Bitcoin: First support at 48000/47500

Bitcoin bottomed exactly at best support for this week at 43900/600. Longs worked perfectly on the bounce to targets of 48190, 49400/500 & the only resistance of any important this week is at 50500/51000.

We topped exactly here so obviously this remains key to direction.

Ripple targets 12450/12500 before a retest of 13450/490.

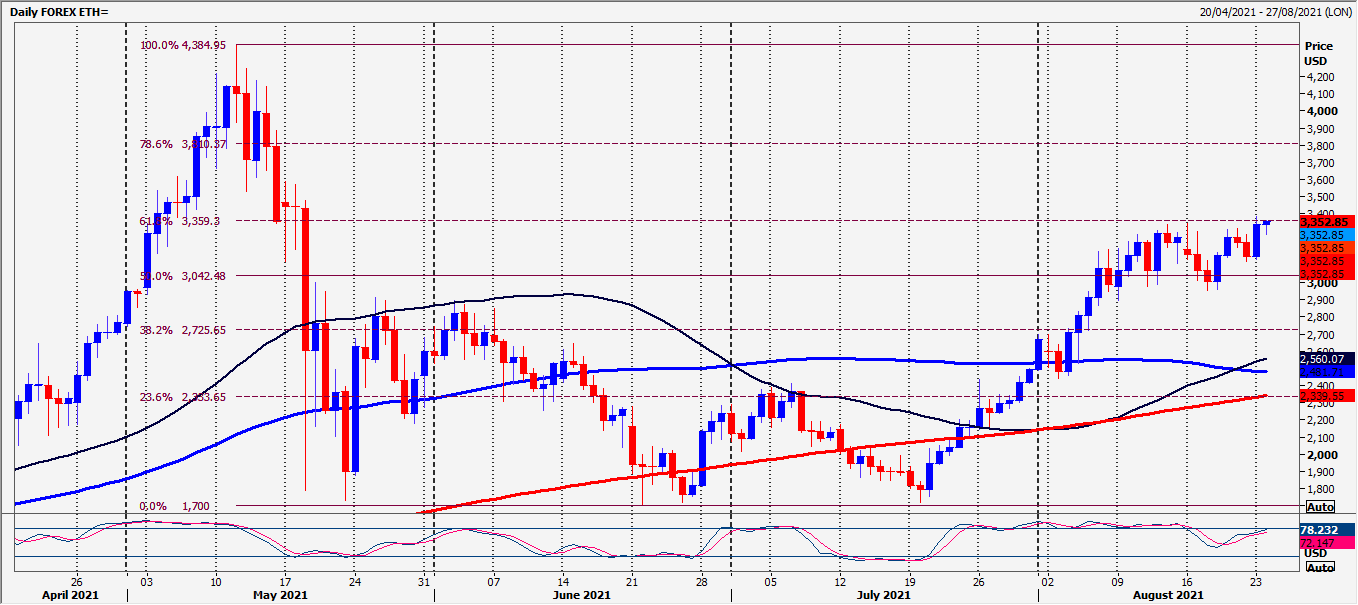

Ethereum in a consolidation sideways range from 3150/3100 up to 3350/3400.

Daily analysis

Bitcoin longs at 43900/600 worked perfectly on the bounce to the only resistance of any important this week is at 50500/51000. A break above 51500 opens the door to 52900/53000 & 56700/750.

First support at 48000/47500, better support at 45700/200. Longs need stops below 44800.

Ripple through resistance at 11850/12000 to target 12450/12500 before a retest of 13450/490. A break higher targets 13615, 14410, 14540 & 14660.

First support at 12100/12090, second support at 11550/000.

Ethereum holding minor support at 3270 retests 3350/3400. A break higher is a buy signal initially targeting 3580/3600.

Second support at 3150/3100. Next target & support at 3000/2970. Longs need stops below 2940.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk