Bitcoin named the best investment asset of the decade

- Bank of America Merrill Lynch names Bitcoin the best asset of the recent ten years.

- BTC/USD is locked in a tight range above the psychological $7,000.

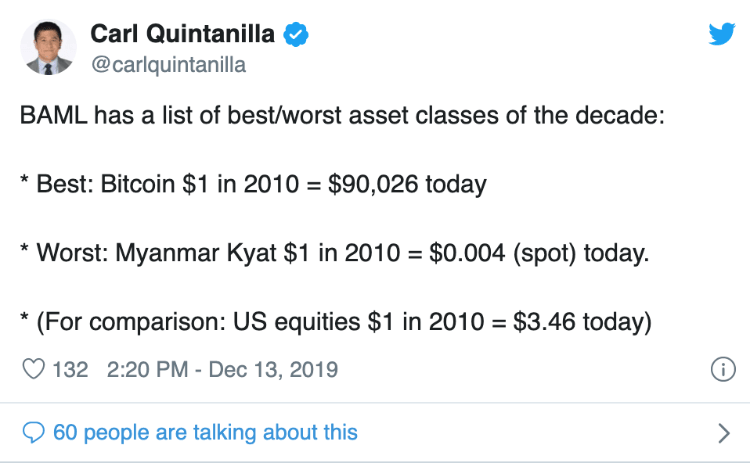

The US-based Bank of America Merrill Lynch believes that Bitcoin (BTC) is the best investment asset of the past ten years based on total investment return.

According to the financial giant, one US dollar invested in Bitcoin in 2010 would have brought $90,026 today. Notably, the American stock market's would have earned $3,46 for each invested dollar during the same ten years.

While the first cryptocurrency has lost about two-thirds of its peak value, $19,811 reached in December 2017, cryptocurrency enthusiasts believe that we are just at the very beginning of a massive bullish trend that will take us much above $20,000 towards new record highs.

Recently, the founder of Silk Road, an online black market, Ross Ulbricht, said that Bitcoin might reach $100,000.

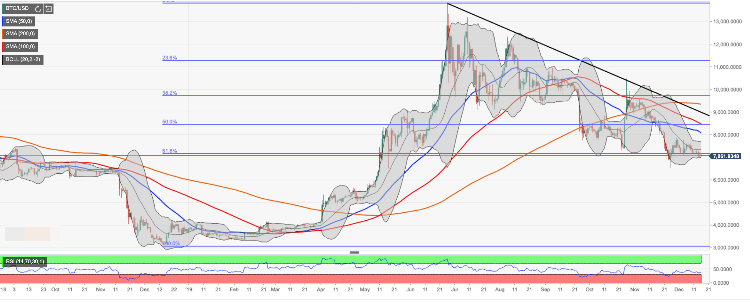

BTC/USD: the technical picture

Meanwhile, at the time of writing, BTC/USD is changing hands marginally above $7,000, This area is the lower boundary of the recent consolidation pattern, reinforced by the lower line of the daily Bollinger Band. Once it is out broken, the sell-off is likely to gain traction with the next focus on $6,500 supported by November's low, and $6,300 ( the lower line of the weekly Bollinger Band). A sustainable move lower will unleash the bearish power, which may be amplified by low liquidity conditions typical to the pre-holiday period.

However, considering flat RSI (the Relative Strength Index) both on a daily and weekly chart, the coin may continue drifting lower within the sloping range limited by $6,500 on the downside.

On the upside, We will need to see a sustainable recovery above $7,300 for the bull's momentum to gain traction. This development will take us above the middle line of the daily Bollinger Band and 61.8% Fibo retracement for the move from $3,226 to $13924. The next upside target is created by a psychological $8,000 with SMA50 (Simple Moving Average) daily located just above this area. However, to break the downside trend, Bitcoin bulls will need to push the price well above the trendline resistance currently at $9,000.

BTC/USD, the daily chart

Author

Tanya Abrosimova

Independent Analyst