Bitcoin price analysis: Bulls take a breather after the 4% surge, what’s next?

- Bitcoin surged close to 4% in under 10 minutes, bulls back in charge.

- Will it sustain the upside above 9k en route 9,250?

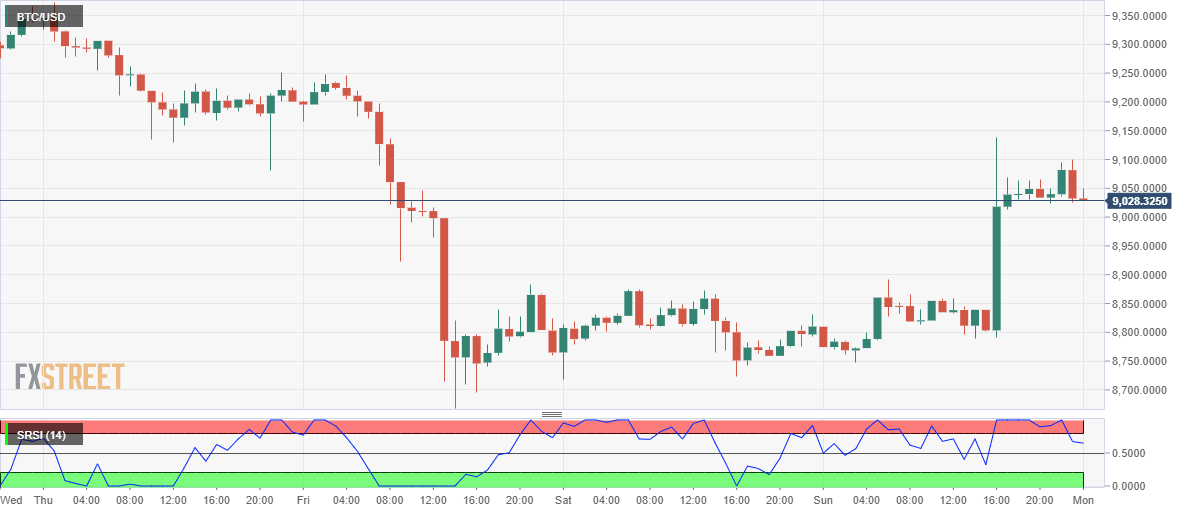

Bitcoin (BTC/USD), the most widely traded cryptocurrency, witnessed a sharp U-turn from the early Sunday sluggish momentum and broke the range to upside late-Sunday after stops got triggered on a break above the key resistance zone around 8,880/90 levels. The spike saw the price rise by almost 4% in less than 10 minutes, completely negating the bearish technical picture painted on the hourly sticks in early trades.

The no.1 coin reached fresh four-day tops of 9,137 but quickly faded the spike to revert to the 9,050 range before settling the day around 9,030 region. The price opened the new week, this Monday, on a positive note, having reached session highs at 9,048. The bulls now take a breather, allowing a phase of consolidation after the recent upsurge. Also, as the coin gathers momentum in order to regain the 9,200 level, a break above which will expose Friday’s high at 9,247.

At the press time, the most favorite coin is testing session lows near 9,030 region, almost unchanged on the day while its market capitalization increased from $ 159.13 billion to $ 163.35 billion.

Joe DiPasquale, CEO of cryptocurrency hedge fund manager BitBull Capital, cited: “The current move is a technical recovery.”

“We mentioned previously that we expect the 50-day moving average to continue acting as support, and that has allowed the price to recover temporarily,” Joe added.

BTC/USD 1-hour chart

BTC/USD Levels to consider

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.