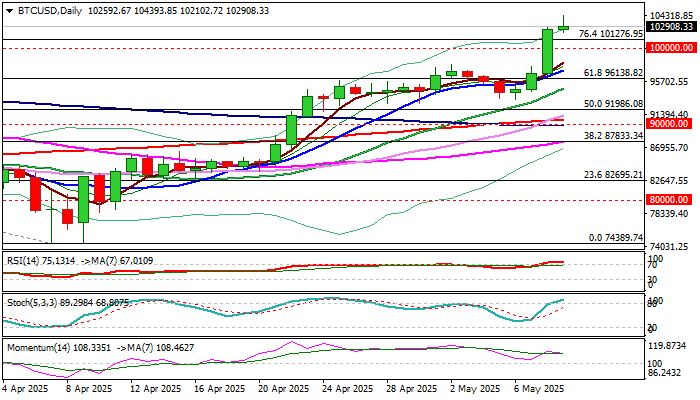

Bitcoin outlook: Holds gains above 100K, limited correction likely to precede attack at new record high

Bitcoin continues to trend higher and hit the highest in almost 3 ½ months on Friday, in extension of Thursday’s 6.7% rally (the biggest daily gain since March 2).

Near-term sentiment was brightened by announcement of US-UK trade agreement and expected talks between US and China over the weekend, which may further boost bullish stance and continue to lift coin’s price.

Bulls eye target at 10644 (Jan 30 high), the last obstacle en route towards 109582 and 110000 (new record high / psychological).

However, end of week profit taking and overbought daily studies, with bearish divergence of 14-d momentum, suggesting that bulls may take a breather before final push towards key targets.

Dips are likely to be limited (though depending on the outcome of US China talks) with broken 100K level marking solid support which should ideally contain as bitcoin is on track for the fifth consecutive weekly gain and generated initial signal that corrective phase off new record high is likely over.

Res: 104393; 106440; 108.400; 109582

Sup: 101276; 100000; 97957; 96138

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.