Bitcoin may extend the growth to $8,500 and here is why

- BTC/USD bulls stopped short of $8,000.

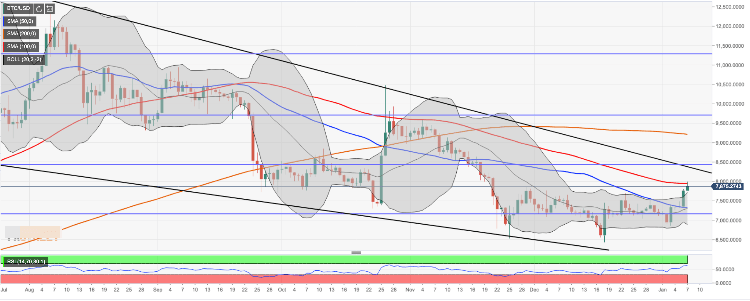

- The price settled above SMA50 weekly.

- A combination of technical and fundamental factors may drive BTC higher.

Bitcoin has settled above SMA50 weekly for the first time since the beginning of December. If the coin holds the ground, we may see another bullish leg towards $8,500 in the nearest future.

At the time of writing, BTC/USD is changing hands at $7,859. The first digital coin stopped within a whisker of psychological $8,000 before the technical correction pushed it back below $7,900. Bitcoin gained over 4% in recent 24 hours and 1.2% since the beginning of the day. Notably, Bitcoin has been growing strongly since January 3 and printed the fifth bullish candle in a row amid strong upside momentum.

Why Bitcoin is growing?

Iran-US tensions tops the list of possible Bitcoin bullish drivers. While opinions divided on this matter, the escalation may have had at least an indirect influence on the cryptocurrency market. The conflict may lead to growing oil prices, which in turn will translate into higher inflation rates. Being regarded as a hedge against inflation along with gold, Bitcoin may gain popularity among investors.

Upcoming halving is another potential reason behind the pump. A stock to flow (S2F) ratio implies that Bitcoin is grossly undervalued even after the current price surge. The Bitcoin's S2F ration that defines how long would it take to reach the maximum supply at the current rate of production has multiple -0.15, which means that its fair value is about $8,500. However, the data is retrieved from the S2F Multiple Twitter bot that has a history of overestimating Bitcoin price potential. While the model is not perfect, it can be used in conjunction with other tools and indicators.

BTC/USD: technical picture

At the time of writing, BTC recovery is capped by SMA100 (Simple Moving Average) at $7,950. This barrier is closely followed by a psychological $8,000. Once it is out of the way, the upside is likely to gain traction with the next focus on $8,400. This barrier is created by a confluence of 50.0% Fibo retracement for the upside move from December 2018 low to July 2019 high and the upper boundary of the long-term descending wedge.

On the downside, the initial support lies with $7,700 (SMA50 weekly and the upper line of the daily Bollinger Band). If this area is cleared, the sell-off may be extended towards $7,350 (SMA50 daily) and $7,000.

BTC/USD daily chart

Author

Tanya Abrosimova

Independent Analyst