Bitcoin retreats despite GameStop and K33 Treasury boost

- GameStop revealed it purchased 4,710 BTC as part of its new Bitcoin treasury strategy.

- K33 announced that it raised $6.2 million from shareholders to launch its Bitcoin treasury.

- Bitcoin dropped below $108,000 on Wednesday, down 2.6% despite the announcements.

Bitcoin (BTC) slips towards $107,000 on Wednesday, despite GameStop's purchase of 4,710 BTC, worth approximately $508 million, and K33's plan to launch its Bitcoin treasury.

Bitcoin declines amid GameStop purchase and K33 treasury announcement

Video game retailer GameStop has made its first Bitcoin purchase after acquiring 4,710 BTC, according to an Securities and Exchange Commission (SEC) filing on Wednesday. The company did not disclose the total price or timing of the Bitcoin purchase. However, BTC's market price at the time of publication shows that its new Bitcoin holding is worth about $508 million.

The acquisition follows GameStop's $1.3 billion convertible note offering, issued in March, as part of its plan to include Bitcoin as a treasury asset.

GameStop's GME stock rose over 6% in premarket trading following the announcement, but then declined by more than 10% at the time of writing.

The GME stock was a key driver of the meme coin frenzy in 2021 after investors from the WallStreetBets subreddit drove its price up by over 1,600%. The surge triggered a short squeeze, forcing hedge funds that held large short positions in the stock to potentially incur losses.

Meanwhile, digital asset research and custody company K33 announced that it entered an investment agreement with shareholders Klein Group, Middelborg Invest AS, Tigergutt Invest AS, and Modiola AS to raise 60 million Swedish krona, approximately $6.2 million.

The company intends to use the funds to purchase Bitcoin and launch its newly approved Bitcoin treasury. K33 termed the development as part of its support for Bitcoin to become part of the "global financial system."

"I am excited to now start the process of building a strong balance sheet backed by Bitcoin, not only as a strong conviction investment but, more importantly, as a strategic enabler for K33 as a leading cryptocurrency broker," said Torbjørn Bull Jenssen, CEO of K33, in a press release on Wednesday.

The moves by GameStop and K33 reflect a broader trend among financial institutions increasingly positioning Bitcoin as a strategic reserve asset, following Strategy's BTC accumulation playbook.

Bitcoin trades at $107,700, down 2.3% over the past 24 hours, despite recent announcements. The top crypto has now stretched its weekly loss to 1.5%.

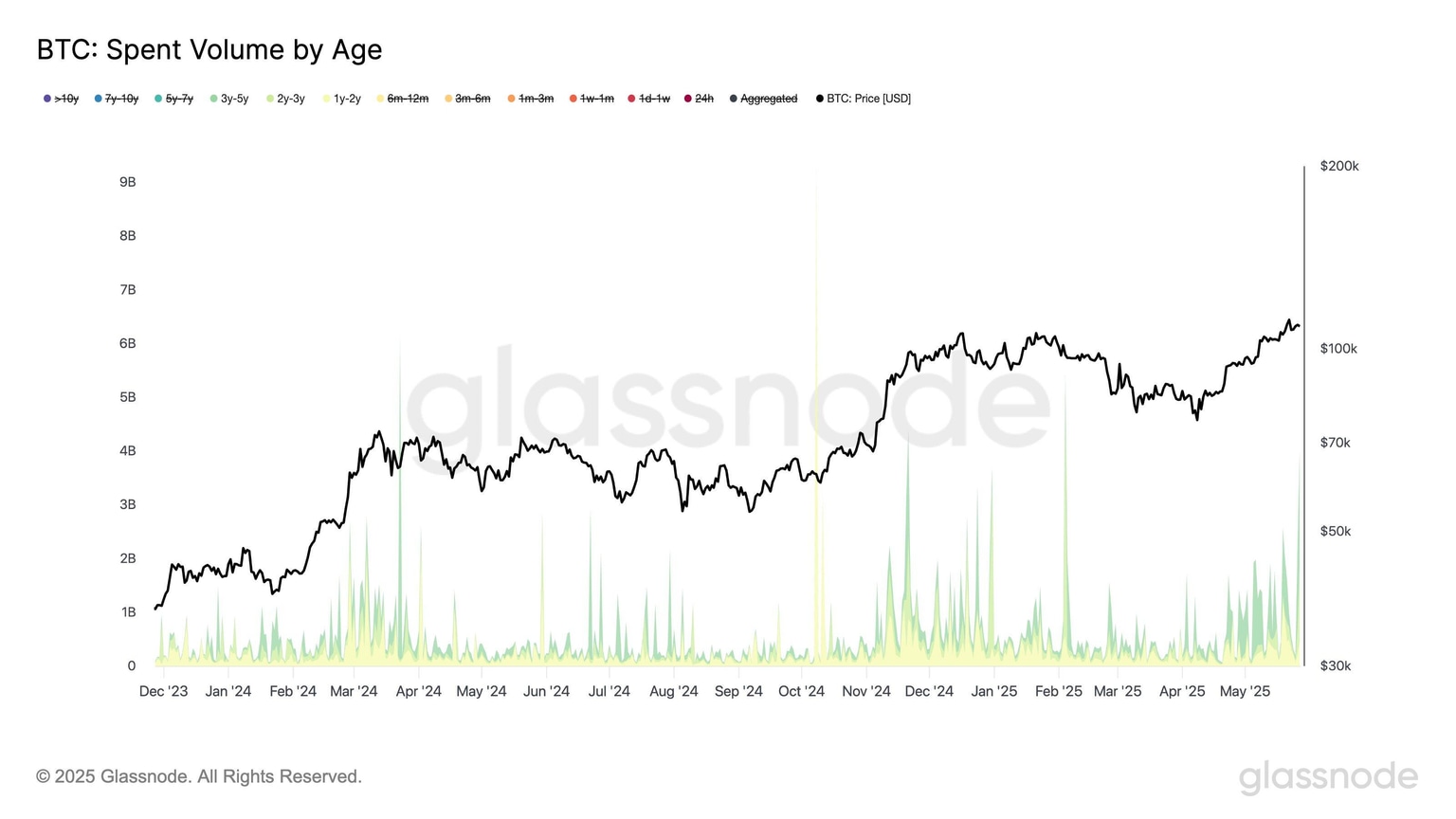

The recent decline follows a surge in profit-taking activity by long-term Bitcoin holders, who have held the asset between one and five years, with their selling volume climbing to $4.02 billion in May, the highest since February, according to Glassnode data.

BTC Spent Volume by Age. Source: Glassnode

The largest selling pressure came from holders within the three- to five-year bracket, which recorded outflows totaling $2.6 billion. This was followed by two- to three-year-old Bitcoin holders, who contributed $1.41 billion in outflows, while holders in the one- to two-year range offloaded approximately $450 million worth of BTC.

Increased profit-taking behavior from these holders could hinder Bitcoin's bullish momentum despite growing institutional demand.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi