Crypto AI Tokens: Why FET, NEAR and RNDR could outperform BTC after White House Summit

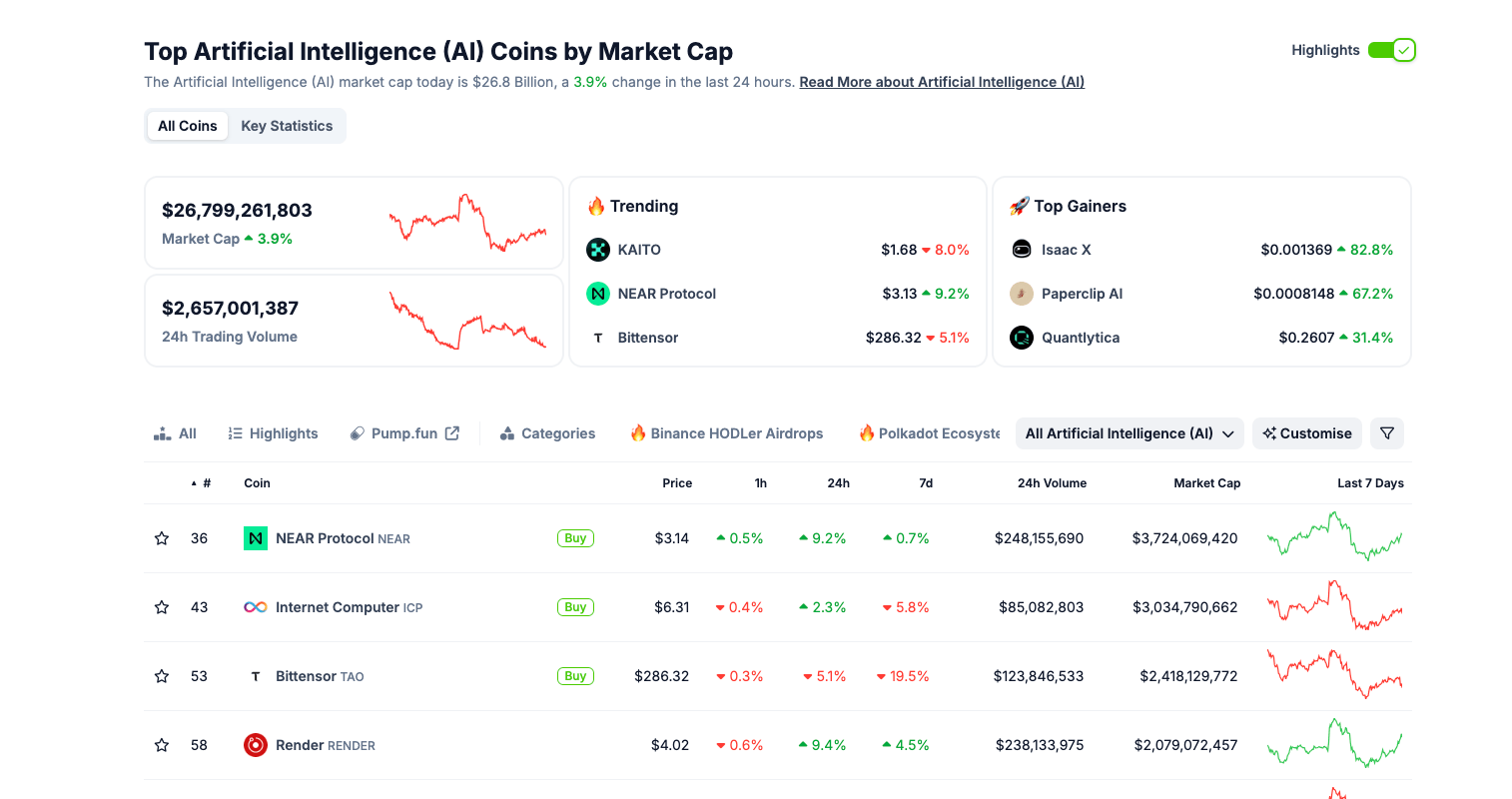

- AI-related cryptocurrencies surged by 3.9% to a $26.8 billion market cap on Thursday, outpacing the broader crypto market average.

- Top-ranked tokens like Artificial Superintelligence Alliance, NEAR Protocol and Render Network gained significant traction.

- The upcoming White House Crypto Summit has fueled anticipation that AI-focused blockchain projects may gain institutional interest.

The White House Crypto Summit is scheduled to hold on Friday. Rather than double-down on BTC, sector-wide price trends show that investors are leaning towards Crypto AI altcoins.

Crypto AI tokens show early bullish signals ahead of White House Crypto Summit

The cryptocurrency sector is experiencing notable momentum, with artificial intelligence (AI) tokens leading the charge. Within 24 hours, the market capitalization of AI-related cryptocurrencies has risen by 3.9% to $26.8 billion adding over $700 million and outpacing the global crypto market's 6.2% growth.

This surge comes ahead of the White House Crypto Summit, scheduled for March 7, where industry leaders and policymakers will discuss regulatory frameworks and innovation strategies for the crypto industry. The anticipation surrounding the summit has fueled speculation that AI-focused blockchain projects may attract increased institutional interest.

Leading the AI token rally, NEAR Protocol (NEAR) rallied as high as 9.2%, in intra-day trading at $3.14, while Render (RNDR) climbed 9.4% to $4.02.

Internet Computer (ICP) also posted a 2.3% increase, reaching $6.31.

However, not all AI tokens have followed this upward trend; Bittensor (TAO) fell by 5.1% to $286.32, marking a 19.5% decline over the past week.

The broader market's focus on AI applications, particularly in blockchain-based machine learning solutions, has contributed to this sector's resilience.

NEAR's trading volume of $248 million suggests strong accumulation, reinforcing bullish sentiment.

Smaller AI tokens like Isaac X and Paperclip AI have also seen significant gains, posting increases of 82.8% and 67.2%, respectively.

As the White House Crypto Summit approaches, traders are closely monitoring AI tokens for sustained momentum, especially if favorable policies emerge from the discussions.

The summit's outcomes could play a pivotal role in shaping the regulatory landscape, potentially providing tailwinds for AI-centric projects within the cryptocurrency space

Render Network price forecast: RNDR eyes $4.60 breakout amid volatility squeeze

RNDR price is consolidating near $3.61, showing early signs of a potential breakout as Bollinger Bands tighten.

The price hovers between $3.35 and $3.97, suggesting reduced volatility, which often precedes a sharp move.

A bullish breakout above the mid-band at $3.97 could send RNDR toward the upper resistance of $4.60, while failure to hold current support could open a path to $3.35.

The MACD indicator, though slightly negative, shows a narrowing gap between the MACD and signal lines, hinting at waning bearish momentum.

If the MACD crosses into positive territory, it would reinforce a bullish scenario, increasing the likelihood of RNDR testing $4.60.

However, a continuation of bearish pressure could drag the price lower, invalidating the bullish thesis.

Traders eyeing leverage should note the volatility squeeze, as a decisive move above resistance or below support will likely trigger liquidations.

If bulls regain control and RNDR clears $4.60, further upside toward $5.00 becomes plausible.

Conversely, a breakdown below $3.35 would invite additional selling pressure, extending losses toward $3.00.

The upcoming White House Crypto Summit may act as a catalyst, influencing sentiment and liquidity inflows.

Artificial Superintelligence Alliance (FET) Price Forecast: Double-bottom pattern signals $4 target

FET price is showing early signs of a potential reversal after forming a double-bottom pattern near $0.60, a structure that typically precedes a bullish breakout.

The price remains constrained within a long-term downtrend, but the latest recovery attempts suggest growing accumulation. A break above the neckline resistance would validate the double-bottom formation, potentially sending FET toward the projected target near $4.

The Bull-Bear Power (BBP) indicator, currently at -0.0741, highlights lingering bearish pressure, but the declining intensity of red bars hints at a possible momentum shift.

If BBP crosses into positive territory, it would reinforce bullish strength, aligning with increasing trading volume, which supports a breakout scenario. The recent volume spikes indicate rising interest, adding credibility to the pattern’s reliability.

On the downside, failure to hold above $0.60 could invalidate the bullish setup, exposing FET to further declines.

A sustained drop below this level could see the price retesting recent lows. However, with volatility likely to increase, leveraged traders should be cautious, as sharp price swings could trigger liquidations on both sides. A decisive move above resistance would open the path toward $1 first, with extended upside potential toward the $4 technical target.

NEAR Protocol (NEAR) Price Forecast: Bulls could target $3.80 as momentum builds

NEAR price is attempting a bullish turnaround as it finds stability near $2.93, following a prolonged downtrend. The Keltner Channel (KC) suggests volatility compression, with price hugging the lower band near $2.55, hinting at an oversold state. If bulls gain control, a breakout toward the median KC line at $3.19 could materialize, with an extended push toward the upper bound at $3.83.

The MACD indicator supports a potential bullish reversal as the histogram has printed light green bars, signaling weakening bearish momentum.

The MACD line (-0.200) is on the verge of crossing above the signal line (-0.221), which would confirm a bullish shift if sustained. However, failure to maintain upward momentum could see NEAR price retesting $2.55, with a deeper decline exposing $2.20.

Liquidity-driven volatility remains a factor, especially with leverage positioning in the market.

A false breakout above $3.19 could trigger short liquidations, fueling a rapid move toward $3.80. Conversely, excessive leverage on long positions may lead to abrupt sell-offs if the price fails to hold key support. A decisive close above $3.20 would strengthen bullish confidence, while rejection could prolong consolidation within the current range.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.