Coinbase to introduce 24/7 futures trading for Bitcoin and Ethereum on May 9

- Coinbase Derivatives has announced the launch of 24/7 Bitcoin and Ethereum futures trading for US traders on May 9.

- The launch will allow US-based crypto derivatives investors to trade Bitcoin and Ethereum futures contracts round-the-clock.

- The contracts will be backed by Coinbase Financial Markets and cleared through Nodal Clear, ensuring clear institutional framework.

Coinbase greenlights 24/7 futures trading for Bitcoin and Ethereum Futures

Coinbase has announced the decision to launch 24-hour trading functionality for US-based traders on May 9 2025, just 24 hours after the US congress advanced a bill for crypto stablecoin regulations. However, until now, US traders have faced limited access due to fixed market hours and contract expiration policies.

By introducing 24/7 trading, Coinbase aims to eliminate inefficiencies that prevent traders from reacting to price movements in real time.

Perpetual futures to bridge US trading inefficiencies

In addition to continuous trading access, Coinbase is also developing a perpetual-style futures contract. Unlike standard futures, these contracts do not have expiry dates, allowing traders to maintain positions indefinitely.

The new perpetual-style contracts aim to provide US traders with more efficient hedging and strategy execution.

Without the constraints of fixed expirations, traders can implement long-term positions without disruptions. Furthermore, the introduction of a regulated perpetual futures market within the US could reduce reliance on offshore exchanges, which have historically offered more competitive alternatives.

Crypto Regulations remain a crucial factor. In recent years, Coinbase has worked closely with the Commodity Futures Trading Commission (CFTC) to ensure compliance while expanding derivatives offerings to altcoins.

The US Congress also advanced a bill for Crypto stablecoin regulations this week as the Trump administration continues to push for crypto reserves, to mitigate mounting national debt.

Key points Coinbase users must note:

- Coinbase Derivatives launches 24/7 Bitcoin and Ethereum futures for US traders on May 9.

- The exchange is developing perpetual-style futures to eliminate contract expirations, enhancing trading flexibility within US markets.

- Coinbase's move is expected to boost institutional crypto adoption while reducing the need for offshore derivatives platforms.

Currently, derivatives account for over 75% of total crypto trading volume globally, according to CCdata.

Investors anticipate that the Coinbase imminent furtures trading launch could drive more capital inflows towards BTC and ETH derivatives markets.

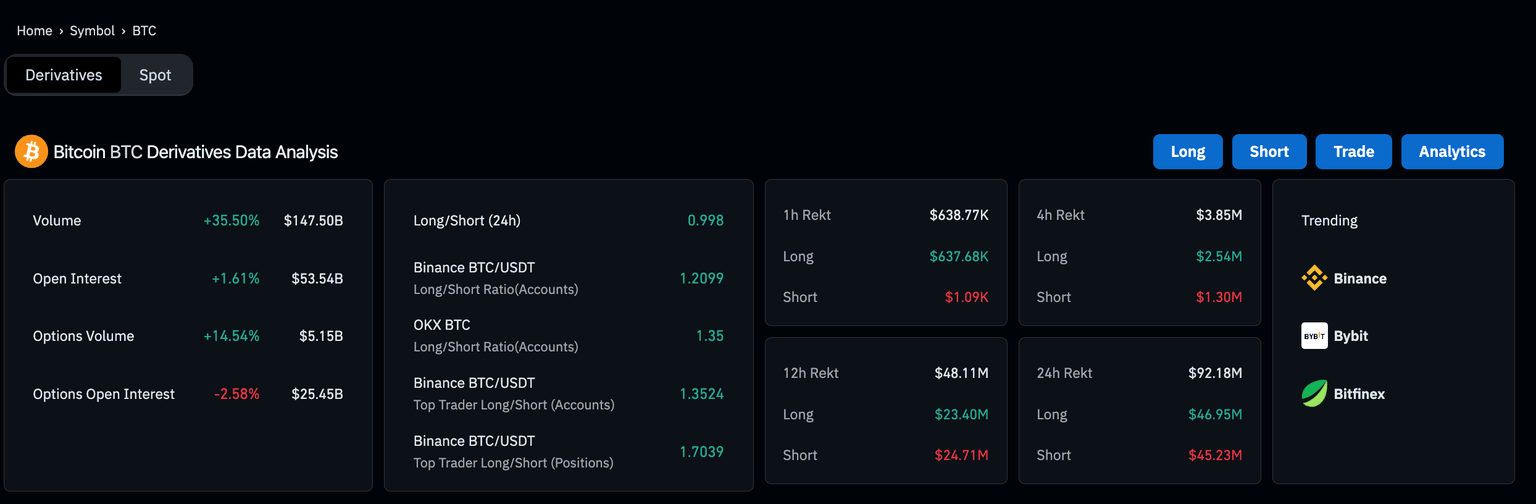

Bitcoin Derivatives Markets Analysis, April 4 | Source: Coingecko

At press time Bitcoin futures open interest stands at $53 billion according to Coingecko data, up 1.6% within the last 24 hours.

Market participants anticipate that the upcoming futures launch and perpetual contract developments will drive greater institutional participation in US-based crypto derivatives.

Perpetual futures lack expiration dates, enabling traders to hold positions indefinitely, providing better flexibility for long-term strategies.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.