Cryptocurrencies Price Prediction: 1inch, Aptos & Solana – European Wrap 9 September

1inch Price Forecast: Whale accumulation and technical breakout set stage for continued rally

1inch (1INCH) price trades in green on Tuesday for a third consecutive day, above $0.258 at the time of writing, after breaking out from a symmetrical triangle pattern, in a technical setup that points to double-digit gains. On-chain data also supports the bullish outlook as accumulation from large wallets is rising.

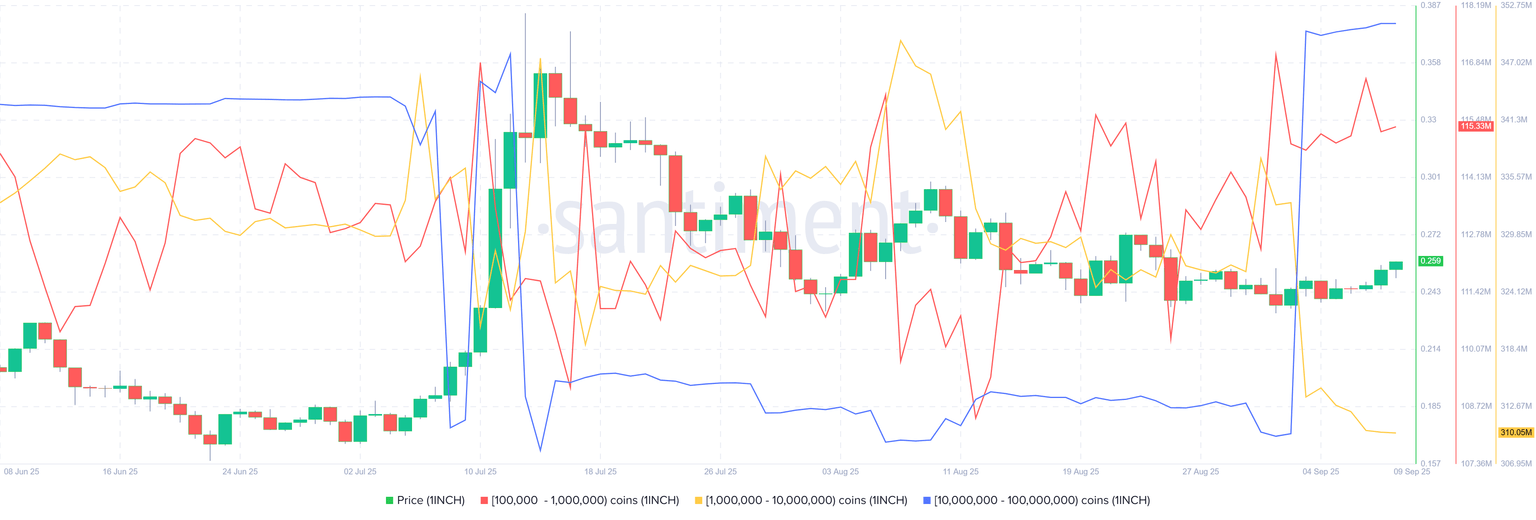

Santiment’s Supply Distribution data supports a bullish outlook for 1inch, as most of the cohorts holding large amounts of tokens continue to increase their holdings. Whales holding between 10 million and 100 million 1INCH tokens (blue line) and wallets holding between 100,000 and 1 million (red line) have accumulated a total of 140.52 million tokens from September 2 to Tuesday.

Aptos Price Forecast: Token unlocks worth over $50 million set to test investor sentiment

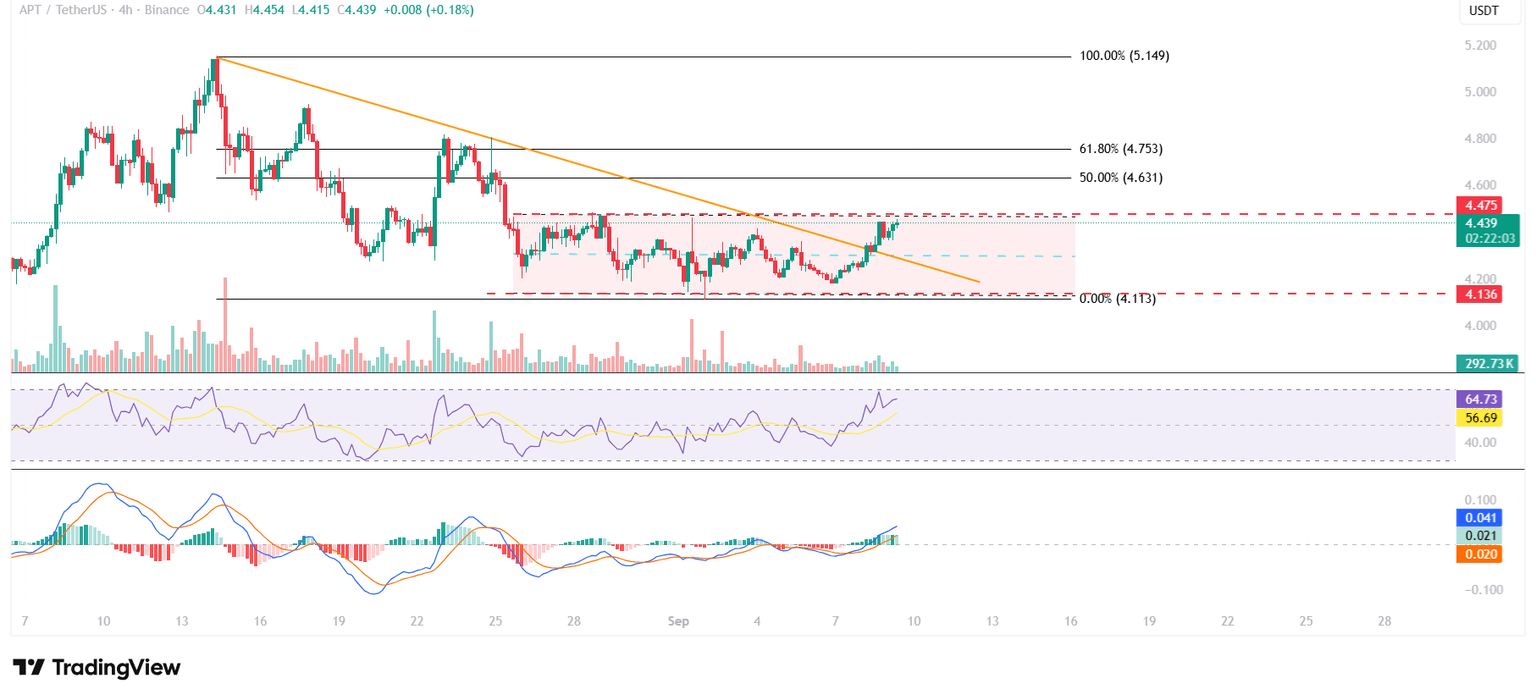

Aptos (APT) price is holding steady near $4.43 at the time of writing on Tuesday, following a modest rebound last week. However, investors are set to face a key test as more than $50 million worth of tokens are scheduled to be unlocked on Thursday, representing 2.20% of the circulating supply. Such unlocks often pressure prices as circulating supply expands, raising caution among traders.

Tokenomist data shows that Aptos is scheduled for a cliff unlock on Thursday, which allows a certain number of tokens to be unlocked immediately after a specified period has elapsed. This event will unlock 11.31 million Aptos, worth $50.22 million, which accounts for 2.20% of the released supply.

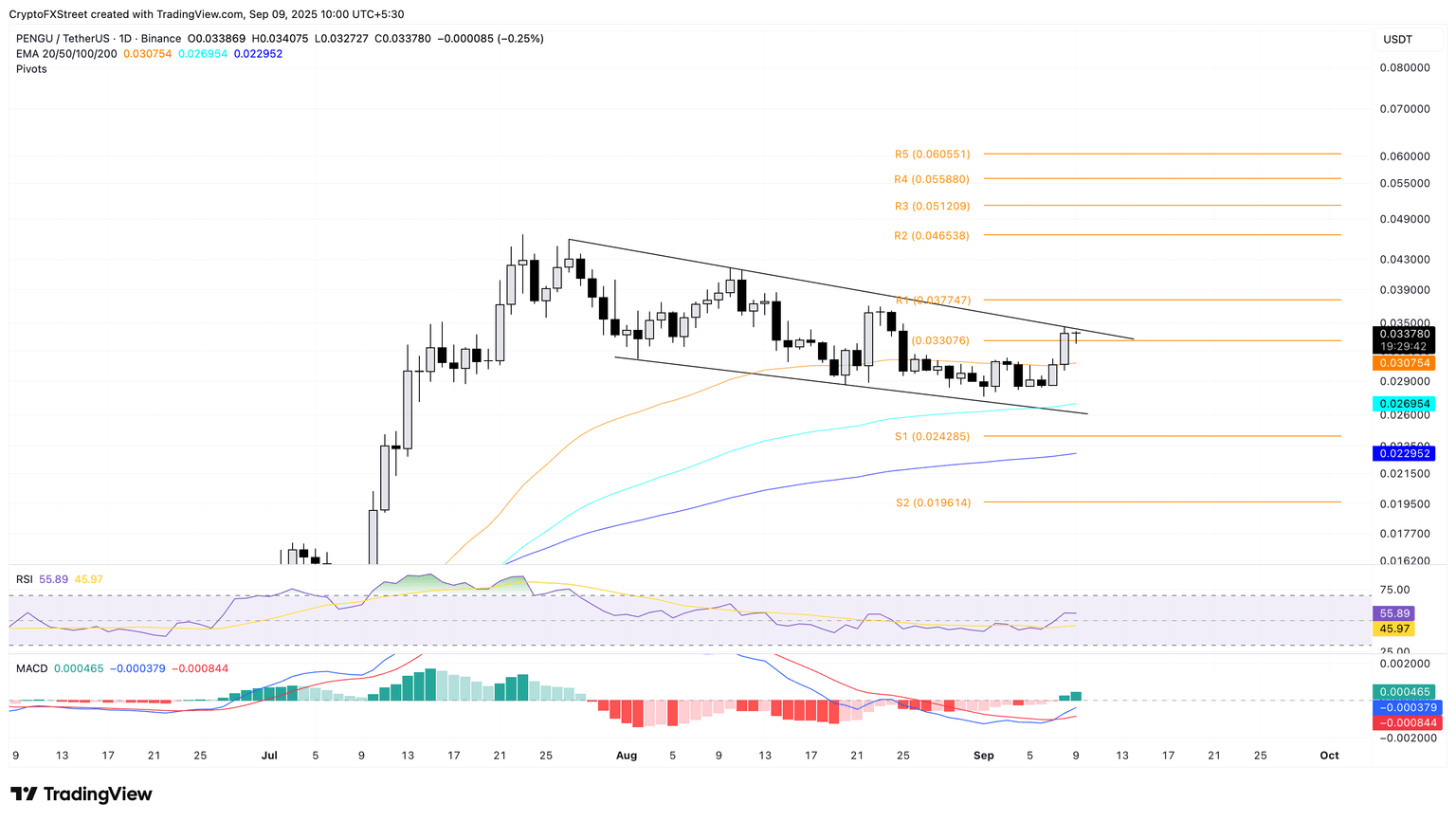

Solana-based meme coins PENGU, FARTCOIN, and BONK target key breakouts amid bullish momentum

Solana-based meme coins such as Pudgy Penguins’ token PENGU, Fartcoin (FARTCOIN), and Bonk (BONK) are a few of the top-performing coins on the broader cryptocurrency market. The rising social chatter surrounding the Solana-based meme coins, combined with the technical outlook, suggests a potential extension of the uptrend.

Santiment’s data shows a surge in social volume and social dominance of the Solana-based meme coins, reaching 85 and 0.15% respectively on Monday. The sudden spike aligns with the broader market recovery, indicating a rise in risk-on sentiment among investors.

Author

FXStreet Team

FXStreet