Chainlink price prepared for a drawdown unless $1.69 billion worth of LINK note profits again

- Chainlink price is moving sideways, trading at $6.13, with price indicators suggesting an imminent downtrend.

- New investors are pulling back as network growth dipped over the weekend following a lack of recovery.

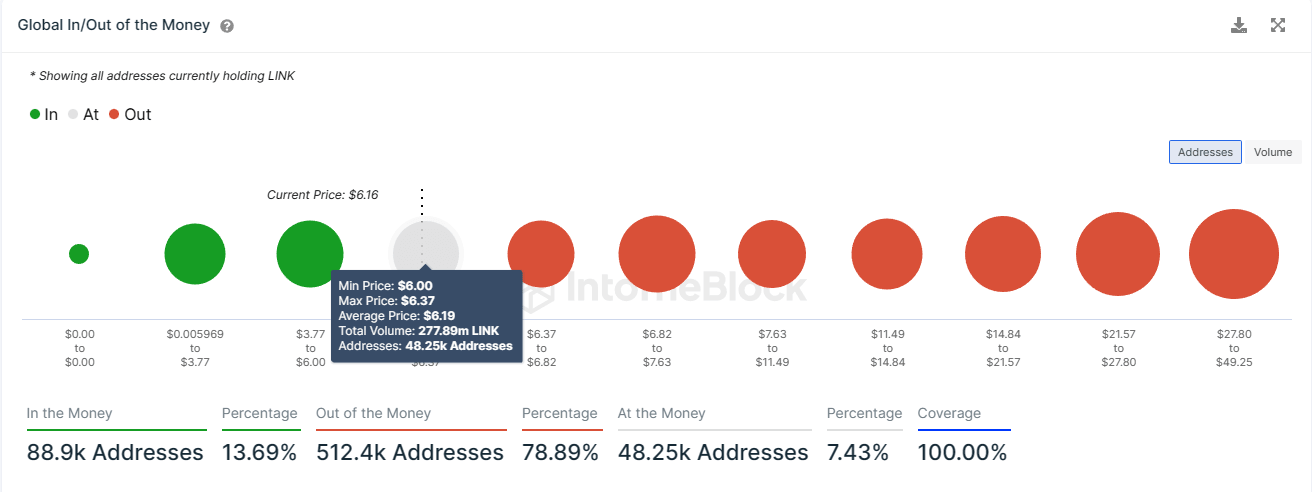

- LINK price could initiate a recovery if it bounces back to $6.38 post, which about 277 million LINK would become profitable, providing the price some stability.

-637336005550289133_XtraLarge.jpg)

Chainlink price after a decent run could be setting itself up to disappoint its investors as the altcoin is seemingly receiving lesser and lesser support from them. Should that occur, LINK might be witnessing unprecedented drawdowns.

Chainlink price might take a downturn

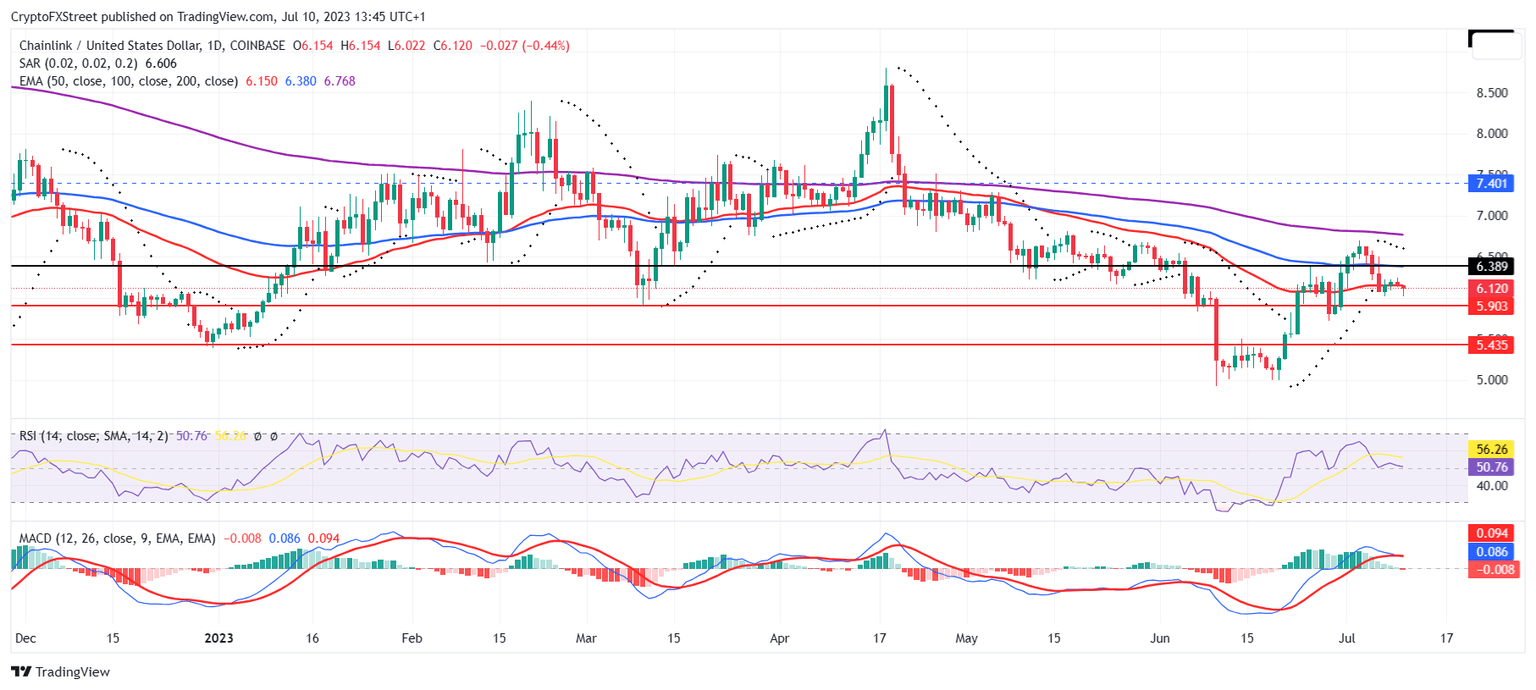

Chainlink price trading at $6.12 is moving sideways after posting red candlesticks for the last few days. The altcoin failed to flip the 100-day Exponential Moving Average (EMA) into a support floor and is now looking to test the line as a resistance barrier. However, if the breach fails again, the coin is vulnerable to a decline.

Looking at the price indicators, Chainlink price seems lile;y t observe a decline within the next few days. The Moving Average Convergence Divergence (MACD) indicator is gradually moving into a bearish crossover position with the red signal line crossing over the indicator line (blue), and the histogram behind in observing observes a first red bar pointing towards initiating bearishness.

LINK/USD 1-day chart

But beyond market indicators, it is the network development and investors’ behavior that bears are finding tempting. New investors are important in providing a sense of asset’s demand in the market. Their data can be measured on Santiment using Network growth which gives an idea of the traction of the project.

Chainlink network growth

High network growth promotes bullishness for the altcoin even during a rather unimpressive market. However, in the case of Chainlink, this may not be the case since, at the moment, both developments are not in favor of the altcoin.

The network growth noted a downtick at the time of writing, but if the potential decline does extend, the altcoin might be well on its way to noting significant losses. Secondly, the recovery plays a crucial role in bringing about profits for the investors whose confidence has been bleak for a while now.

In order to ascertain profits, the altcoin needs to close above the $6.38 level, which would result in profits worth $1.69 billion to investors.

Chainlink GIOM

Secondly, the price level also coincides with the 100-day Exponential Moving Average and flipping it into support would bring an immediate shift in trend.

If that does not occur, a decline is most likely set to be witnessed by LINK holders.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B18.14.48%2C%252010%2520Jul%2C%25202023%5D-638246137907889332.png&w=1536&q=95)