Cardano Price Forecast: ADA targets $1 as whale holdings, open interest surge

- Cardano extends a falling wedge breakout, with bulls targeting the $1 milestone.

- Large investors holding over 10 million ADA have expanded their portfolio to 18.79 billion tokens.

- ADA Open Interest increases, inching closer to a record high.

Cardano (ADA) struggles to surpass $0.90 at press time on Thursday following a positive week so far. The derivatives market data suggests increasing interest in Cardano as large wallet investors, also known as whales, extend their buying streak.

Whales continue to acquire more ADA

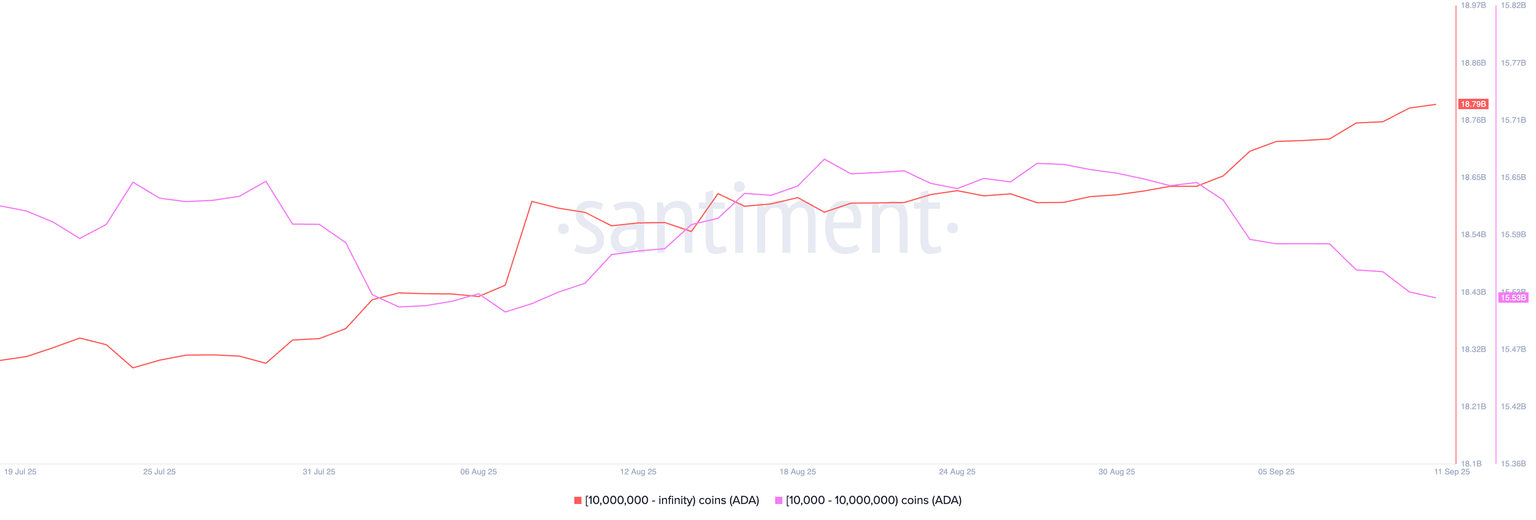

Santiment data shows that the large wallet investors with over 10 million ADA hold 18.79 billion tokens, up from 18.63 billion tokens on September 1. This increase in 16 million ADA tokens reflects a boost in risk-on sentiment of large investors, anticipating further recovery.

Even so, investors with 10,000 to 10 million ADA offload their holdings to 15.53 billion ADA, from 15.64 billion ADA in the same time period. This suggests a shakeout of medium-scale investors as Cardano struggles to uphold the bullish trend.

Cardano supply distribution. Source: Santiment

Open Interest surge signals bullish anticipation

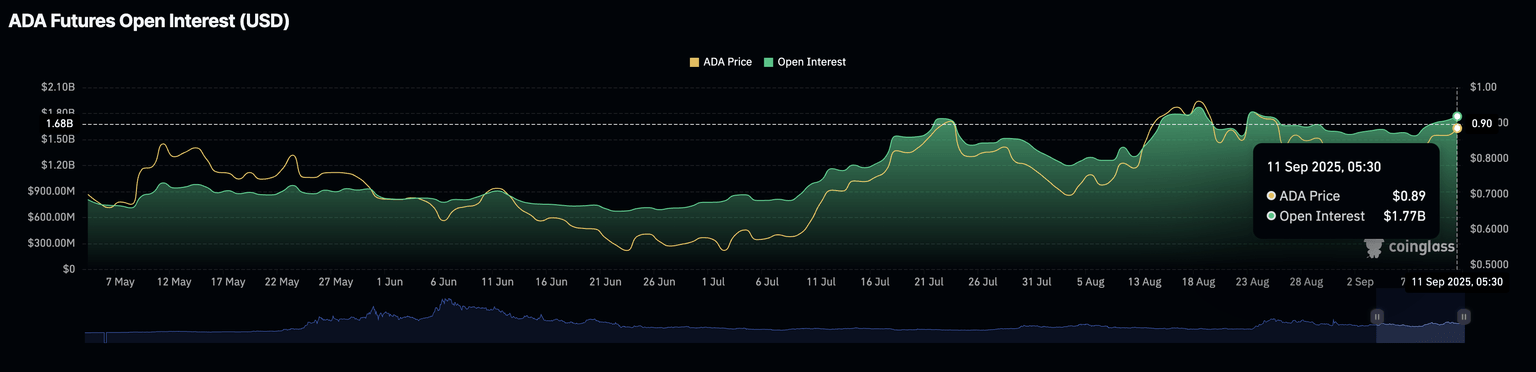

CoinGlass data shows that the ADA Open Interest is rising to $1.77 billion, from $1.72 billion on Thursday. This surge in capital inflow into Cardano derivatives inches closer to its record high of $1.87 billion, suggesting a boost in risk-on sentiment among investors.

Cardano Open Interest. Source: CoinGlass

Cardano at a crucial crossroads targets $1

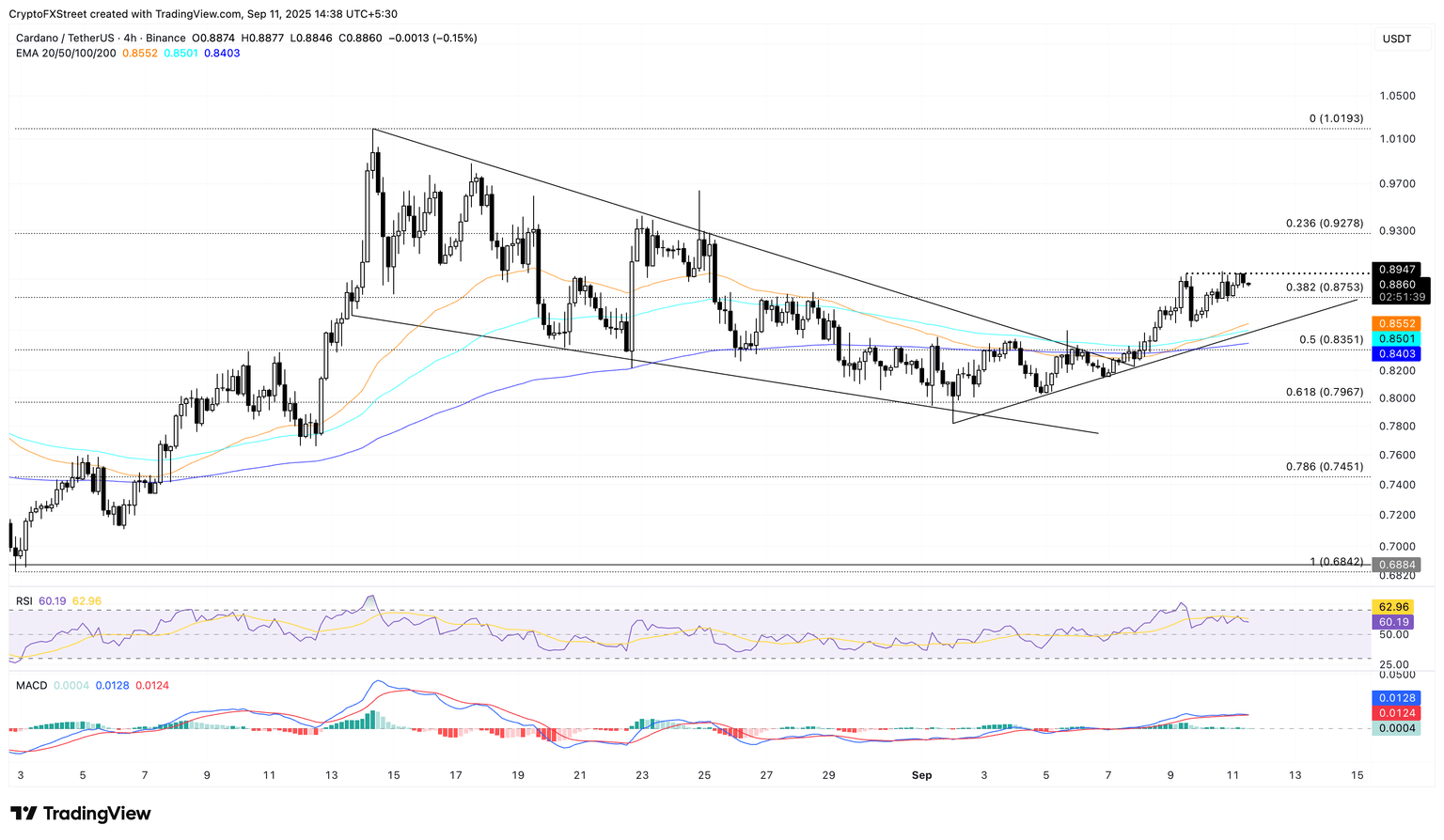

Cardano recovers with a falling wedge pattern breakout rally on the 4-hour chart, struggling to surpass the $0.8947 level. At the time of writing, ADA stalls below this key resistance, with the 38.2% Fibonacci level at $0.8753 acting as the immediate support level, derived by the retracement between the August 2 low at $0.6842 and the August 14 high at $1.0193

If Cardano’s rally surpasses the $0.8947 resistance level, it could target the $1.0000 psychological level.

The 50-period Exponential Moving Average crosses above the 100-period EMA on the 4-hour chart, marking a Golden Cross pattern, which indicates a stronger recovery outpacing the prevailing trend.

Still, the momentum indicators on the same chart show a risk of downside reversal. The Moving Average Convergence Divergence (MACD) moves closer to its signal line, risking a potential crossing below the same, which would indicate a bearish shift in momentum, triggering a sell signal.

Additionally, the Relative Strength Index (RSI) at 60, pointing downside as it reverses from the overbought boundary, indicates that the buying pressure is softening.

ADA/USDT daily price chart.

Looking downside, Cardano’s drop below $0.8753 could lead to a decline to the 50-period EMA at $0.8551.

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.