Crypto Market Update: Bitcoin resumes the decline, $8,500 under threat

- The cryptocurrency market has resumed its decline on Monday.

- Bitcoin is at risk of an extended sell-off if $8,500 is sustainably broken.

Cryptocurrency bears are getting bold as Bitcoin and major altcoins have been in retreat after a strong growth on Sunday. The cryptocurrency market capitalization decreased to $235 billion, while the average daily trading volume reduced to $99 billion. Bitcoin's market dominance settled at 66.5%.

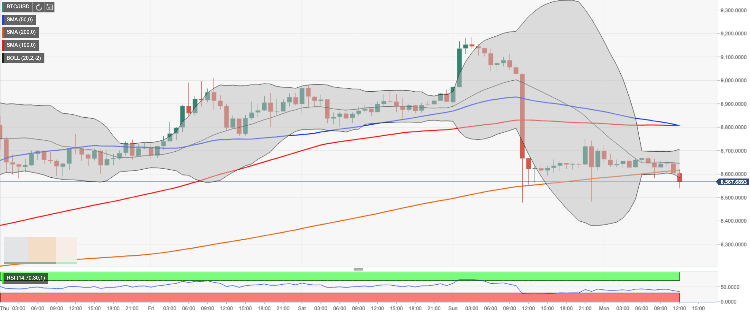

Bitcoin (BTC) price update

The largest cryptocurrency by market capitalization retreated from Sunday's high of $9,184 to $8,564 by press time. The coin has resumed the decline after a short period of sidelined trading and dropped below SMA200 1-hour at $8,600. Now the recent low of $8,479 is in focus. BTC/USD is unchanged on a day-to-day basis and down 1.5% since the beginning of the day.

BTC/USD 1-hour chart

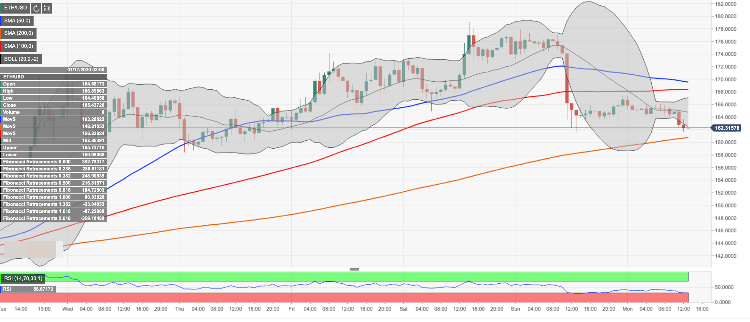

Ethereum (ETH) price update

Ethereum hit $179.10 on January 18 only to drop back to $162.35 by the time of writing. The strong downside move was caused by technical correction on the market. ETH/USD has lost about 2% since the beginning of the day and 1.5% in the recent 24 hours. From the short-term perspective, the coin is moving within a bearish trend amid low volatility. The nearest support is created by SMA200 1-hour at $160.00

ETH/USD 1-hour chart

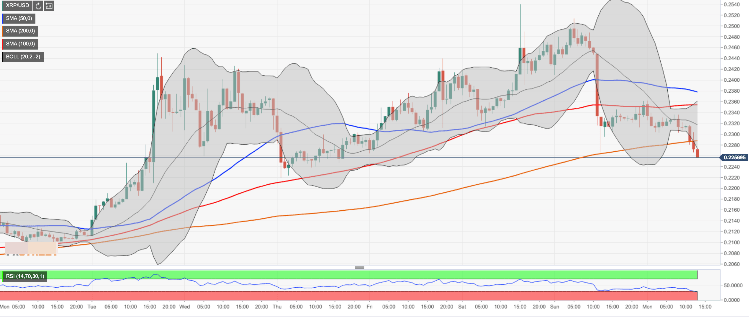

Ripple's XRP price update

Ripple's XRP retreated to $0.2273 after a short-lived spike above $0.2500 on January 18. The third-largest digital asset has been losing ground after the support of $0.2300 gave way. XRP/USD has lost over 3.6% since the beginning of Monday, moving in sync with the market. The short-term trend is bullish.

XRP/USD 1-hour chart

The best-performing altcoins out of top-20

DigixDAO +13.8% ($30.44)

Bitcoin SV +12% ($273)

THETA +7.4% ($0.1144)

Author

Tanya Abrosimova

Independent Analyst