Citadel Securities to pay $7 million fine to SEC for violating short sale rule

- US SEC is charging Citadel Securities for violating order marking requirements of short sale regulations

- Reportedly, the firm incorrectly marked trades over the last five years despite making profits.

- It depicts an unsafe financial market where leading market makers feast upon retail investors.

Citadel Securities LLC, a renowned broker-dealer, has been charged for violating Rule 200(g) of Reg SHO, a regulation that requires broker-dealers to mark sale orders as long, short, or short exempt. The firm has agreed to the charges, consenting to a stark fine for settlement against the US Securities and Exchange Commission (SEC).

Also Read: SEC to probe more exchanges and DeFi players after Coinbase and Binance

Citadel Securities settles with the SEC

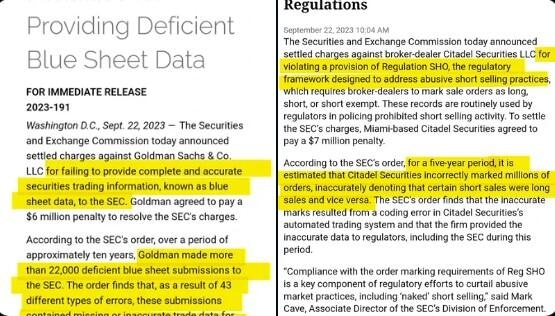

Citadel Securities has agreed to settle charges with the US SEC after the financial regulator charged the broker-dealer with breaking a clause under Regulation SHO. This is a regulatory structure targeting unlawful short-selling practices.

U.S. SEC SAYS IT CHARGES CITADEL SECURITIES FOR VIOLATING ORDER MARKING REQUIREMENTS OF SHORT SALE REGULATIONS

— *Walter Bloomberg (@DeItaone) September 22, 2023

Short selling, otherwise called shorting, refers to a trading strategy where you borrow a security, sell it, and then buy it back at a lower price. The short seller therefore profits from the asset’s value dropping.

Under Regulation SHO, broker-dealers must order mark (mark a sale order as long, short, or short exempt), with the records helping financial regulators to prevent unlawful activities in shorting activity. Citing the SEC’s Associate Director of the Division of Enforcement Mark Cave:

Compliance with the order marking requirements of Reg SHO is a key component of regulatory efforts to curtail abusive market practices, including ‘naked’ short selling.

The regulator indicates that the Miami-based broker-dealer marked millions of orders incorrectly for five years straight. Specifically, Citadel Securities inaccurately denoted that some short sales were long and some long were short. While the commission’s findings attribute this foul play to a coding error in the dealer’s automated trading system, Citadel is charged for presenting inaccurate data to regulators, the SEC included. Notably, Goldman Sachs has also been charged with the same violation.

Citadel Securities and Goldman Sachs & Co. charged by SEC

According to the SEC, Citadel has agreed to pay a $7 million penalty in settlement of the charges, with the commission articulating that broker-dealers failing to comply with the Reg SHO rules would eventually affect the accuracy of its electronic records, “including electronic blue sheet reporting.” In turn, this would deprive the SEC of crucial data pertaining to the very same market it is supposed to be regulating.

While Citadel agreed to the penalty, it did not admit or deny the regulator’s findings but instead consented to a cease-and-desist order. The punishment comprises a censure, a fine, a written confirmation that the coding error has been fixed, and an evaluation of Citadel’s computer programming and coding structure that they use to process transactions.

The incident depicts how unsafe financial markets can be, with leading market makers feasting upon retail investors.

Cryptocurrency prices FAQs

How do new token launches or listings affect cryptocurrency prices?

Token launches like Arbitrum’s ARB airdrop and Optimism OP influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

How do hacks affect cryptocurrency prices?

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

How do macroeconomic releases and events affect cryptocurrency prices?

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence risk assets like Bitcoin, mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

How do major crypto upgrades like halvings, hard forks affect cryptocurrency prices?

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs. This has been observed in Bitcoin and Litecoin.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.