Bitcoin moves exactly as warned from 110K – C for chance, another?

In our 10th June 2025 update - B for Bitcoin: Will it cry in wave-C?, we said loud and clear:

Bitcoin is once again at a critical turning point… If the 110K resistance holds, we may soon witness Wave-C unfold.

And that’s exactly how the market played it out.

What happened after 10th June 2025?

Bitcoin tried to test the 108–110K zone again… but failed.

From there, it slipped back sharply into our magical 100–102K zone, even dipping to a new low of 98141 USD on 22nd June 2025.

This fall was also backed by geopolitical tensions between Iran & Israel, adding fuel to the fire.

But Bitcoin wasn’t done just yet.

Post 22nd June: A rebound followed, pushing Bitcoin back up — this time topping out at 108345 USD on 26th June 2025.

Another clear rejection near 110K.

This zone is now confirmed as a strong supply zone.

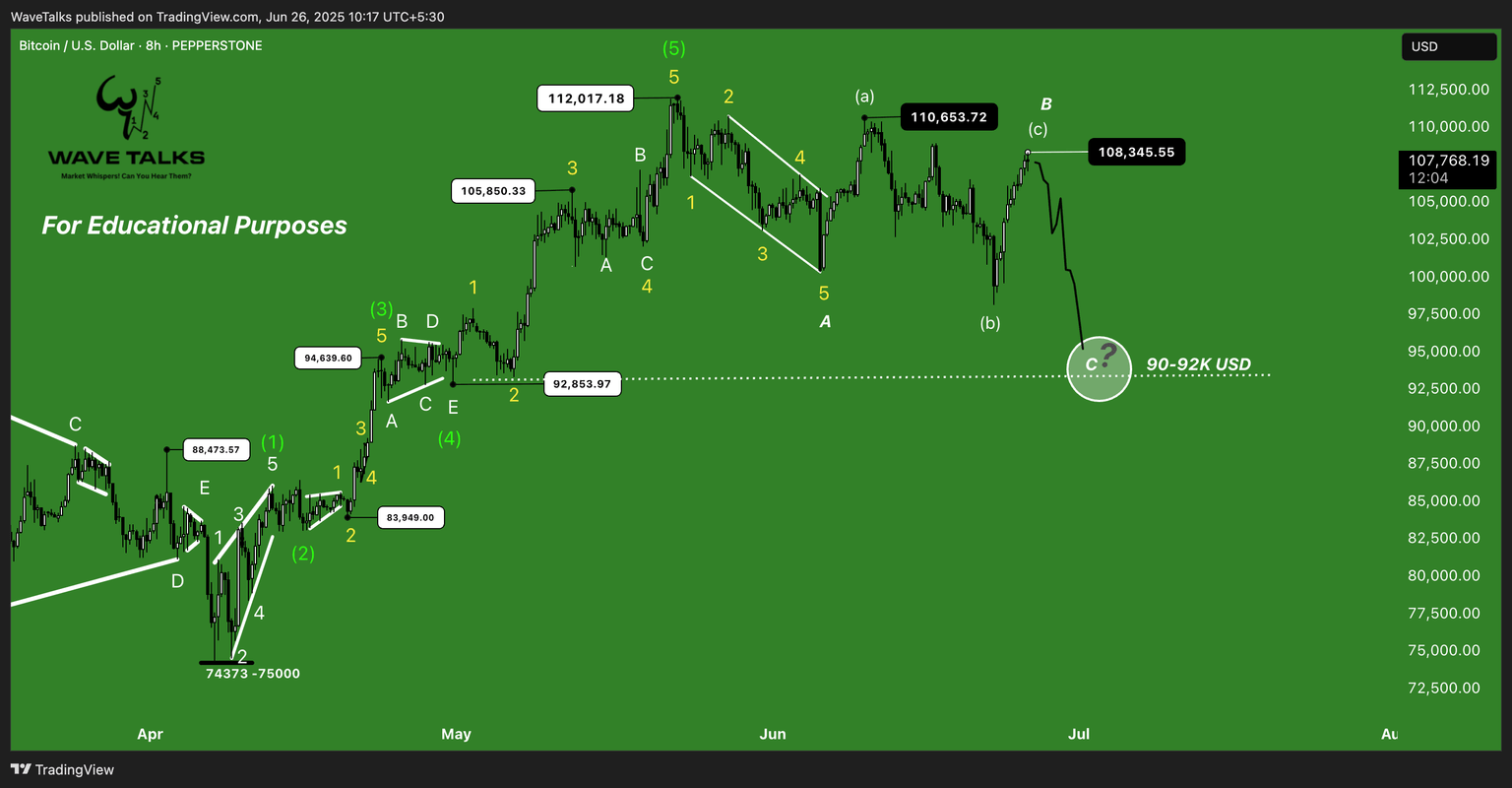

Let’s decode the wave count

Here’s how it looks now:

- Wave A (Down): From 112K – 100K zone.

- Wave B (Up): Bounced two times, each time facing resistance at 108–110K.

– A textbook 3-legged structure (minor a–b–c). - We may now be heading into Wave C (Down).

What to watch now

As long as Bitcoin fails to cross 110K, the bearish setup stays valid.

Next watch zones

- First support: 100–102K (once again).

- If broken: look for deeper drop to 95–98K zone.

A potential final leg of Wave C

That zone could become a bounce pad for a fresh rally targeting above 112K, but…

Let’s not jump ahead — one wave at a time.

Conclusion

Bitcoin remains stuck inside a critical supply zone of 108–110K.

Each rejection here strengthens the case for Wave C down.

Keep your focus on:

- 100–102K = our magical zone (yet again).

- 95–98K = strong support in case of deeper correction.

Once that completes, we may see a fresh rally unfold — but patience is key.

The waves are still whispering… are you listening?

WaveTalks – Market Whispers! Can You Hear Them?

Author

Abhishek H. Singh

WaveTalks

Abhishek is a seasoned financial analyst with over a decade of experience specializing in Elliott Wave Theory.