- A new hot project emerged in the DeFi industry.

- BNSD token gained over 3000% in less than 24 hours; however, the correction has already started.

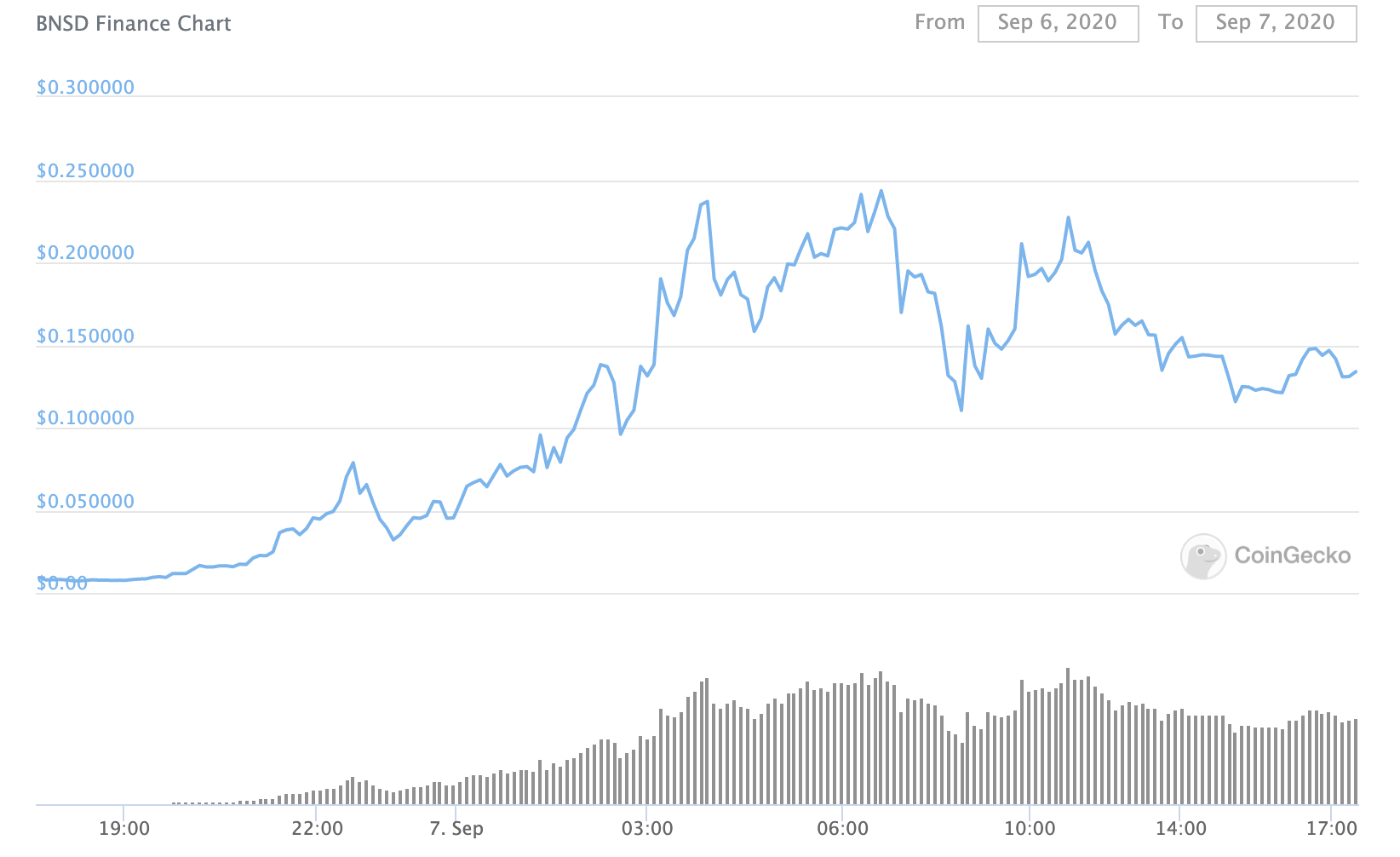

BNSD Finance is a new darling in the bubbling DeFi industry. The project's token (BNSD) takes the 2300th place in ConMarketCap's rating; however, its price catapulted by over 3000% from $0.006 on September 6 to $0.2433 on September 7. Bt the time of writing, BNSD has retreated to $0.1313, though it is still one of the hottest DeFi coins in the space with the current average daily trading volume over $4 million. Notably, the coin is the most actively traded Uniswap (v2). However, it is also available only on KuCoin and Bitbns.

Source: CoinGeko

It has never happened before, and here we go again

The project has been launched in August, but the yield farmers have discovered it loved in only now. One of the users announced on Twitter, and here we go. The barely known token skyrockets to the moon and early adopters reap juicy rewards.

@bitbns goes DeFi!

— Crypto Szene Schweiz (@CryptoSzene) September 6, 2020

This project bnsd finance is in early stages and the rewards are super high now! Join and farm with me!

Website:https://t.co/oPCpIAkpvj

Coingecko:https://t.co/6GbeccNslt

Uniswap:https://t.co/5ONzWhTnC1 pic.twitter.com/RsGGyjESoL

Some other users urged Binance to jump on the bandwagon and list BNSD. As the FXStreet previously reported, the cryptocurrency exchange had added several DeFi tokens recently, including the controversial SUSHI and RUNE. The cryptocurrency community turned against the trading platform for fuelling the DeFi mania and supporting risky and potentially fraudulent projects.

However, the head of the exchange, Chanpeng Zhao, reacted to the criticism by saying that innovations require risk-taking. Notably, he also added that all users should assess the risks and by themselves.

As one of the leaders of the space, we support innovation. With innovation comes the chance of high reward and high risk. Some projects make it to the moon, while some fall short. Always manage your risk accordingly.

What's next for BNSD

The coin has already lost over 46% from the all-time high, and the downside correction may gain traction, especially if the DeFi-space continues to cool down. The star of BNSD may go down as quickly as it has risen.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Uniswap nears $3 billion in daily trading volume despite Wells notice and fee hike

Uniswap's (UNI) price witnessed a double-fold crash in the past week after it received a Wells notice from the SEC and later due to the general crypto market crash over the weekend. In the past week, UNI has decreased more than 38%.

Arbitrum Price Prediction: 10% losses likely for holders ahead of $107 million worth of cliff token unlocks

Token unlocks are considered bearish catalysts, particularly when recipients are likely to cash in for a quick profit. The event, which adds tokens to the project’s circulating supply without increasing demand, leaves an effective imbalance in favor of supply.

Ethereum recovers from dip as Hong Kong ETH ETF approval sparks whale buying spree

Ethereum's (ETH) price slightly improved on Monday after Hong Kong approved applications for a spot Bitcoin and Ethereum ETF. Whales have also been accumulating ETH after the market dip over the weekend.

Bitcoin price delays pre-halving rally as US and China battle for BTC supremacy ahead of halving

Bitcoin has failed to showcase an enticing pre-halving rally. As the event remains less than a week out, traders and investors remain at the edge of their seats, with thoughts on whether the impact of the fourth cycle will be different than what has been seen before.

Bitcoin: BTC’s rangebound movement leaves traders confused

Bitcoin (BTC) price has been hovering around the $70,000 psychological level for a few weeks, resulting in a rangebound movement. This development could lead to a massive liquidation on either side before a directional move is established.