Bitcoin is an instant buy at these price zones

- Bitcoin price reveals three important buy zones at $29,000, $19,500 and $12,000.

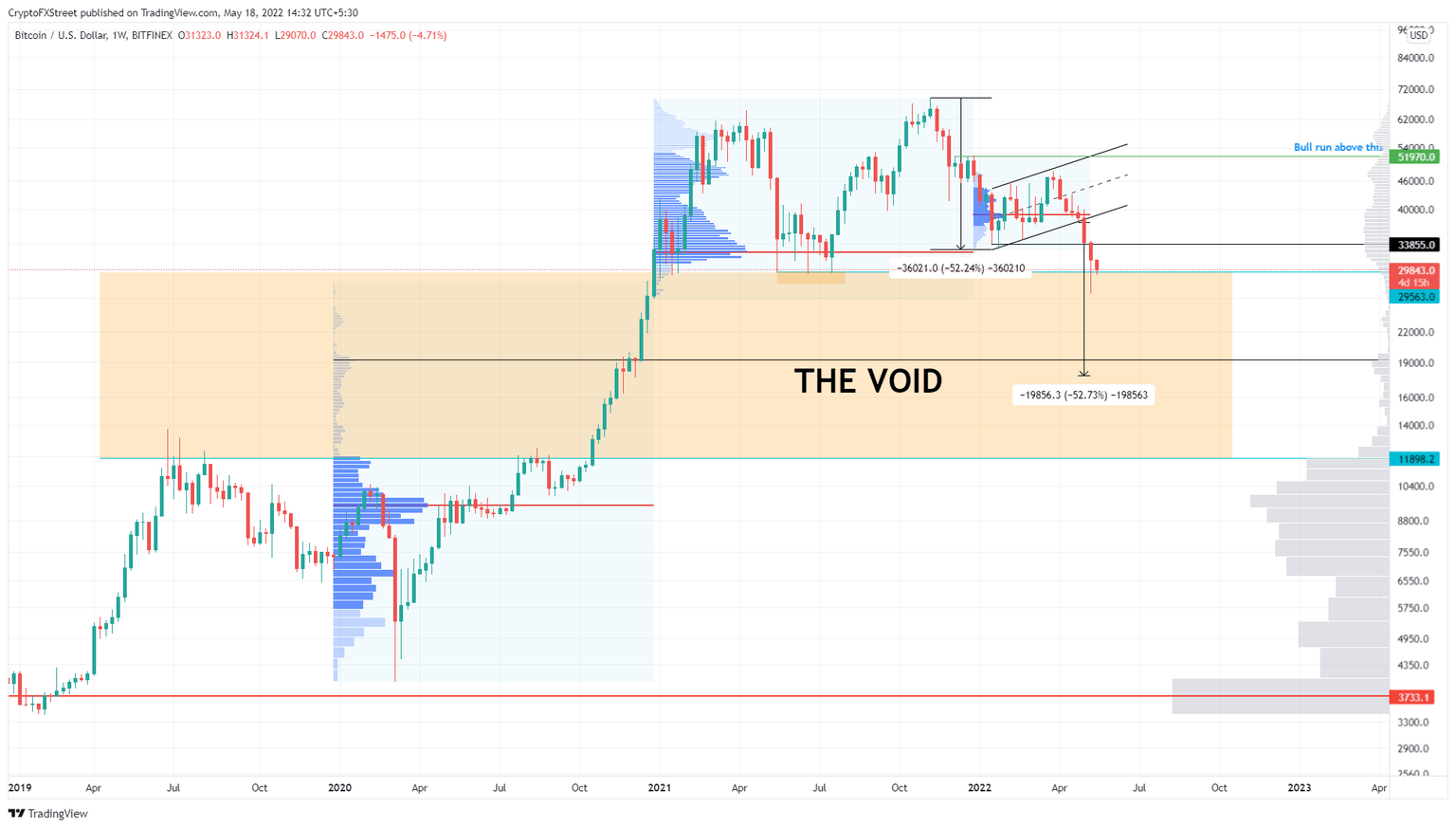

- Due to a bear flag formation and market inefficiencies, BTC could crash to $19,500 or lower.

- A weekly candlestick close above $52,000 will invalidate the bearish thesis for BTC.

Bitcoin price has been stabilizing around a critical psychological level for almost a week now. While the recent downswing might already seem like a big drop, the macro outlook reveals that more selling-off has yet to come.

Bitcoin price to head into deep discount

Bitcoin price is hovering around the $30,000 level after crashing nearly 60% from its all-time high at $69,000. This downswing set a temporary bottom at $26,591 and also signaled a breakout from the bear flag setup.

This continuation pattern forecasts a 52% downswing to $17,803, obtained by adding the flagpole’s height to the breakout point at $37,660.

Furthermore, the weekly chart attached below shows the volume profile for 2020, 2021, and 2022 with a visible range volume profile extending from 2019 to 2022. The volume point of control (POC) represents the price level where the most volume was traded and price is, therefore, more likely to face support and resistance. The recent downswing has crashed below the 2022 POC at $32,480 suggesting the downtrend has a lot of strength.

But, perhaps, the most significant data is for the 2020 and 2021 profiles, which shows that there is a gap extending from $11,891 to $29,424. This “Void” is a result of the market’s exponential move when it closed the gap caused by market pricing inefficiencies.

As Bitcoin price explores these inefficient areas, it will provide investors with an opportunity to accumulate BTC at a discount. The most critical buy levels include $29,000, $19,500 and $12,000. The ideal buy zone with the least risk and the possibility of a quick reversal would be anywhere between $19,500 to $12,000.

BTC/USD 1-week chart

While such a large downswing might seem extremely unnatural, a weekly candlestick close above $52,000 will mark a reversal. This would set up a higher high from a macro time frame and allow sidelined buyers to jump in.

In such a case, BTC could continue moving higher and tag the $60,000 psychological level or set up a new all-time high at $80,000.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.