Bitcoin price is above $41,000 as BTC whales make strategic moves

- Bitcoin price is trading on the defensive above $41,000 on Monday after a weeklong decline.

- Whales on a leading crypto exchange have closed their leveraged positions, leading to a significant increase in USDT reserve.

- Whale’s strategic moves, which ushered in a 21% decline in open interest on Bitfinex, signal that BTC price could extend losses.

Bitcoin (BTC) is struggling on Monday morning to keep its head above volatile waters, trading at $41,000, after its value fell last week. A decline in open interest by large-wallet investors (popularly known as whales), coupled with an increase of their Tether (USDT) reserves on Bitfinex, suggests that the downward trend for BTC price could extend in the short term.

Also read: Grayscale’s Bitcoin sale unlikely to have driven BTC price lower, profit taking is likely driver

Daily digest market movers: Bitcoin whales position for shift

- Crypto market participants track the moves of large wallet addresses on derivatives exchanges like Bitfinex since this helps determine the direction of BTC price, in the short term. According to CryptoQuant data, whales on Bitfinex have closed their leverage positions, and open interest in BTC has declined by nearly 21%.

Bitcoin Open Interest and price. Source: CryptoQuant

- Open interest is considered a key metric that represents the total value of open derivatives contracts. A decline in open interest suggests that investor's confidence in BTC price decline is low.

- While Bitcoin ETFs continue to attract billions of dollars in volume, the effect is yet to be seen on BTC spot prices. Bitcoin price dropped nearly 2% in the past week and nearly 7% in the last month.

- Profit taking by whales is seen as one of the main drivers of Bitcoin's recent price decline, analysts say.

- There is a correlation between Bitfinex open interest and Bitcoin price, which is one of the key reasons why whale movements on the derivatives exchange are important to BTC traders.

- If the Tether exchange reserves continue rising, in tandem with declining open interest, it is likely a bearish indicator for Bitcoin price. A correction in Bitcoin could follow as derivatives traders close their leveraged positions.

Technical Analysis: Bitcoin price could bleed if it fails to bounce from $41,000

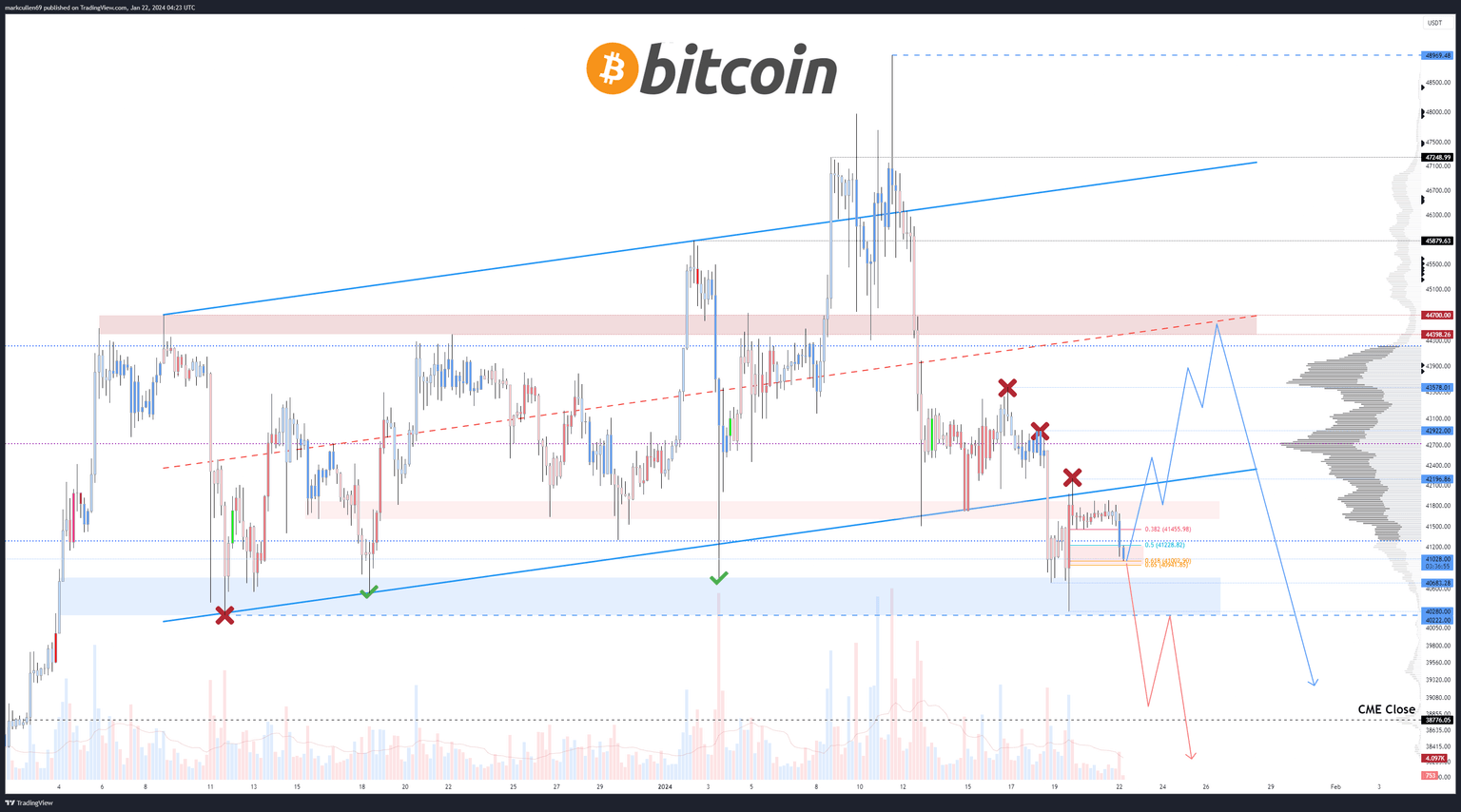

Mark Cullen, a crypto analyst on X (formerly Twitter), expects Bitcoin price to bounce from $41,000 to above $44,000. However, if BTC fails to bounce from this level, Cullen predicts a correction towards $39,080.

Bitcoin price chart

Open Interest, funding rate FAQs

How does Open Interest affect cryptocurrency prices?

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

How does Funding rate affect cryptocurrency prices?

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.