Bitcoin Price Prediction: Bulls hit the pause button as BTC/USD slides under $7,500 – Confluence Detector

- BTC/USD recovery momentum is fading away as the coin retreats from the recent high.

- Strong support levels below the current price may limit the sell-off.

BTC/USD is changing hands below $7,500 amid shrinking volatility. The first digital coin recovered from Wednesday's drop below $7,000 and touched $7,676 during early Asian hours; however, the upside momentum fated away on approach to a strong resistance area of $7,700-$7,800. BTC/USD has gained 6% on a day-to-day basis and stayed unchanged since the beginning of the day.

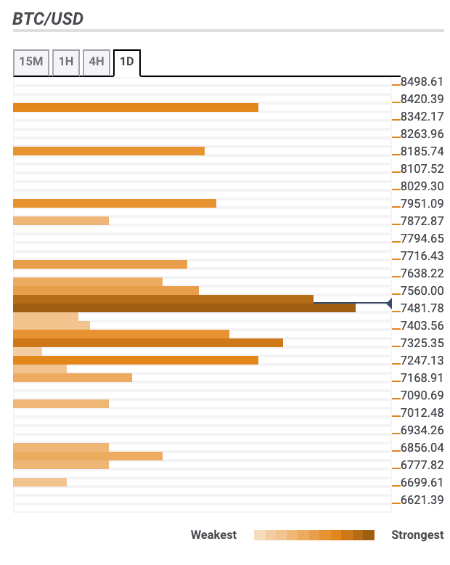

Bitcoin confluence levels

Looking technically, there are a lot of barriers clustered below the current price, which means further upside becomes a path of least resistance in the short run. Let’s have a closer look at the technical levels that may serve as resistance and support areas for the coin.

Resistance levels

$7,550 - 38.2% Fibo retracement weekly, the middle line of 1-hour Bollinger Band, a host of short-term SMA (Simple Moving Average) levels

$7,700 - the upper lines of Bollinger Band on 1-hour and 4-hour timeframes, the highest level of the previous day

$7,950 - 61.8% Fibo retracement weekly, SMA100 4-hour

Support levels

$7,430 - the lowest level of the previous hour, 23.6% Fibo retracement daily

$7,350 - 38.2% Fibo retracement daily, the lower line of 1-hour Bollinger Band, the lowest level of the previous month

$7,250 - 23.6% Fibo retracement weekly

Author

Tanya Abrosimova

Independent Analyst