BTC/USD outlook: Mixed signals but downside remains vulnerable below 60K barrier

BTC/USD

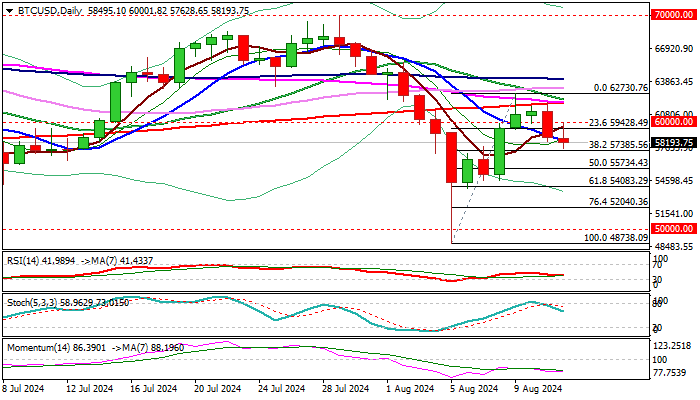

BTCUSD firmed on Monday and recovered a part of Friday’s drop, but upside attempts were so far capped by psychological 60K barrier and warning that gains may be short-lived..

Near-term action to keep slight bullish bias above 10 DMA (58440), with rising and thinning daily Ichimoku cloud expected to attract, however lack of firmer positive signals to keep the downside vulnerable, especially while the price stays below 60K pivot.

Negative momentum on daily chart and converged 55/200DMA about to for a death cross, with falling 20DMA on track to form another cross, weigh on near-term action.

Caution on close below 10DMA which would add to formation of reversal pattern on daily chart and risk deeper drop towards 57385 (Fibo 38.2% of 48738/62730) and 55734 (50%) in extension.

Markets await release of US CPI data on Wednesday for fresh signals.

Res: 59428; 60000; 61922; 62171.

Sup: 57628; 57385; 55734; 54251.

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.