Bitcoin price rests above key indicator amid 'return of retail investors'

Despite pulling back from recent highs, the world’s largest crypto by market cap remains above a key long-term indicator, reflective of bullish market conditions.

Prices are currently changing hands for around $46,350 after topping out $46,453 in the last 24-hours, CoinDesk data shows. The crypto is still up 57% year-to-date and is making headway toward its all-time high of $64,829, witnessed April 14.

“After a quiet July, we’re seeing a return of retail investors,” said Caroline Bowler, CEO of Australian crypto exchange BTC (+0.42%) Markets. “Market wisdom draws a line between the retreat of Chinese bitcoin miners and the recentering of trading activity in the U.S. and Europe.”

Indeed, Tuesday’s on-chain analysis by blockchain data firm Kaiko suggests trading activity is continuing to shift from China to the U.S. and EU amid the crackdown against crypto mining in the Communist state, CoinDesk reported.

BTCUSD Daily Chart

Source: TradingView

The 200-day moving average now appears to be holding prices above $45,117, according to Bitstamp exchange data. As CoinDesk reported, price action is considered bullish above (red line) and bearish below, per technical market theory.

“Despite July being a quieter month, we experienced a significantly larger number of accounts trading over $1 million per month,” Bowler said.

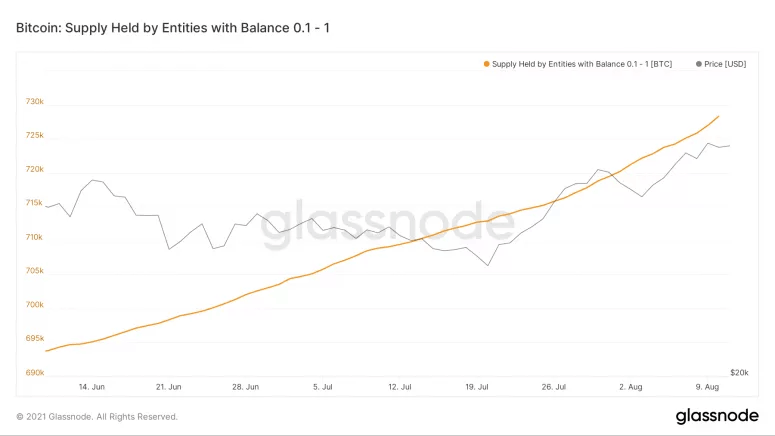

Data from provider Glassnode shows the total supply of bitcoin held by entities with a balance of 0.1-1 BTC has continued to increase alongside bitcoin’s price suggesting retail is buying up alongside institutional investors.

Bitcoin isn’t the only crypto whose experiencing an uptick in trading activity for the month of August.

“Ether (ETH, +2.18%) and other assets are representing the majority in trading volume and not bitcoin,” said Daniel Kim, head of capital markets at Maple Finance. “This shows that individuals and institutions are feeling a lot more comfortable holding other cryptos and are no longer “diversifying” their portfolios by just holding bitcoin.”

Other notable altcoins in the top 20 by market capitalization are also riding high over a 24-hour period with the cardano (ADA, +18.9%), XRP (+8.26%), binance coin, polygon (MATIC, +9.82%) and stellar (XLM, +6.29%) having posted the highest gains.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.