Cardano CEO Charles Hoskinson believes DeFi will become the “most competitive area” in two years

- Cardano head Charles Hoskinson stated decentralized identities (DIDs) are critical for the compliance of Travel Rules.

- Hoskinson said that the appeal of DeFi is pushing more centralized players into pursuing decentralized identities.

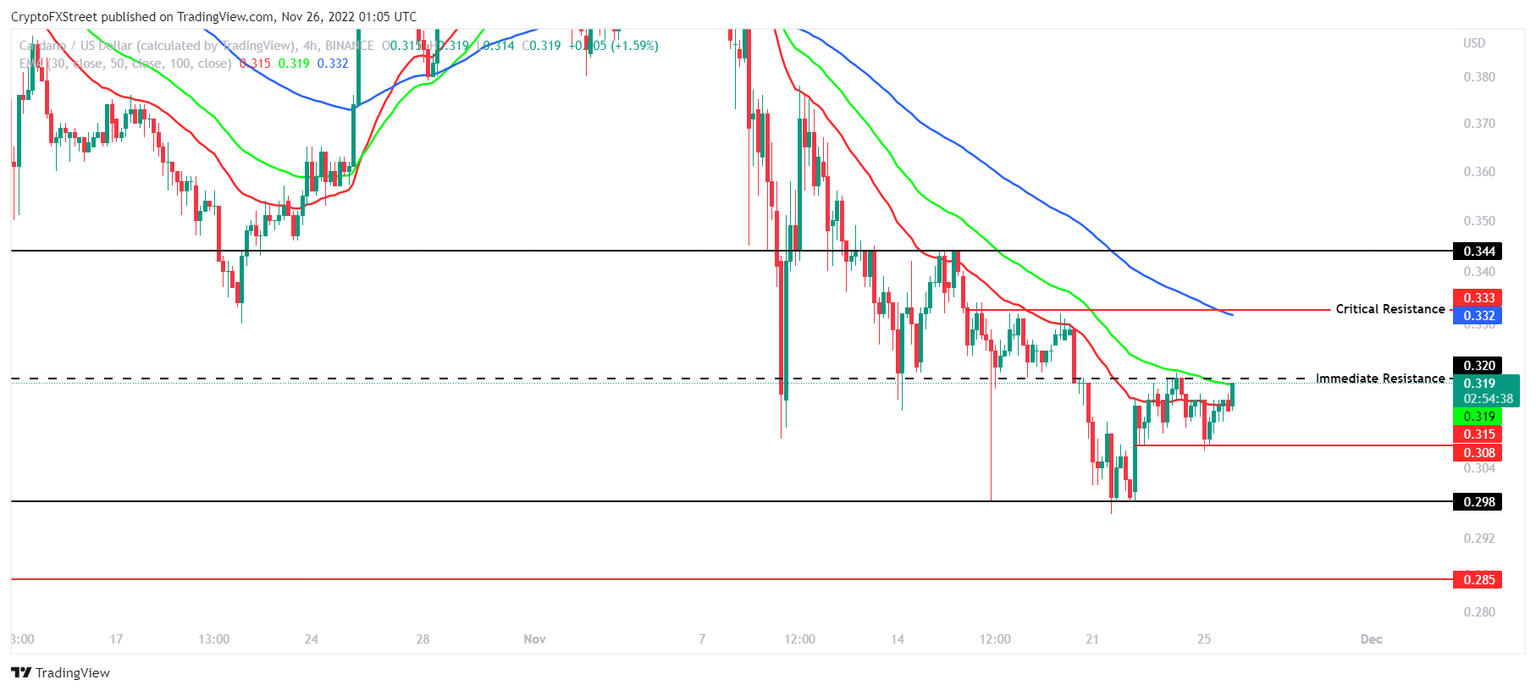

- Cardano price is preparing for an 8% rally, trading at $0.319 as buying pressure begins rising for the altcoin.

Cardano is also known as the third-generation cryptocurrency for its ability to combine all things crypto with DeFi providing a cheaper and far more scalable blockchain. While the world is yet to see a full-scale application of the same, Cardano’s CEO Charles Hoskinson continues believing in DeFi to be the future of crypto.

Charles Hoskinson on decentralized identities

Cardano’s co-founder recently engaged in a Q&A session, where Hoskinson mentioned that going forward, DeFi will play a crucial role in the crypto space. The first instance of the same was given in the form of the Financial Action Task Force’s Travel Rule. The set of rules used to prevent illicit transfers allows exchanges to hold the assets during transactions.

Hoskinson stated that if the customer was to transfer assets off of the exchange into a self-custodial wallet, they could lose access to their cryptocurrencies. To prevent this, a decentralized identity could be added to the transactions.

Charles Hoskinson believes that this can be done on a transactional level between regulated and non-regulated entities. He further added that centralized industry players are even more pursuant of decentralized identities.

As reported by FXStreet, earlier this month, Singapore conducted its first-ever institutional DeFi trade with JP Morgan, SBI and DBS Bank. This was done with the use of verifiable credentials, which dictated who could and who could not participate in the transaction.

Commenting on the prospect of DeFi going forward, Hoskinson stated,

“It’s going to be one of the most competitive areas in the space in the next 24 months.”

Cardano price could be heading toward recovery

Cardano price noted an almost 4% increase in price in the last 24 hours, bringing the altcoin to trade at $0.319. The altcoin is nearing a flip of its immediate resistance at $320, which would be crucial in ADA’s attempt at recovery.

If the $0.320 hurdle is flipped into a support floor, Cardano price would have the opportunity to mark an upswing toward $0.333. Acting as the critical resistance, reclaiming this level would allow ADA to initiate a run-up toward $0.344, marking an 8% rally.

ADA/USD 4-hour chart

However, if the bearish momentum builds up again and prices take a hit, ADA could end up tagging the support level at $0.315. It would also lose the support of the 30 and 50-day Exponential Moving Averages (EMAs).

Bulls will have another chance to save Cardano price from further decline by bouncing off of the $0.298 mark. But a daily candlestick close below this level will invalidate the bullish thesis, resulting in the altcoin tagging the lows of $0.285.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.