Bitcoin Price Analysis: BTC gets rejected near $39,000, correction to $32,000 likely

- BTC/USD rose to a fresh two-week high near $39,000 on Friday.

- Sharp pullback suggests that sellers look to retake control.

- Next line of defence is located around $32,000.

Bitcoin gained traction in the late American session on Friday and touched its highest level in two weeks near $39,000. However, BTC/USD failed to preserve its bullish momentum and staged a sharp technical correction to close the day modestly higher at $34,270. On Saturday, Bitcoin remains on the back foot and was last seen losing 1.1% at $33,870.

Critical support aligns at $32,000

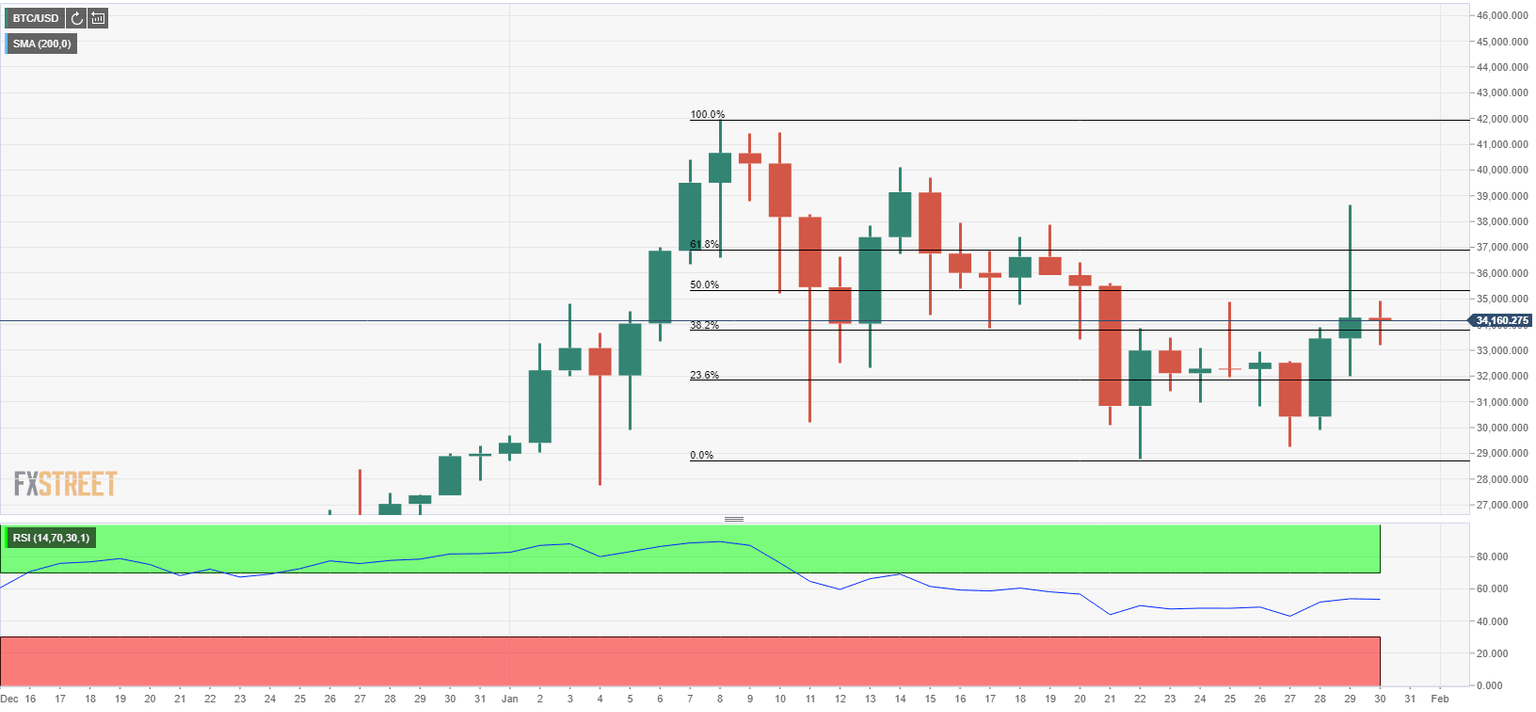

With Friday's upsurge, BTC/USD broke above the descending trend line coming from January 14 that can be seen on the four-hour chart. However, sellers took control of the price action as soon as the Relative Strength Index (RSI) on the same chart reached the overbought area above 70, suggesting that buyers showed no interest in defending the upside.

Currently, the 200-period SMA at $33,800 seems to be limiting Bitcoin's downside. Below that level, the next support could be seen at $32,000, where the trend line is located.

BTC/USD four-hour chart

Moreover, the 23.6% Fibonacci retracement of the three-week downtrend seen in January is reinforcing the $32,000 area. If Bitcoin manages to hold above that level in the near term, it could reverse its direction, once again. On the upside, the first resistance aligns at $35,500 (Fibonacci 50% retracement) ahead of $37,000 (Fibonacci 61.8% retracement) and $39,000 (Jan. 29 high).

BTC/USD one-day chart

Friday's impressive rally failed to attract bulls and BTC/USD fell sharply. However, the broken descending trend line suggests that Bitcoin could try to turn north. As long as $32,000 support holds, additional gains could be expected. On the other hand, a drop below $32,000 is likely to cause the technical outlook to turn bearish.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.