Bitcoin Gold Price Analysis: BTG bulls in tactical retreat after 20% rally

- Bitcoin Gold reverses gains after a strong rally above critical resistance.

- BTG/USD may retest the channel support before another bullish attempt.

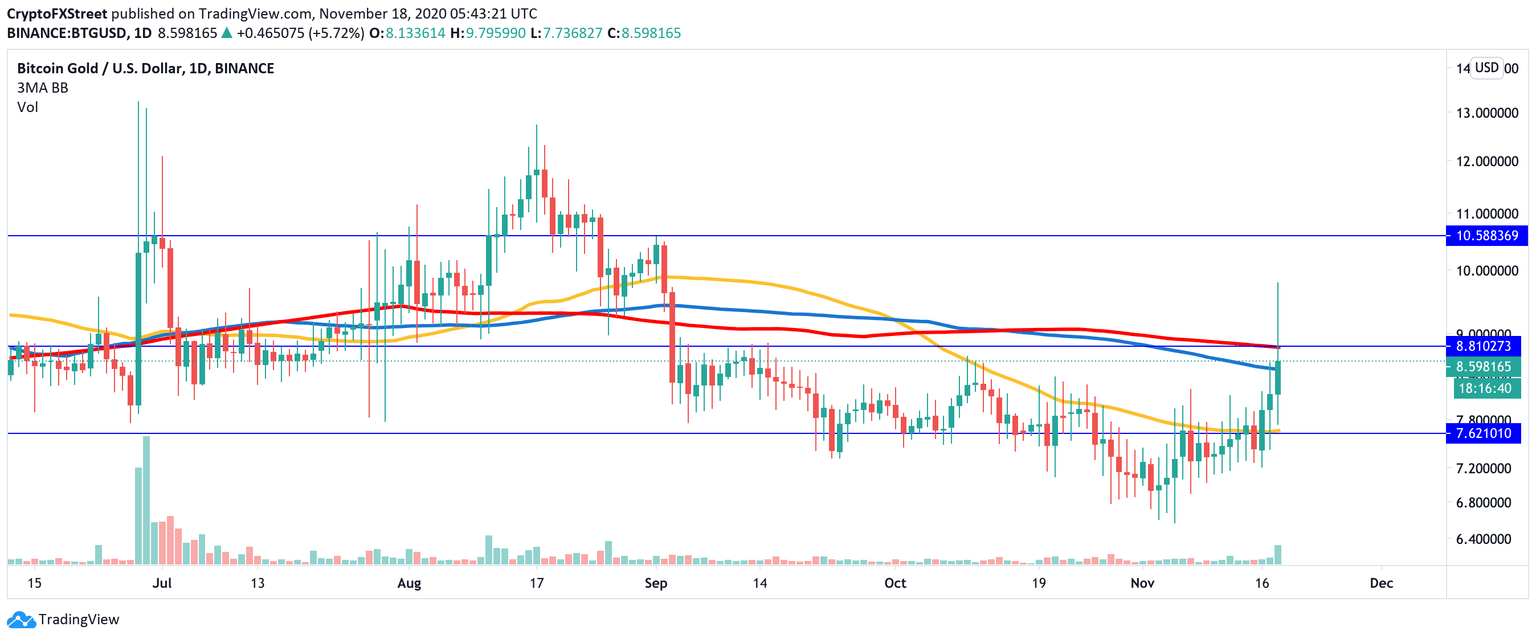

Bitcoin Gold (BTG) hit $9.79, the highest level since September 2. At the time of writing, BTG/USD is changing hands at $8.6; however, it is still 15% higher on a day-to-day basis.

Bitcoin Gold is a Bitcoin's fork that came to life in October 2017. It is currently the 75th-largest digital asset with a current market capitalization of $164 million and an average daily trading volume of $17 million. The coin is most actively traded on Binance, Huobi global, and OKEx.

BTG rally fades away

BTG is one of the best-performing coins out of the top-10 on Wednesday. A strong move above the daily EMA200 at $8.8 created a powerful bullish wave and pushed the price towards the psychological barrier of $10. However, the upside momentum proved to be unsustainable as the profit-taking pushed the price back inside the previous trading range limited by $8.8 on the upside and $7.6 on the downside.

BTG/USD daily chart

The price may retest the channel support reinforced by the daily SMA50 before another recovery attempt towards $8.8. A sustainable move above this technical barrier is needed for the upside to gain traction with the next focus on $10.5. On the downside, a sell-off below $7.6 will invalidate the bullish scenario and allow for an extended correction towards $7.

Author

Tanya Abrosimova

Independent Analyst