Can bulls seize the initiative and get Litecoin (LTC) back to $150?

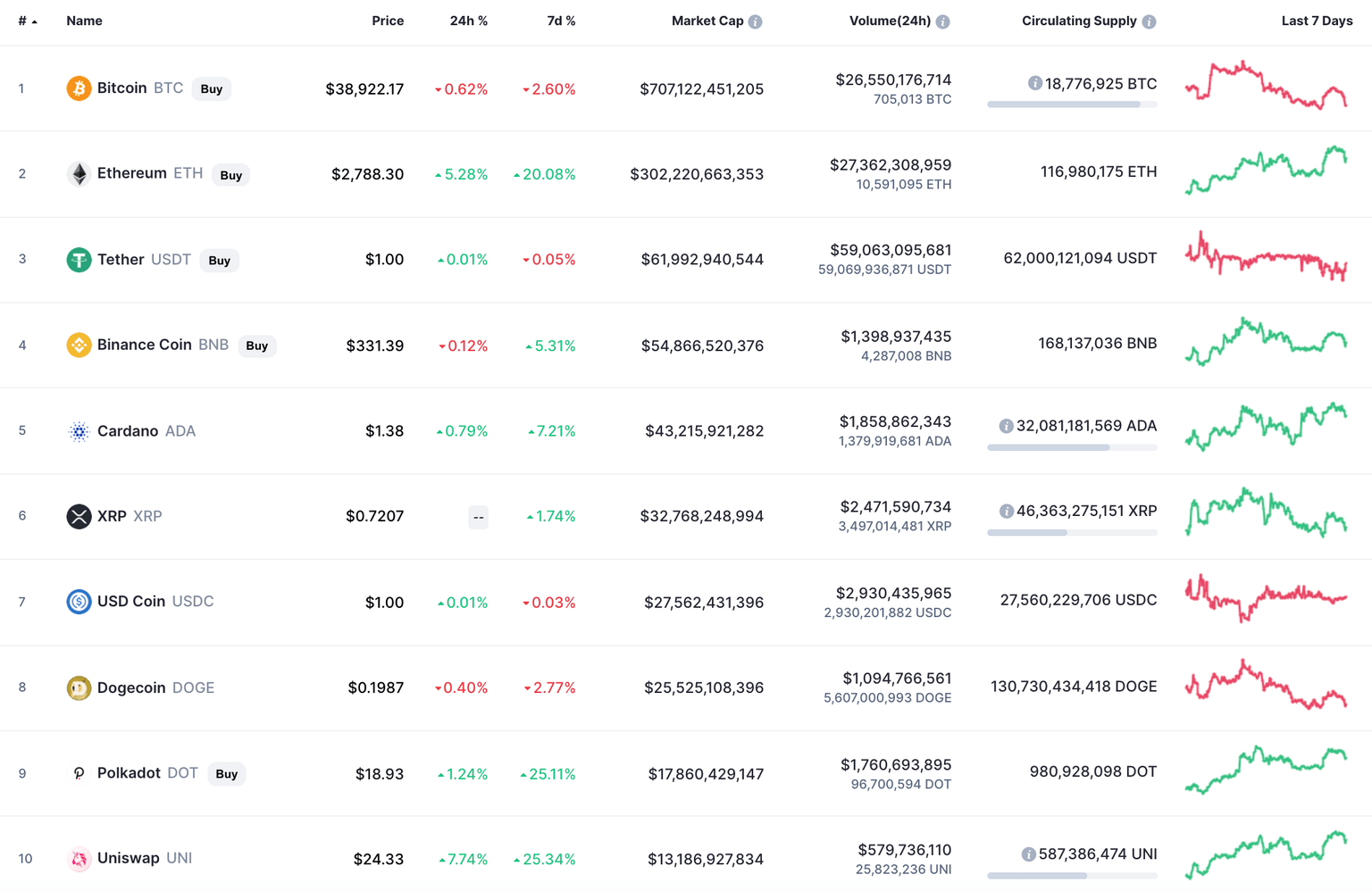

Today, neither bulls nor bears are dominating as some coins are in the green zone while others are in red.

Top coins by CoinMarketCap

LTC/USD

Litecoin (LTC) could not follow the rise of Bitcoin (BTC) and other growing coins as the rate of the "digital silver" has gone down by 1.21% since yesterday.

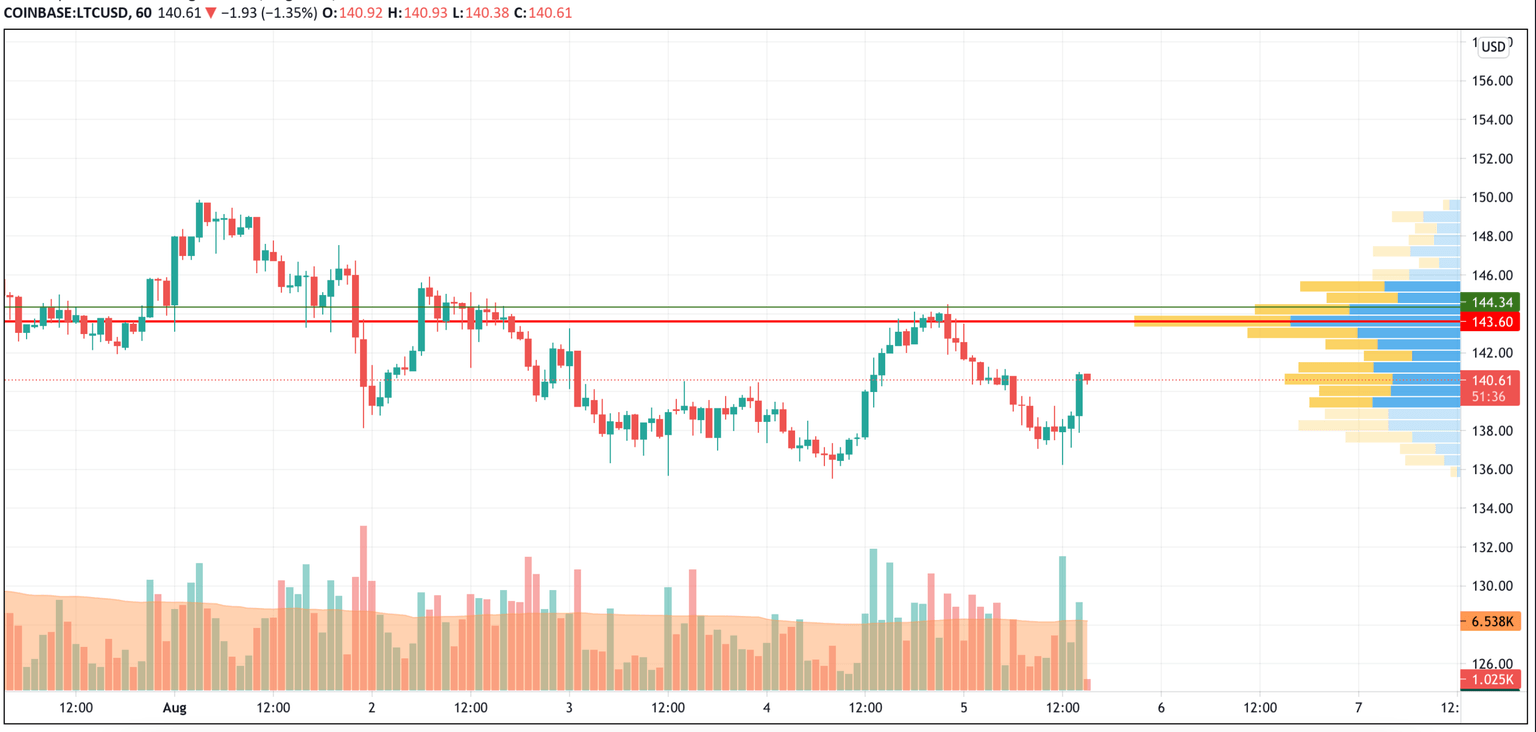

LTC/USD chart by TradingView

On the hourly chart, Litecoin (LTC) has bounced off the $136 mark, following a rising trading volume. At the moment, there is a high chance to come back to the zone of the most liquidity around $140.

Such a scenario is relevant until the end of the day.

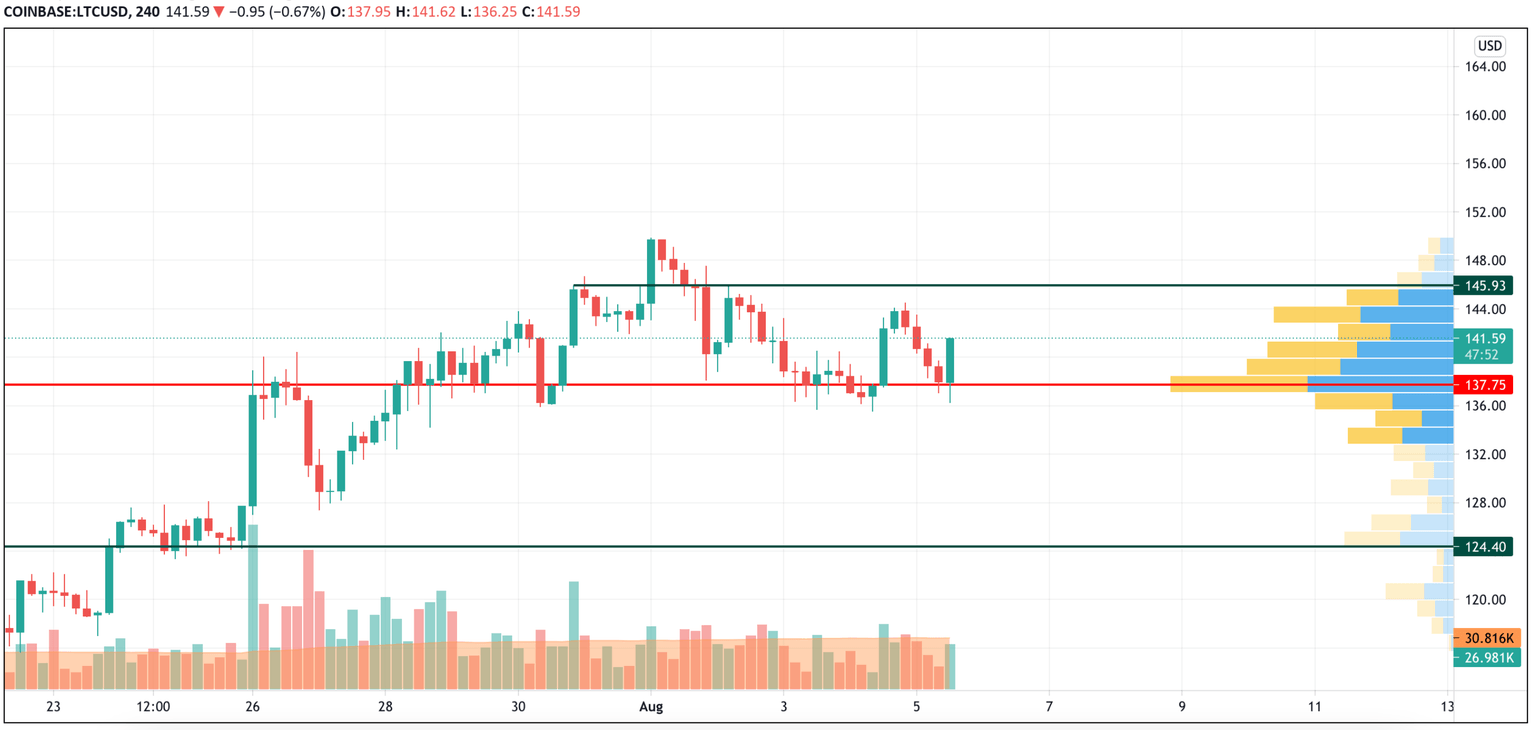

LTC/USD chart by TradingView

On the bigger chart, bulls have seized the initiative after testing the $135 mark. In this case, there is a high probability of seeing a test of the resistance at $145. However, there are few chances of buyers breaking this zone today as they have run out of fuel to keep the growth going.

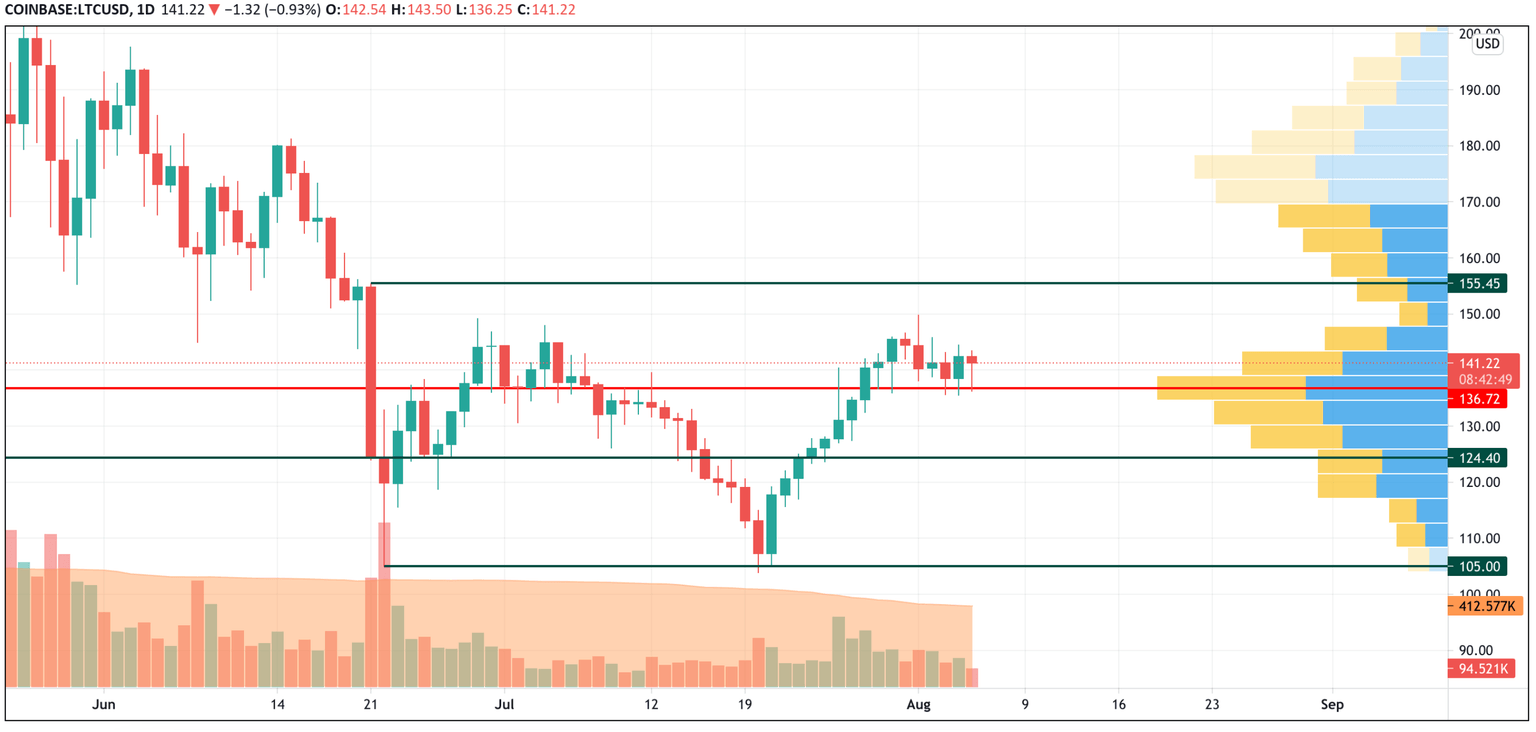

LTC/USD chart by TradingView

According to the daily time frame, Litecoin (LTC) is accumulating power in the range of $140-$145. The trading volume is low, which means that after a breakout of the vital $150 mark, the price can continue the growth to the nearest resistance at $155.

Litecoin is trading at $141.22 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.