Cardano eyes recovery as it retests key support, funding rate and bullish bets signal optimism

- Cardano price recovers slightly on Tuesday after falling nearly 7% the previous day.

- On-chain data signals a recovery as ADA’s funding rate turns positive, with bullish bets at a monthly high.

- A daily candlestick close below $0.57 would invalidate the bullish thesis.

Cardano (ADA) recovers slightly by 4%, trading around $0.70 on Tuesday after falling nearly 7% the previous day. On-chain metrics signal further recovery as ADA’s funding rate turns positive while its bullish bets reach the highest level over a month.

Cardano Price Forecast: ADA retest key support level

Cardano’s price declined 36.36% last week and continued its pullback on Monday by nearly 7%. At the time of writing on Tuesday, it recovers slightly after retesting its key support level at

$0.64.

The $0.64 level roughly coincides with multiple levels as follows, making it a key reversal zone:

- The previously broken descending trendline.

- Its 61.8% Fibonacci retracement level at $0.67.

- The bullish order block area extends from $0.64 to $0.57. A bullish order block area is where market participants, such as institutional traders, previously placed buy orders.

If the abovementioned level holds as support, ADA could extend the recovery to retest its next resistance level at $0.98.

However, the Relative Strength Index (RSI) reads 44, below its neutral level of 50, indicating bearish momentum. The RSI must move above its neutral level of 50 to sustain bullish momentum. Such a development would add a tailwind to a recovery rally.

ADA/USDT daily chart

On-chain metrics support Cardano’s recovery

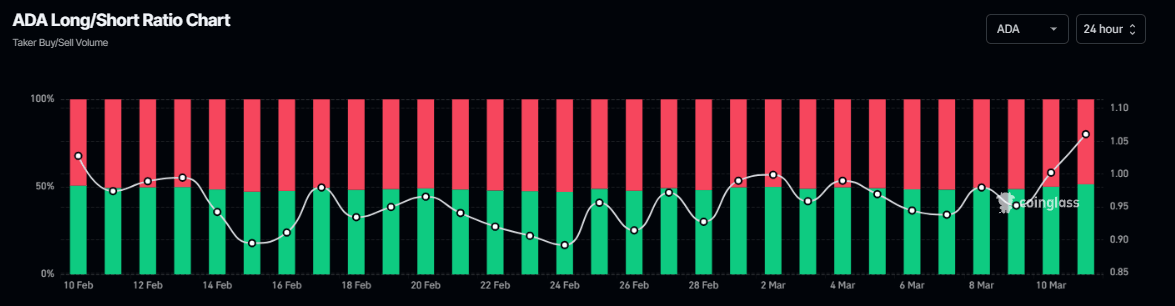

Looking at on-chain metrics supports further recovery. Coinglass data shows ADA’s long-to-short ratio, which reads 1.06, is at its highest level in over a month. This ratio above one reflects bullish sentiment in the markets as more traders are betting on the asset price to rise.

ADA long-to-short ratio chart. Source: Coinglass

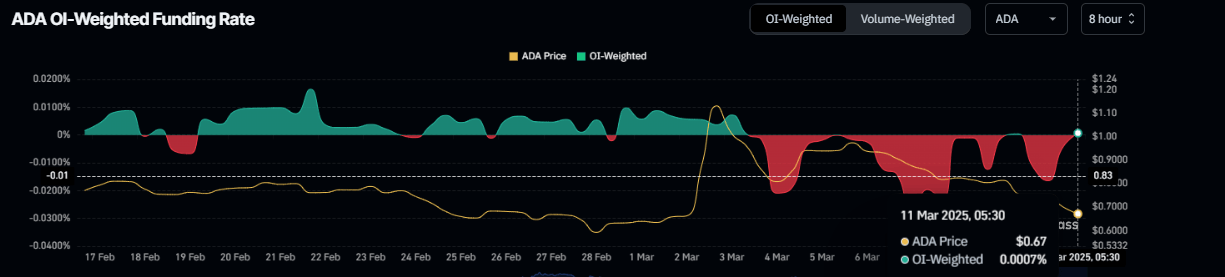

According to Coinglass’s OI-Weighted Funding Rate data, the number of traders betting that the price of Cardano will slide further is lower than that anticipating a price increase.

This index is based on the yields of futures contracts, which are weighted by their Open Interest (OI) rates. Generally, a positive rate (longs pay shorts) indicates bullish sentiment, while negative numbers (shorts pay longs) indicate bearishness.

In the case of ADA, this metric reads 0.0007%, reflecting a positive rate and indicating that longs are paying shorts. This scenario often signifies bullish sentiment in the market, suggesting a potential recovery in Cardano’s price.

Cardano OI-Weighted Funding Rate chart. Source: Coinglass

Even though on-chain metrics and technical analysis support the bullish outlook, a daily candlestick closes below $0.57 would invalidate the bullish thesis. This development could cause Cardano’s price to decline and retest its next support level at $0.50.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.