Bitcoin Weekly Forecast: BTC bull rally remains strong in the long-term according to technicals

- Bitcoin price has been extremely volatile in the past week.

- MicroStrategy has continued to accumulate even more BTC despite the fall in prices.

- Bitcoin's rally remains strong as the digital asset continues to defend critical support level

Bitcoin price has rebounded from a key support level on the daily chart and aims for a full recovery. The past week has been quite volatile for the flagship cryptocurrency experiencing moves of up to 10% in just 24 hours. A lot has happened so let’s take a look at the most important developments over the past week.

Positive news for Bitcoin in the past week

In the past week, Microstrategy made several more investments in Bitcoin. The first happened on March 1 right after Bitcoin price touched the local bottom of $43,000. Microstrategy announced the purchase of around 328 Bitcoins for $15 million.

MicroStrategy has purchased an additional ~205 bitcoins for ~$10.0 million in cash at an average price of ~$48,888 per #bitcoin. As of 3/5/2021, we #hodl ~91,064 bitcoins acquired for ~$2.196 billion at an average price of ~$24,119 per bitcoin. $MSTRhttps://t.co/a0BRd4Wy3r

— Michael Saylor (@michael_saylor) March 5, 2021

However, earlier today, the company announced yet another purchase of $10 million worth of Bitcoin and stated that it holds more than 91,000 BTC in total, acquired for about $2.2 billion.

Clearly, Bitcoin is receiving unprecedented interest from institutional investors. Arcane Research, a subsidiary of the Norwegian investment company Arcane Crypto has recently released a report on Bitcoin stating that the digital asset could serve as collateral in a trillion-dollar market.

Other notorious analysts have publicly stated that the flagship cryptocurrency has more room to grow in the near future. Despite the massive 500% rally in the past year, British asset manager Ruffer believes Bitcoin will rise higher in the near future. Ruffer manages around $28 billion of investor money. Ruffer invested 3% of its assets into Bitcoin last year.

However, other investors aren’t so sure about the short-term of Bitcoin and they expect a harder correction.

Is Bitcoin primed for a stronger correction before a clear bounce?

One of the main indicators of Bitcoin’s potential corrections is the Grayscale Bitcoin Trust product which is trading at -12% for the first time ever. This means that investors can trade BTC at a 12% discount which indicates that whales have cashed out some of their profits. GBTC, created by Grayscale is the largest Bitcoin investment product right now and manages over $32 billion worth of assets.

Ki Young Ju, CEO of on-chain insights platform Cryptoquant noted that Bitcoin’s last drop was caused by a massive deposit from a BTC whale.

Result: $BTC price dropped -8% after the whale deposit.

— Ki Young Ju 주기영 (@ki_young_ju) March 5, 2021

Chart https://t.co/oIVOkm5U3a https://t.co/nMJGa7XsEn pic.twitter.com/lKrfiC6Ceo

According to Young, this also happened on February 22, causing a 26% drop for Bitcoin.

Other investors are concerned about Trump’s Anti-Money Laundering push. These rules were proposed by the Trump administration to create new requirements for platforms to record the identities of cryptocurrency holders.

Bitcoin rally is at no risk just yet according to technicals

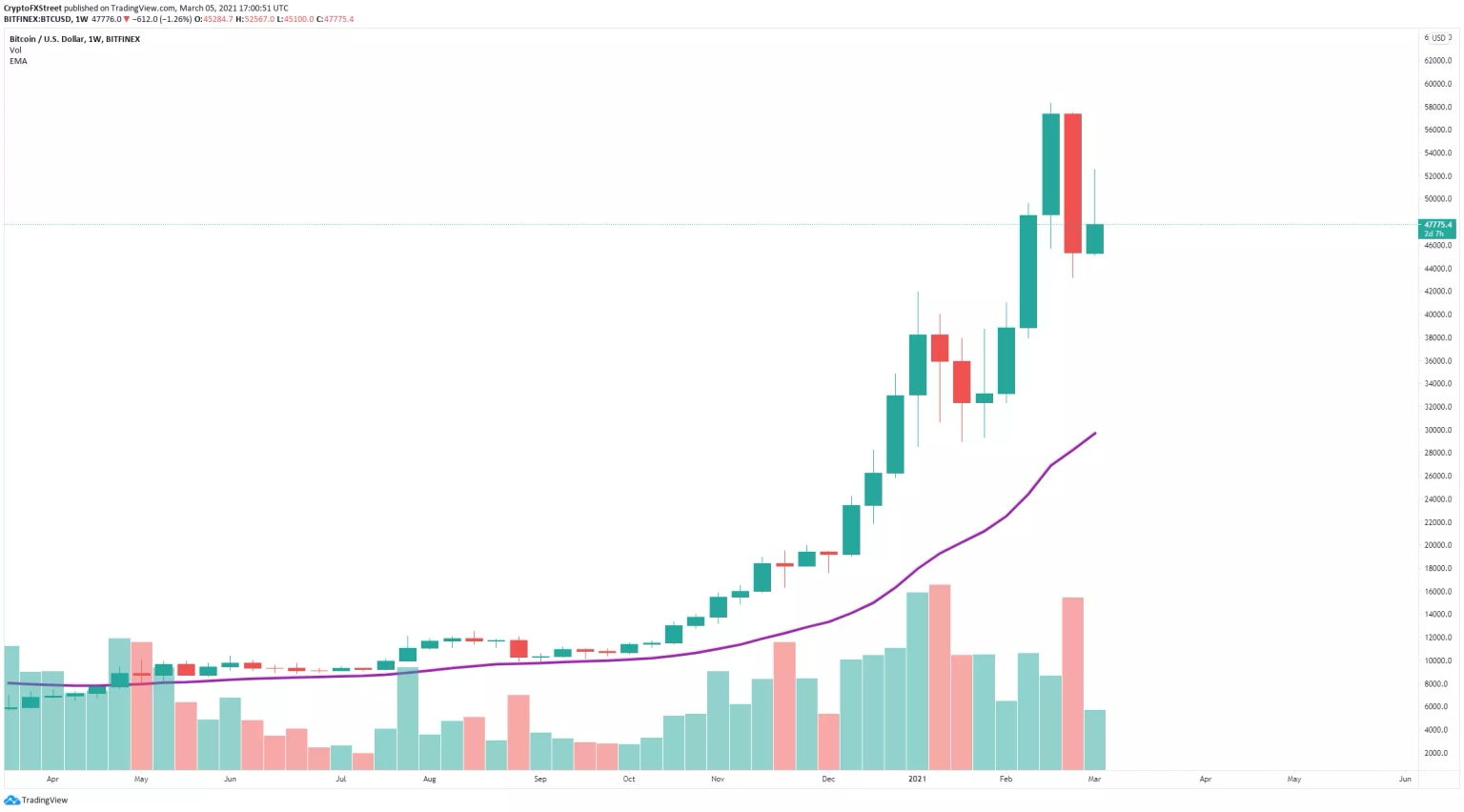

However, despite the potential bad news and regulations, Bitcoin price in the long-term remains extremely bullish. On the weekly chart, BTC is not close to a key support level in the form of the 26-EMA which is currently located at $30,000.

BTC/USD weekly chart

The 26-EMA served as a perfect indicator for the 2015-2018 Bitcoin rally as it was never lost on the weekly chart. Every time Bitcoin price was near this level, it had significant rebounds into new all-time highs.

BTC/USD weekly chart

In fact, the only time that Bitcoin lost this key support level was on January 29 when it crashed below $10,000. That was indeed the end of the bull rally. This means that as long as Bitcoin bulls can hold the 26-EMA, the rally should remain intact.

BTC MVRV(30d) chart

The MVRV(30d) for Bitcoin has trespassed into the buy zone below 0% like it did on January 22. This has been an accurate indicator of Bitcoin local bottoms in the past and it seems to suggest that the flagship cryptocurrency is perhaps primed for a new leg up.

However, at the same time, even though Bitcoin is not close to the 26-EMA, during the previous rally, the price did touch this level several times which means that the flagship cryptocurrency could fall as low as $30,000.

BTC/USD daily chart

On the daily chart, the 26-EMA has also served as a robust support level and bulls currently fight to defend it. A breakdown below this key level has the potential to drive Bitcoin price down to $43,704 which is the 50% Fibonacci level. Losing this level, which is also close to the $43,171 low of February 28 would confirm a daily downtrend for the first time since January 22.

BTC Holders Distribution

On top of that, the number of whales in the past month has decreased notably for Bitcoin. The amount of large holders with 1,000 to 10,000 coins decreased from 2,392 to 2,277 currently. Similarly, the number of whales with 10,000 to 100,000 BTC also went down from a high of 97 on February 10 to 93 currently.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B18.11.54%2C%252005%2520Mar%2C%25202021%5D-637505611935230626.png&w=1536&q=95)

%2520%5B18.08.10%2C%252005%2520Mar%2C%25202021%5D-637505610464160859.png&w=1536&q=95)