Bitcoin (BTC) price analysis — Slowly approaching $10,000 mark

Are traders likely to see Bitcoin (BTC) above $10,000 this month?

June 9th has started with a negative mood on the cryptocurrency market. Most coins from the top 10 list are in the red zone. XRP is the only one trying to remain bullish, having risen by 0.01% since yesterday.

Top 10 coins by Coinstats

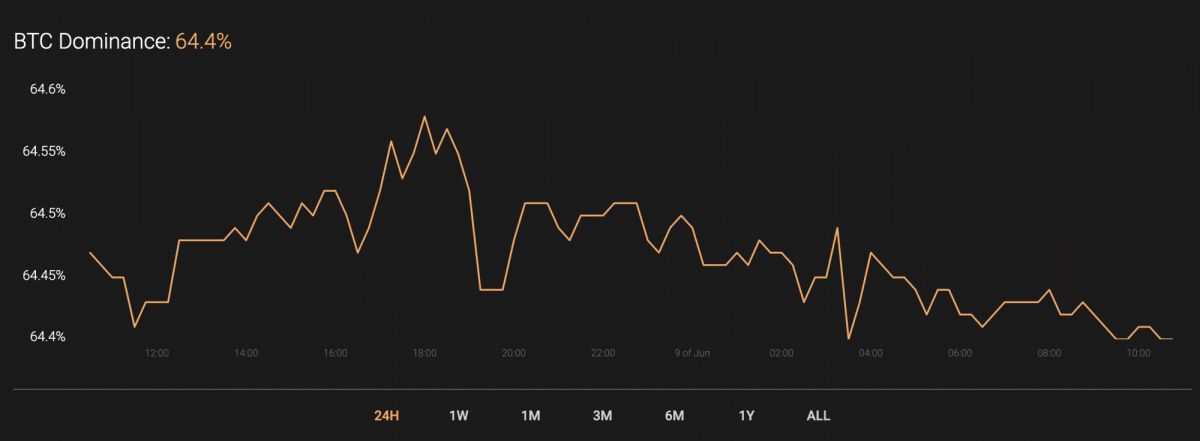

The decline of most of the cryptocurrencies has not affected the dominance rate of the main crypto, which remains at the same level at 64.4%.

BTC’s market share

The relevant data for Bitcoin is as follows.

Name: Bitcoin

Ticker: BTC

Market Cap: $178,464,060,180

Price: $9,699.65

Volume (24h): $22,958,180,494

Change (24h): -0.42%

The data is relevant at press time.

BTC/USD: Is it still possible to reach $10,000?

On the hourly chart, Bitcoin (BTC) made a false breakout of the $9,900 mark. The decline over the past 24 hours of the main crypto has amounted to 0.42%

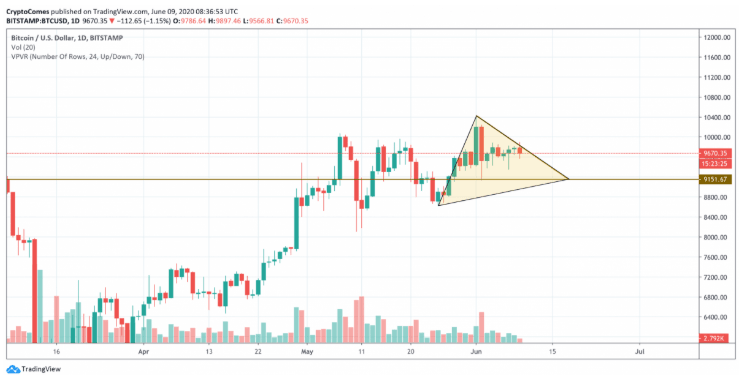

BTC/USD chart by TradingView

Even though the bullish scenario has not yet fallen apart, there is strong resistance at $9,900 that is preventing Bitcoin (BTC) from moving forward. Thus, the trading volume is decreasing and mostly dominated by sellers. In this case, one should not also exclude the possibility of a retest of the $9,600-$9,650 zone shortly.

BTC/USD chart by TradingView

On the 4H time frame, there is no dominance from bulls or bears. The liquidity is high enough. However, trading volume is too low to push the rate higher. Summing up, the more likely scenario for the next days is a sideways trend in the yellow area between $9,600 and $9,750.

BTC/USD chart by TradingView

Bitcoin (BTC) is about to finish its bullish trend as 'fuel' for further growth is running out. Such a statement is confirmed by the declining trading volume and falling heights.

If bulls cannot seize the initiative, the next stop is $9,150. In this case, the Triangle pattern will be formed and the bearish trend will start.

Bitcoin is trading at $9,672 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.