Crypto Today: Bitcoin, Ethereum and XRP recover as traders shift focus to Nvidia Q2 earnings

- Bitcoin, Ethereum and XRP rallied slightly on Wednesday, hovering close to key support levels.

- TON blockchain suffers a temporary outage, per official announcement.

- Binance is facing scrutiny for allegedly confiscating funds from Palestinian users.

Bitcoin, Ethereum and XRP updates

- Bitcoin hovers around $60,000 early on Wednesday. The largest cryptocurrency extends its value by nearly 1% on the day after suffering heavy losses the prior day, trading at $59,978 at the time of writing.

- Bitcoin options data from Deribit shows that there is a bullish sentiment towards a BTC rally to $90,000 by September.

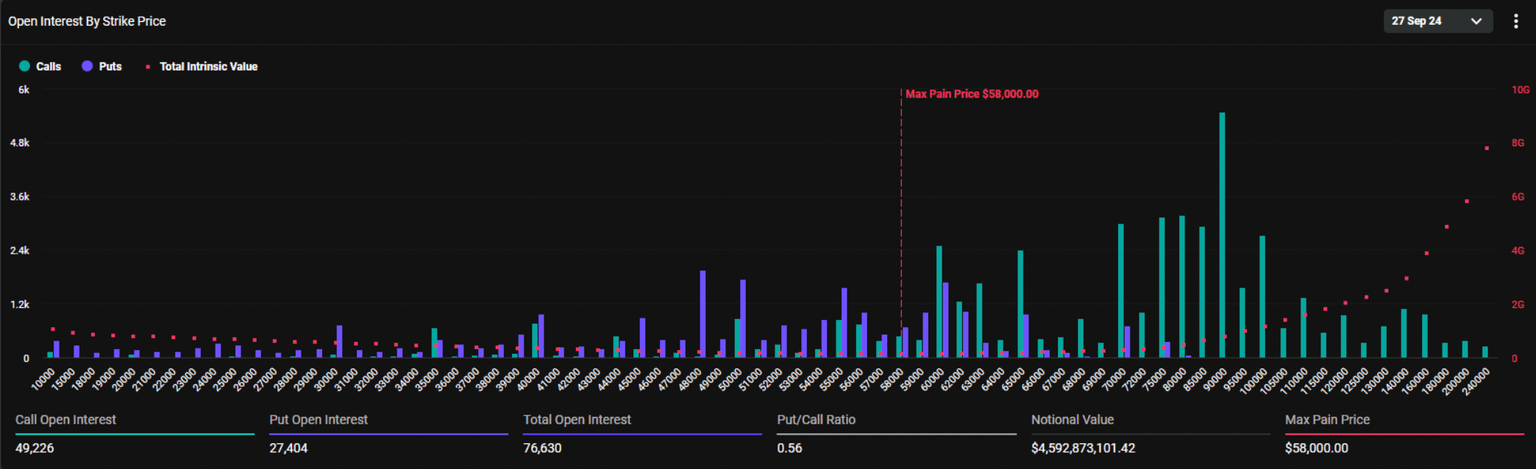

- Contracts with September 27 expiry have a total open interest of 76,630 BTC, with a put-to-call ratio of 0.56. Charts show a concentration of open interest at the $90,000 strike price, for nearly 50,000 Bitcoin. The data points to a large percentage of derivatives traders betting on Bitcoin potentially rallying to or past $90,000 by the end of September.

Bitcoin September 27 options data

- Ethereum added nearly 3% to its value and trades at $2,524 at the time of writing.

- XRP gains 2.59%, rallying to $0.5813 on Wednesday.

Chart of the day

Artificial Superintelligence Alliance (FET) broke out from its downward trend on August 22. FET has extended gains to a peak of $1.477 on Tuesday and corrected back since then. If bullish momentum returns, particularly if Nvidia earnings give a push to AI-related crypto tokens, FET could rally towards $1.500, adding nearly 15% to its value.

The Moving Average Convergence Divergence (MACD) momentum indicator flashes green histogram bars above the neutral line, signaling an underlying positive momentum in FET’s price trend.

The Relative Strength Index (RSI) reads 64, below the overbought zone. Traders need to watch out for RSI breaking into the overbought zone, as that generates a sell signal.

FET/USDT daily chart

Looking down, the Artificial Intelligence (AI) token could find support in the Fair Value Gap (FVG) extending between $1.050 and $1.200.

Market updates

- Ray Youssef, co-founder of Paxful, reported that Binance allegedly confiscated Palestinian users’ funds upon instruction from the Israel Defense Forces (IDF). The exchange responded to the allegations and stated that only a small number of accounts were restricted and that these were linked to illicit funds.

Binance has seized all funds from all Palestinians as per the request of the IDF. They refuse to return the funds. All appeals denied.

— Ray Youssef (@ray_noOnes) August 26, 2024

Your funds are SAFU at @noonesapp tho.

In accordance with the authority delegated to me by the Minister of Defense, according to Section 61(a)… pic.twitter.com/RYlsFmlh2i

- Nasdaq seeks regulatory approval from the US Securities & Exchange Commission to launch and trade options on a Bitcoin index, per a Reuters report.

- TON blockchain suffered a temporary outage per an official report on X.

TON Blockchain is currently experiencing a disruption in block production.

— TON (@ton_blockchain) August 28, 2024

The issue is occurring due to the abnormal load currently on TON. Several validators are unable to clean the database of old transactions, which has led to losing the consensus.

TON Core has issued a call…

Industry updates

- Indian crypto exchange WazirX filed an application with a Singaporean High Court for a moratorium of 30 days. The exchange seeks more time to restructure its finances, after the $230 million exploit in July 2024. WazirX has applied for legal protection from creditors.

- The crypto market capitalization erased 4% from its total value in the last 24 hours ahead of Nvidia’s (NVDA) Q2 earnings report, as traders anticipate volatility on Wednesday. Past earnings releases from the chipmaker have led to sharp moves in cryptocurrency markets, particularly for AI-related tokens.

- Analysts at Greeks.Live note that the anticipation surrounding the Nvidia Q2 earnings report has likely resulted in a small increase in the implied volatility in cryptocurrencies on Wednesday. Analysts note that cryptocurrency prices have suffered a sharp decline recently.

NVIDIA is about to report earnings, and as the brightest star stock in the U.S. at the moment, major markets are focusing on the impact of the earnings report on the broader U.S. stock market.

— Greeks.live (@GreeksLive) August 28, 2024

Cryptocurrencies are down recently, yesterday's sharp decline superimposed on Nvidia… pic.twitter.com/AWiQrp7azG

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.