Chainlink Market Update: LINK/USD at the highest level in three month, targets $5.00

- Chainlink jumps to the highest level since the beginning of March.

- The next critical resistance is created by psychological $5.00.

Chainlink (LINK) is the best-performing altcoin out of top-20 on Monday. LINK/USD has gained over 7% in the recent 24 hours to trade at $4.4 by the time of writing. The coin takes 12th place in the global cryptocurrency rating with the market value of $1.53 billion and an average daily trading volume of $461 million. LINK’s growth is accompanied by high volumes, which adds credibility to the upside trend. LINK is most actively traded against USDT on Binance and Bilaxy.

What is Chainlink

Chainlink (LINK) is a decentralized oracle network that helps smart contracts obtain data from the real world in a safe and secure manner. The team issued 1 billion LINK tokens and raised $32 million during the ICO in 2017. Node operators received 32% of LINK tokens, while 30% stayed within Chainlink for development.

According to the data obtained from the underlying blockchain, users have been actively taking their LINK tokens from the exchanges, which is often regarded as a positive signal for the coin. It means that holders have no intention to sell their tokens and moving them for long-term storage.

Considering a strong use case for the Cgainlink, some experts believe the coin is undervalued. Michael Anderson, the co-founder of Framework Ventures, noted as cited by CoinDesk:

“Chainlink is the most successful blockchain network over the last two years and we still feel like the underdog,”

LINK/USD: Technical picture

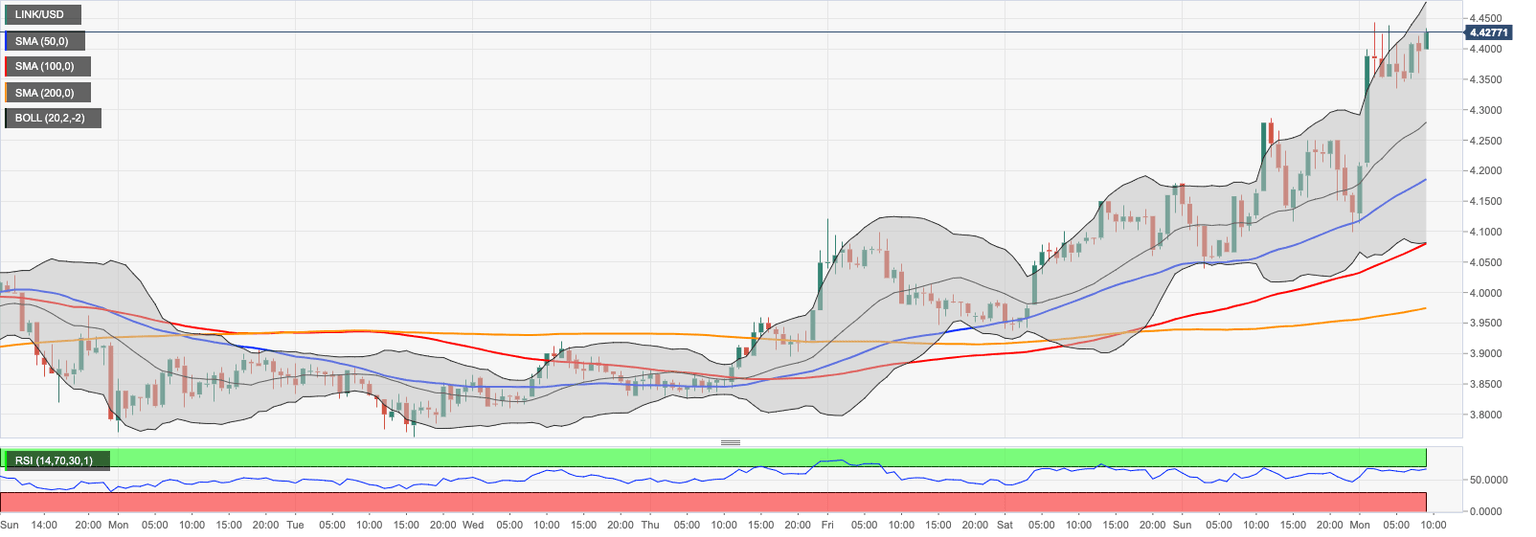

On the intraday chart, LIMK/USD is moving along the upside trendline, created by 1-hour SMA50. This technical barrier serve as a strong resistance that has been verified on several occasions recently. If it is broken, the sell-off may be extended towards psychological $4.00 reinforced by a combination of 1-hour SMA200 and the lower line of the 1-hour Bollinger Band.

On the upside, local resistance is created by the intraday high and the upper line of the 1-hour Bollinger Band on approach to $4.50. A sustainable move above this area will open up the way towards $5.00.

LINK/USD 1-hour chart

Author

Tanya Abrosimova

Independent Analyst