcoin Price Forecast: BTC/USD bulls shoot price above $11,800, aim for $12,000

BTC/USD bulls stayed in control for the third straight day as the price went up from $11,795.39 to $11,817. Having taken the price above $11,800, the bulls will next want to aim for the $12,000-level. As per the daily confluence detector, BTC/USD has strong resistance at $12,300, which has the one-week and one-month Pivot Point resistance-one.

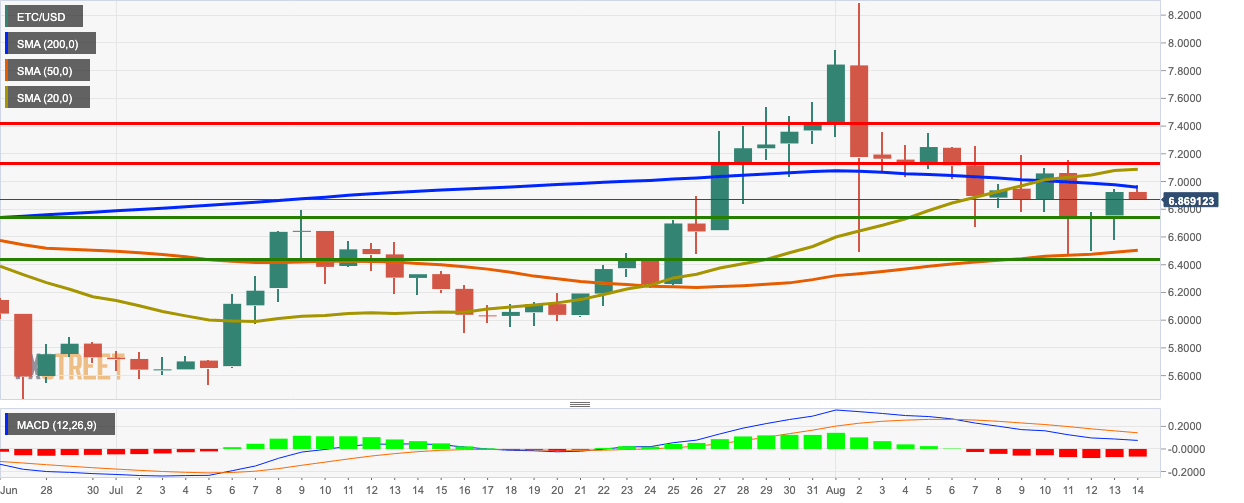

Ethereum Classic Price Analysis: ETC/USD bulls fail near the $7-level

ETC/USD faced bearish correction following two straight bullish sessions. The price dropped from $6.925 to $6.889. The moving average convergence/divergence (MACD) shows sustained bearish market momentum. There are four strong resistance levels at $6.96 (SMA 200), $7.09 (SMA 20), $7.143 and $7.41.

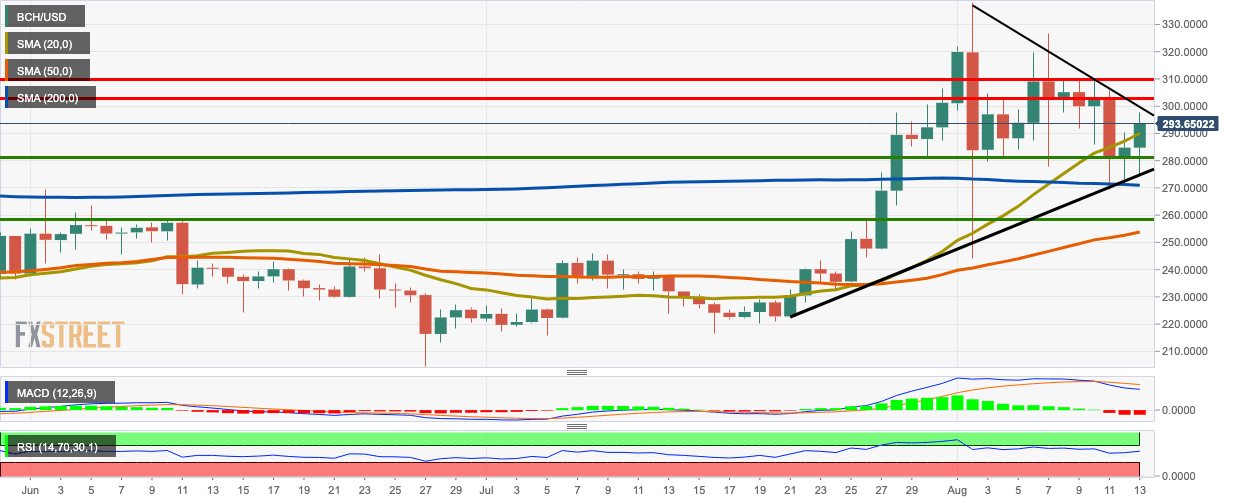

Bitcoin Cash Technical Analysis: BCH/USD bulls retreat from the $300-level

BCH/USD stayed in control of the market for the second straight day as the price went up from $284.78 to $294.25. The price reached intraday highs of $297.65 before the bulls commenced their retreat. The MACD shows increasing bearish market momentum. The relative strength index (RSI) is trending around 57.15.

Author

FXStreet Team

FXStreet